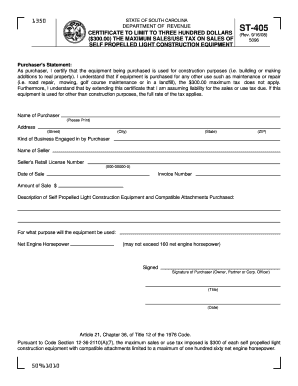

ST 405 the South Carolina Department of Revenue Sctax Form

What is the ST 405 The South Carolina Department Of Revenue Sctax

The ST 405 form is a crucial document issued by the South Carolina Department of Revenue. It is primarily used for sales tax exemption purposes, allowing eligible entities to purchase goods and services without incurring sales tax. This form is essential for businesses and organizations that qualify for tax-exempt status, such as non-profits, government agencies, and certain educational institutions. Understanding the purpose and requirements of the ST 405 is vital for compliance and to ensure that eligible purchases are correctly exempted from sales tax.

Steps to complete the ST 405 The South Carolina Department Of Revenue Sctax

Completing the ST 405 form requires careful attention to detail. Here are the steps to follow:

- Obtain the form: Download the ST 405 from the South Carolina Department of Revenue website or request a physical copy.

- Fill in your information: Provide your name, address, and the name of the organization claiming the exemption.

- Specify the reason for exemption: Clearly state the reason for the tax exemption, such as being a non-profit organization or a government entity.

- Sign and date the form: Ensure that the form is signed by an authorized representative of the organization, along with the date of signing.

- Submit the form: Provide the completed ST 405 to the vendor from whom you are purchasing goods or services.

Legal use of the ST 405 The South Carolina Department Of Revenue Sctax

The ST 405 form is legally binding when completed accurately and submitted in accordance with South Carolina tax laws. To ensure its legal standing, the form must be filled out by an authorized representative of the organization claiming the exemption. Additionally, it is important that the organization meets the criteria for tax exemption as defined by the South Carolina Department of Revenue. Misuse or fraudulent claims can lead to penalties, making it essential to understand the legal implications of using the ST 405.

Key elements of the ST 405 The South Carolina Department Of Revenue Sctax

Several key elements must be included in the ST 405 form to ensure its validity:

- Organization Information: The name and address of the organization claiming the exemption.

- Exemption Reason: A clear explanation of why the organization qualifies for tax exemption.

- Authorized Signature: The signature of an authorized representative, confirming the accuracy of the information provided.

- Date: The date on which the form is signed, which is crucial for record-keeping and compliance.

How to obtain the ST 405 The South Carolina Department Of Revenue Sctax

Obtaining the ST 405 form is a straightforward process. It can be accessed online through the South Carolina Department of Revenue's official website, where it is available for download. Alternatively, organizations may request a physical copy by contacting the department directly. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines / Important Dates

While the ST 405 form does not have a specific filing deadline, it is important to submit it at the time of purchase to ensure that the transaction is processed as tax-exempt. Organizations should be aware of any changes in tax laws or regulations that may affect their eligibility for exemption. Keeping track of important dates related to tax filings and renewals of exemption status is essential for ongoing compliance.

Quick guide on how to complete st 405 the south carolina department of revenue sctax

Complete ST 405 The South Carolina Department Of Revenue Sctax effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage ST 405 The South Carolina Department Of Revenue Sctax on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign ST 405 The South Carolina Department Of Revenue Sctax without hassle

- Locate ST 405 The South Carolina Department Of Revenue Sctax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Alter and eSign ST 405 The South Carolina Department Of Revenue Sctax to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 405 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 405 form from The South Carolina Department Of Revenue?

The ST 405 form is a crucial document used for sales tax exemption in South Carolina, managed by The South Carolina Department Of Revenue. Businesses can utilize this form to exempt eligible purchases from sales tax. Completing the ST 405 correctly ensures compliance with state tax regulations.

-

How does airSlate SignNow help with ST 405 The South Carolina Department Of Revenue Sctax?

airSlate SignNow streamlines the process of signing and submitting the ST 405 form to The South Carolina Department Of Revenue Sctax. Its intuitive platform allows users to eSign documents quickly, ensuring that the required paperwork is processed efficiently. Keep your tax documents organized and easily accessible with airSlate SignNow.

-

What are the pricing options for using airSlate SignNow for ST 405 The South Carolina Department Of Revenue Sctax?

airSlate SignNow offers various pricing plans designed to fit different business needs and budgets. These plans enable users to send and eSign documents, including the ST 405 form, without breaking the bank. Evaluate our plans to find the most cost-effective solution for your document management needs.

-

What features does airSlate SignNow provide for managing ST 405 The South Carolina Department Of Revenue Sctax?

With airSlate SignNow, you have access to features like template creation, team collaboration, and advanced eSignature capabilities for the ST 405 form. These tools simplify document management and ensure compliance with The South Carolina Department Of Revenue Sctax requirements. Enjoy a hassle-free signing experience that saves time and improves accuracy.

-

Is airSlate SignNow compliant with The South Carolina Department Of Revenue Sctax regulations?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that eSignatures and document management align with The South Carolina Department Of Revenue Sctax regulations. Our platform adheres to the necessary legal standards for electronic signatures, making it suitable for sensitive tax documents like the ST 405 form.

-

Can I integrate airSlate SignNow with other software to manage ST 405 The South Carolina Department Of Revenue Sctax?

Absolutely! airSlate SignNow offers robust integrations with various software solutions, enhancing your ability to manage documents like the ST 405 form. Connect seamlessly with platforms such as CRMs and accounting systems to streamline your workflow related to The South Carolina Department Of Revenue Sctax.

-

What are the benefits of using airSlate SignNow for ST 405 The South Carolina Department Of Revenue Sctax?

Using airSlate SignNow for the ST 405 form can signNowly reduce processing times and increase efficiency. Our solution eliminates the need for printing and mailing, allowing businesses to send documents electronically. Additionally, eSigning is secure and legally binding, ensuring compliance with The South Carolina Department Of Revenue Sctax.

Get more for ST 405 The South Carolina Department Of Revenue Sctax

Find out other ST 405 The South Carolina Department Of Revenue Sctax

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free