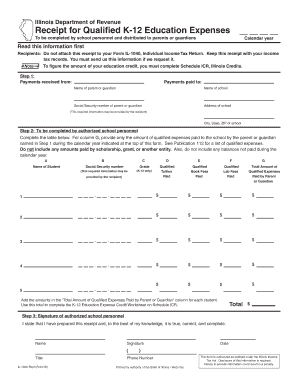

IL 1040 Rcpt Illinois Department of Revenue Form

What is the IL 1040 Rcpt Illinois Department Of Revenue

The IL 1040 Rcpt is a receipt form issued by the Illinois Department of Revenue. It serves as proof of filing for individual income tax returns in the state of Illinois. This form is essential for taxpayers who wish to confirm that their tax returns have been submitted and processed. The IL 1040 Rcpt includes important details such as the taxpayer's name, Social Security number, and the date of filing. It is a vital document for record-keeping and may be required for various financial transactions or audits.

How to use the IL 1040 Rcpt Illinois Department Of Revenue

Using the IL 1040 Rcpt involves keeping it as a record after filing your tax return. Once you have submitted your IL-1040 form, you will receive this receipt, which you should store securely. It can be used to verify your tax filing status if needed. Additionally, if you are applying for loans, financial aid, or other services that require proof of income tax filing, the IL 1040 Rcpt can serve as evidence of compliance with state tax obligations.

Steps to complete the IL 1040 Rcpt Illinois Department Of Revenue

Completing the IL 1040 Rcpt involves several steps:

- File your IL-1040 tax return with the Illinois Department of Revenue.

- Once your return is processed, you will receive the IL 1040 Rcpt.

- Review the receipt for accuracy, ensuring that your personal information is correct.

- Store the IL 1040 Rcpt in a safe location, such as a digital file or a physical folder.

- Use the receipt as needed for verification or proof of filing.

Legal use of the IL 1040 Rcpt Illinois Department Of Revenue

The IL 1040 Rcpt is legally binding as proof of tax filing. It is recognized by the Illinois Department of Revenue and can be presented in legal situations where proof of compliance with tax obligations is required. This receipt is essential for taxpayers who may face audits or need to provide documentation for loans or other financial matters. Retaining this form ensures that taxpayers have evidence of their filing status and can defend against any claims of non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IL-1040 tax return are typically aligned with federal tax deadlines. For most taxpayers, the deadline is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to be aware of any changes to these dates, as the Illinois Department of Revenue may announce extensions or specific filing requirements for certain tax years. Keeping track of these deadlines helps ensure timely filing and avoids potential penalties.

Required Documents

To complete the IL 1040 Rcpt, certain documents are necessary. These typically include:

- Your completed IL-1040 tax return form.

- W-2 forms from employers, if applicable.

- 1099 forms for other income sources.

- Documentation for deductions and credits claimed.

- Any other relevant financial documents that support your income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The IL 1040 Rcpt can be obtained through various submission methods. Taxpayers can file their IL-1040 forms online through the Illinois Department of Revenue's website, which often provides immediate confirmation and receipt. Alternatively, forms can be mailed to the appropriate address, where processing times may vary. In-person submissions are also accepted at designated locations. Each method has its own benefits, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete il 1040 rcpt illinois department of revenue

Complete IL 1040 Rcpt Illinois Department Of Revenue effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle IL 1040 Rcpt Illinois Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

Steps to modify and eSign IL 1040 Rcpt Illinois Department Of Revenue with ease

- Obtain IL 1040 Rcpt Illinois Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal authority as a traditional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign IL 1040 Rcpt Illinois Department Of Revenue and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1040 rcpt illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1040 Rcpt Illinois Department Of Revenue?

The IL 1040 Rcpt Illinois Department Of Revenue is a receipt document that confirms your payment and filing of state income taxes in Illinois. This receipt is crucial for tax records and is often required for personal and business financial audits.

-

How can airSlate SignNow assist with the IL 1040 Rcpt Illinois Department Of Revenue?

airSlate SignNow provides an efficient platform for businesses to eSign and send the IL 1040 Rcpt Illinois Department Of Revenue quickly and securely. By utilizing our electronic signature solutions, you can streamline your tax document processes, ensuring timely submission and compliance.

-

What features does airSlate SignNow offer for managing tax documents like the IL 1040 Rcpt Illinois Department Of Revenue?

With airSlate SignNow, you gain access to features such as customizable templates, automated workflows, and advanced tracking capabilities. These tools simplify the management of tax documents, including the IL 1040 Rcpt Illinois Department Of Revenue, enabling a smooth and efficient filing experience.

-

Is airSlate SignNow cost-effective for small businesses handling the IL 1040 Rcpt Illinois Department Of Revenue?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. This makes it an affordable choice for managing essential tax documentation like the IL 1040 Rcpt Illinois Department Of Revenue without compromising on quality or service.

-

Can I integrate airSlate SignNow with other accounting tools for the IL 1040 Rcpt Illinois Department Of Revenue?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software. This ensures that when you're working with the IL 1040 Rcpt Illinois Department Of Revenue, all your necessary financial data is synchronized, making tax management more efficient.

-

What are the benefits of using airSlate SignNow for the IL 1040 Rcpt Illinois Department Of Revenue?

Using airSlate SignNow for the IL 1040 Rcpt Illinois Department Of Revenue offers numerous benefits, including faster processing times and reduced paperwork. Additionally, our secure eSignature feature minimizes errors and provides legal compliance, enhancing your document handling efficiency.

-

How secure is airSlate SignNow for handling the IL 1040 Rcpt Illinois Department Of Revenue?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and comply with industry standards to ensure that your IL 1040 Rcpt Illinois Department Of Revenue is handled with the utmost security, protecting sensitive financial information from unauthorized access.

Get more for IL 1040 Rcpt Illinois Department Of Revenue

Find out other IL 1040 Rcpt Illinois Department Of Revenue

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free