50 162 Appointment of Agent for Property Tax Matters 2016-2026

What is the 50 162 Appointment of Agent for Property Tax Matters

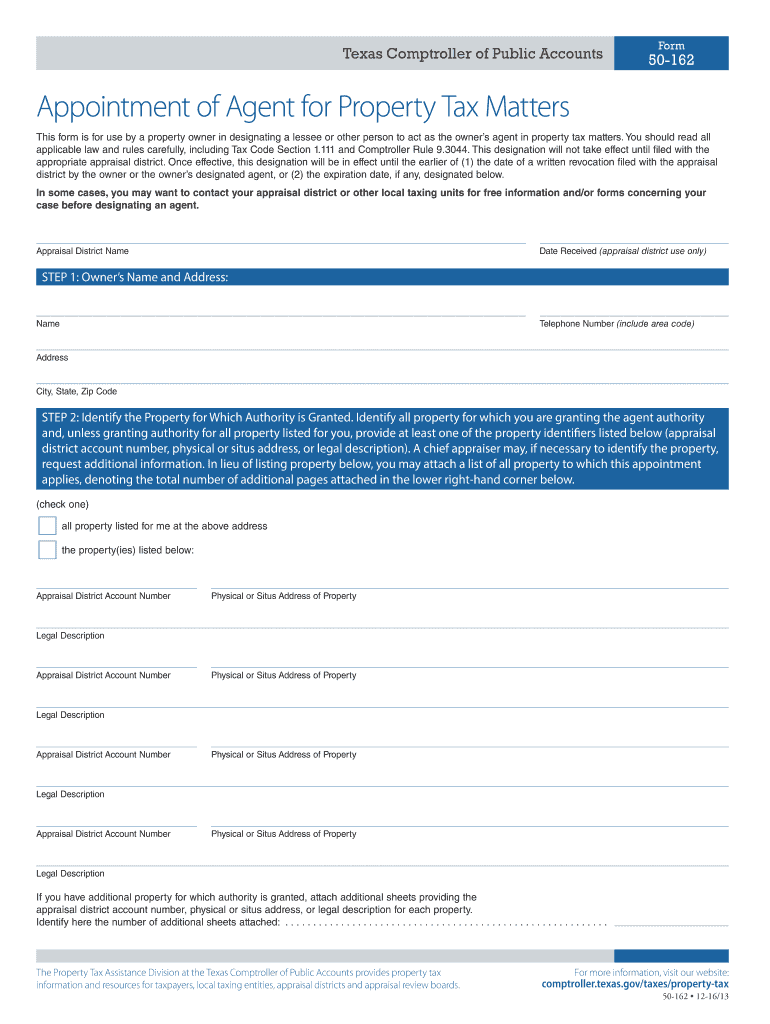

The 50 162 form, also known as the Appointment of Agent for Property Tax Matters, is a legal document used in Texas. This form allows property owners to designate an agent to represent them in property tax matters before the local appraisal district. By completing this form, property owners can ensure that their chosen agent has the authority to act on their behalf regarding property tax issues, including protests and appeals. This form is particularly useful for individuals who may not have the time or expertise to navigate the complexities of property tax regulations.

Steps to Complete the 50 162 Appointment of Agent for Property Tax Matters

Completing the appointment of agent form 50 162 involves several straightforward steps:

- Obtain the form from the Texas Comptroller’s website or a local appraisal district.

- Fill in the property owner’s name, address, and contact information accurately.

- Provide the agent’s details, including their name, address, and phone number.

- Specify the property or properties for which the agent is being appointed.

- Sign and date the form to validate the appointment.

Once completed, the form should be submitted to the appropriate appraisal district to ensure the agent's authority is recognized.

Legal Use of the 50 162 Appointment of Agent for Property Tax Matters

The legal validity of the 50 162 form hinges on compliance with Texas property tax laws. When properly filled out and submitted, this form grants the designated agent the authority to act on behalf of the property owner in all matters related to property taxes. This includes the ability to receive notices, file protests, and negotiate with appraisal district officials. It is essential to ensure that the form is signed by the property owner to uphold its legal standing.

Key Elements of the 50 162 Appointment of Agent for Property Tax Matters

Several key elements must be included in the 50 162 form to ensure its effectiveness:

- Property Owner Information: Full name and address of the property owner.

- Agent Information: Full name and contact details of the appointed agent.

- Property Details: A clear description of the property or properties involved.

- Signature: The property owner's signature is crucial for validation.

Including all these elements will help prevent any issues with the form’s acceptance by the appraisal district.

How to Obtain the 50 162 Appointment of Agent for Property Tax Matters

The 50 162 form can be obtained directly from the Texas Comptroller's website or through local appraisal district offices. Many appraisal districts provide downloadable PDF versions of the form, which can be printed and filled out. It is important to ensure that you are using the most current version of the form to avoid any complications during submission.

Form Submission Methods for the 50 162 Appointment of Agent for Property Tax Matters

Once the 50 162 form is completed, it can be submitted to the local appraisal district through various methods:

- By Mail: Send the completed form to the address of the local appraisal district.

- In-Person: Deliver the form directly to the appraisal district office.

- Online: Some appraisal districts may offer electronic submission options via their websites.

Choosing the appropriate submission method is essential to ensure timely processing of the appointment.

Quick guide on how to complete 50 162 appointment of agent for property tax matters

Prepare 50 162 Appointment Of Agent For Property Tax Matters effortlessly on any gadget

Digital document management has gained prominence among businesses and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed forms, allowing you to locate the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage 50 162 Appointment Of Agent For Property Tax Matters on any gadget with airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to modify and eSign 50 162 Appointment Of Agent For Property Tax Matters effortlessly

- Obtain 50 162 Appointment Of Agent For Property Tax Matters and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your preference. Modify and eSign 50 162 Appointment Of Agent For Property Tax Matters and ensure superior communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 50 162 appointment of agent for property tax matters

Create this form in 5 minutes!

How to create an eSignature for the 50 162 appointment of agent for property tax matters

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 50 162 and how does airSlate SignNow help with it?

Form 50 162 is a specific document related to various business processes. With airSlate SignNow, you can easily create, send, and eSign form 50 162, streamlining your workflow and ensuring compliance with all necessary regulations.

-

How much does airSlate SignNow cost for managing form 50 162?

airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. By subscribing to our service, you gain access to features that simplify the management of form 50 162 and other essential documents without breaking the bank.

-

What features does airSlate SignNow offer for form 50 162?

Our platform provides features like customizable templates, real-time tracking, and mobile access specifically for form 50 162. These tools enhance productivity, allow for easy collaboration, and ensure that your documents are processed efficiently.

-

Can I integrate airSlate SignNow with other software for form 50 162?

Yes, airSlate SignNow supports integrations with several popular applications such as CRM systems, cloud storage services, and more. This integration capability enhances the handling of form 50 162 and allows for seamless document management across platforms.

-

What are the benefits of using airSlate SignNow for form 50 162?

Using airSlate SignNow for form 50 162 provides numerous benefits, including faster turnaround times, reduced paper usage, and improved document security. Our solution helps maintain a professional image while simplifying the eSignature process.

-

Is it easy to navigate airSlate SignNow while working with form 50 162?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing even those with minimal technical knowledge to easily manage form 50 162. Our intuitive interface makes it simple to create, edit, and send documents with just a few clicks.

-

How does airSlate SignNow ensure the security of form 50 162?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to protect form 50 162 and other sensitive documents from unauthorized access.

Get more for 50 162 Appointment Of Agent For Property Tax Matters

- Iciq ui short form pdf

- 145502 pregnancy notes v13 117 06 13 hi preg info form

- Perceived stress scale bengali translation document kungfu psy cmu form

- Site connection proposal form

- Phlebotomy handbook 9th edition pdf download form

- Phs 1813 form

- Dc one fund campaignapplication for notforprofit form

- Alarm permit application by clicking here city of apache junction form

Find out other 50 162 Appointment Of Agent For Property Tax Matters

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form