Business License Application Revised 3 28 19 Final Form

Understanding the Business License Tax Application

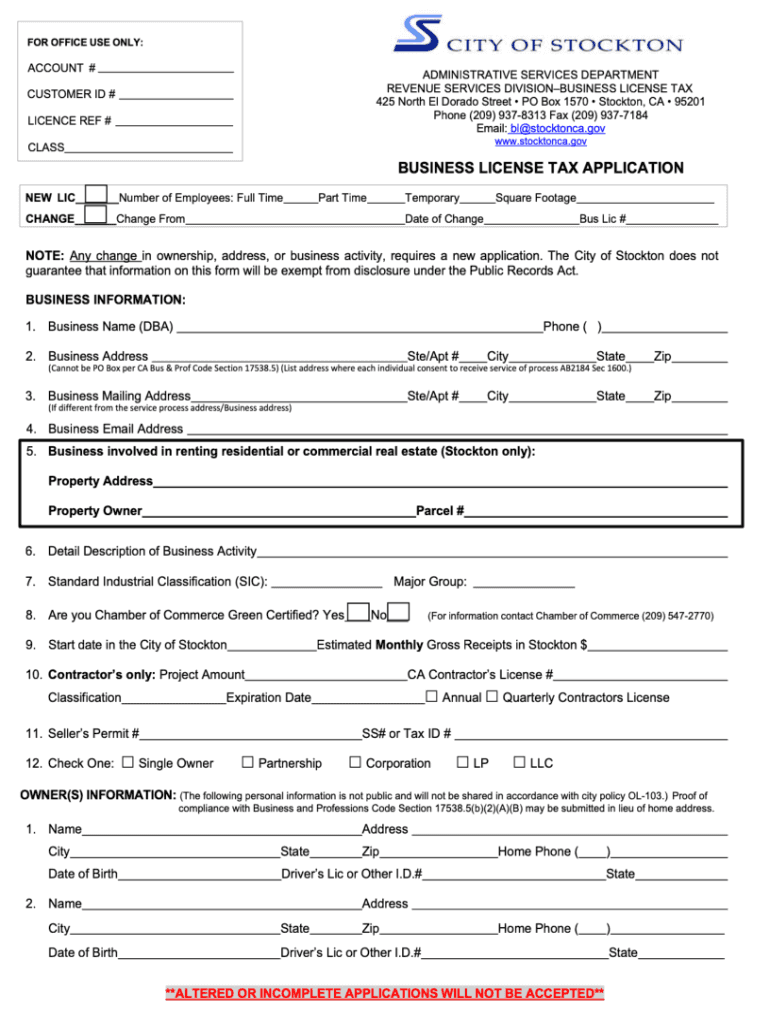

The business license tax application is a crucial document for businesses operating in the United States. This application serves as a formal request for a license that allows a business to operate legally within a specific jurisdiction. It typically includes essential information about the business, such as its name, address, ownership structure, and the type of services or products offered. Understanding the requirements and purpose of this application is vital for compliance with local regulations.

Steps to Complete the Business License Tax Application

Completing the business license tax application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and any required documentation. Next, fill out the application form carefully, ensuring that all fields are completed and accurate. Review the form for any errors or omissions before submission. Finally, submit the application according to the specified method—whether online, by mail, or in person—and retain a copy for your records.

Required Documents for Submission

When submitting the business license tax application, certain documents may be required to support your application. Commonly required documents include:

- Proof of identity, such as a government-issued ID

- Business formation documents, like Articles of Incorporation or partnership agreements

- Tax identification number (EIN)

- Proof of address, such as a utility bill or lease agreement

- Any relevant permits or licenses specific to your industry

Having these documents ready can streamline the application process and help avoid delays.

Who Issues the Business License Tax Application

The business license tax application is typically issued by local government agencies, such as city or county offices. The specific agency responsible may vary based on the type of business and its location. It is essential to identify the correct issuing authority to ensure that you are using the appropriate application form and following the correct procedures for your area.

Application Process and Approval Time

The application process for obtaining a business license tax application can vary depending on the jurisdiction. Generally, once the application is submitted, it undergoes a review process by the issuing authority. This process may take anywhere from a few days to several weeks, depending on the complexity of the application and the workload of the agency. It is advisable to check with the local agency for specific timelines and any potential delays.

Penalties for Non-Compliance

Failing to obtain a business license tax application can lead to significant penalties. These may include fines, legal action, or even the closure of the business. Additionally, operating without a proper license can damage a business's reputation and hinder future growth opportunities. Therefore, it is crucial to understand and comply with all licensing requirements to avoid these consequences.

Quick guide on how to complete business license application revised 3 28 19 final

Complete Business License Application Revised 3 28 19 Final seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Business License Application Revised 3 28 19 Final on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and eSign Business License Application Revised 3 28 19 Final effortlessly

- Obtain Business License Application Revised 3 28 19 Final and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Business License Application Revised 3 28 19 Final and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business license application revised 3 28 19 final

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business license tax application?

A business license tax application is a document submitted to the appropriate government authority to obtain a license for operating a business legally. This process ensures compliance with local regulations. Utilizing airSlate SignNow can streamline this process, allowing you to sign and send your application quickly and securely.

-

How can airSlate SignNow help with my business license tax application?

airSlate SignNow simplifies the business license tax application process by providing an intuitive platform for eSigning and sending documents. With its user-friendly interface, you can complete your application efficiently and without any paperwork delays, saving you time and resources.

-

Is there a cost associated with using airSlate SignNow for business license tax applications?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs. These plans are designed to be cost-effective, allowing businesses to choose an option that fits their budget while ensuring they can effortlessly manage their business license tax application process.

-

What features does airSlate SignNow offer for managing business license tax applications?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your business license tax application. These tools enhance efficiency by allowing you to automate the submission process and ensure all necessary documents are included.

-

Can airSlate SignNow integrate with other software for my business license tax application?

Absolutely! airSlate SignNow supports integration with various business systems such as CRM tools and accounting software, streamlining your business license tax application workflow. This ensures all relevant data is synchronized, improving overall productivity and compliance.

-

How secure is my business license tax application data with airSlate SignNow?

Security is a top priority for airSlate SignNow. Your business license tax application data is protected through advanced encryption methods and compliance with industry standards, ensuring that your sensitive information remains confidential throughout the eSigning process.

-

Can I track the status of my business license tax application with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your business license tax application in real time. You will receive notifications when the application is viewed or signed, providing you with peace of mind and transparency during the submission process.

Get more for Business License Application Revised 3 28 19 Final

Find out other Business License Application Revised 3 28 19 Final

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy