Sba Form 172

What is the SBA Form 172?

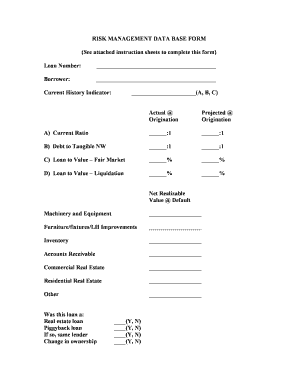

The SBA Form 172, also known as the SBA Transaction Report on Loan Serviced by Lender, is a crucial document used by lenders to report on the status of loans they service on behalf of the Small Business Administration (SBA). This form is essential for maintaining transparency and accountability in the management of SBA-backed loans. It provides detailed information about the loan's performance, including payment history, outstanding balances, and any modifications made to the loan terms. Understanding the purpose and requirements of the SBA Form 172 is vital for both lenders and borrowers to ensure compliance with SBA regulations.

Steps to Complete the SBA Form 172

Completing the SBA Form 172 requires careful attention to detail to ensure accuracy and compliance. Here are the key steps involved:

- Gather necessary information about the loan, including borrower details, loan amount, and servicing history.

- Fill out the form by entering the required data in the designated fields. Ensure all entries are accurate and reflect the current status of the loan.

- Review the completed form for any errors or omissions. Double-check figures and ensure that all required sections are filled out.

- Submit the form to the appropriate SBA office or online portal as per the instructions provided. Keep a copy for your records.

Legal Use of the SBA Form 172

The legal use of the SBA Form 172 is governed by federal regulations that dictate how lenders must report on SBA-backed loans. This form serves as an official record of loan servicing activities and must be completed accurately to avoid legal repercussions. Compliance with the reporting requirements not only ensures that lenders fulfill their obligations but also protects the interests of borrowers by providing a clear account of loan management. Understanding the legal implications of this form is essential for maintaining good standing with the SBA.

How to Obtain the SBA Form 172

The SBA Form 172 can be obtained directly from the Small Business Administration's official website or through authorized SBA lenders. It is typically available in a downloadable PDF format, which can be filled out electronically or printed for manual completion. Lenders should ensure they are using the most current version of the form to comply with any updates or changes in reporting requirements. Accessing the form is straightforward, and it is advisable to review any accompanying instructions to facilitate accurate completion.

Examples of Using the SBA Form 172

The SBA Form 172 is utilized in various scenarios related to loan servicing. For instance, a lender may use the form to report on a borrower's payment history when a loan is in good standing. Alternatively, if a borrower has requested a loan modification due to financial hardship, the lender would document the changes using this form. These examples highlight the form's role in maintaining accurate records and ensuring that both lenders and borrowers are aware of the loan's status throughout its lifecycle.

Required Documents for SBA Form 172 Submission

When submitting the SBA Form 172, certain supporting documents may be required to validate the information provided. These documents can include:

- Loan agreements and modifications.

- Payment history records.

- Correspondence related to the loan servicing.

- Any additional documentation requested by the SBA or required for compliance.

Ensuring that all required documents accompany the form submission can help prevent delays and facilitate a smoother review process by the SBA.

Quick guide on how to complete sba form 172

Effortlessly Prepare Sba Form 172 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Administer Sba Form 172 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Sba Form 172 with Ease

- Obtain Sba Form 172 and click Get Form to initiate.

- Employ the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about misplaced or lost documents, tedious form navigation, or mistakes that require printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Sba Form 172 while ensuring effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form 172

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 172 and how can airSlate SignNow help with it?

Form 172 is a specific document that businesses often need to complete and sign for compliance or regulatory purposes. With airSlate SignNow, you can streamline the entire process of filling out and electronically signing form 172, ensuring that it is both efficient and secure.

-

Does airSlate SignNow support electronic signatures for form 172?

Yes, airSlate SignNow fully supports electronic signatures for form 172. This allows you to sign the document quickly and easily, eliminating the need for printing, scanning, or mailing, thereby saving time and resources.

-

What are the pricing options for using airSlate SignNow with form 172?

AirSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. You can choose a plan that fits your budget while ensuring you have the necessary features to manage form 172 and other documents efficiently.

-

What features does airSlate SignNow offer for managing form 172?

AirSlate SignNow provides a variety of features ideal for handling form 172, including customizable templates, real-time collaboration, and robust tracking capabilities. These features help you manage the document lifecycle seamlessly from creation to signing.

-

Can I integrate airSlate SignNow with other applications for managing form 172?

Absolutely! airSlate SignNow offers integrations with popular applications and tools, making it easier to work with form 172 alongside your favorite software. This connectivity enhances your workflow and overall efficiency.

-

Is airSlate SignNow secure for signing sensitive documents like form 172?

Yes, security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to ensure that all documents, including form 172, are protected throughout the signing process.

-

How can airSlate SignNow benefit my business with form 172?

Using airSlate SignNow for form 172 can greatly enhance your business operations. It simplifies document management, reduces turnaround times, and ensures compliance, ultimately leading to increased productivity and cost savings.

Get more for Sba Form 172

Find out other Sba Form 172

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure