OTC 921 Tax Year 2024 Revised 11 Name 2022

Understanding the OTC 921 Tax Year 2024 Form

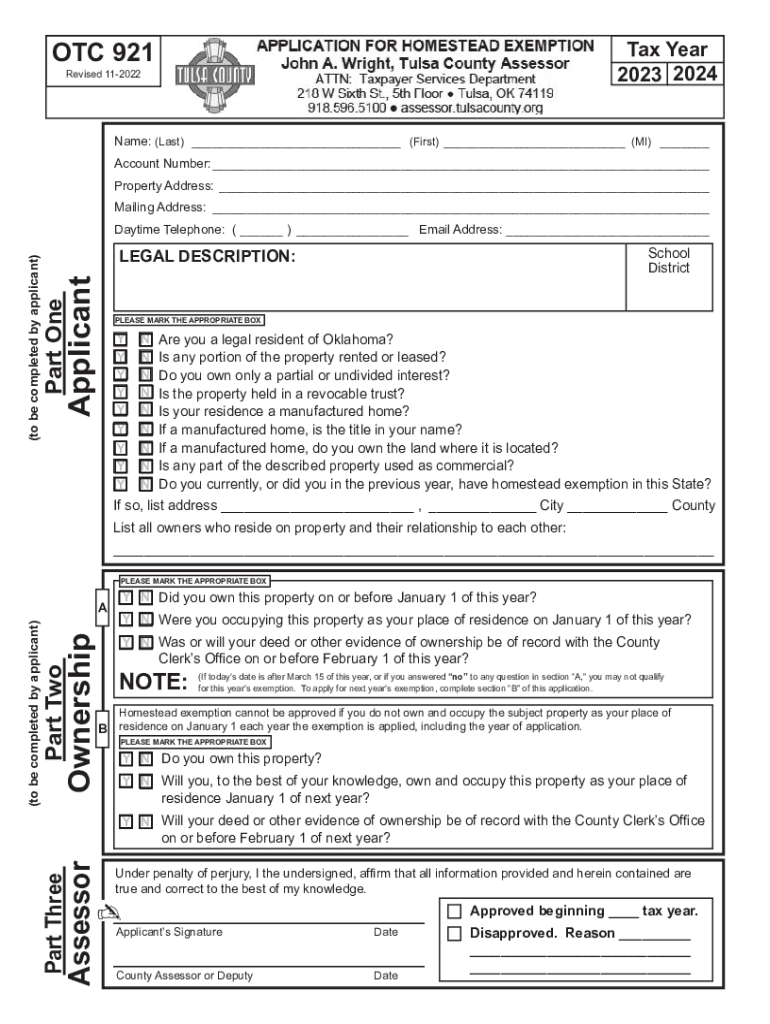

The OTC 921 form is essential for homeowners in the United States seeking to apply for a county homestead exemption. This exemption can significantly reduce property taxes for eligible homeowners by providing a reduction in the assessed value of their primary residence. Understanding the specifics of this form is crucial for ensuring accurate completion and maximizing potential tax benefits.

Steps to Complete the OTC 921 Form

Completing the OTC 921 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including proof of residency and ownership.

- Fill out personal information, ensuring accuracy in names and addresses.

- Provide details about the property, including its location and assessed value.

- Sign and date the form to validate your application.

Each of these steps is vital for the successful submission of your application.

Required Documents for the OTC 921 Form

To ensure a smooth application process, it is important to prepare the following documents:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, like a deed or mortgage statement.

- Any previous tax statements that may be relevant.

Having these documents ready will facilitate the completion of the county homestead exemption form.

Eligibility Criteria for the County Homestead Exemption

To qualify for the county homestead exemption, applicants must meet specific eligibility criteria. Generally, these include:

- The property must be the applicant's primary residence.

- Applicants must be the legal owner of the property.

- There may be income limitations or age requirements, depending on state regulations.

Reviewing these criteria before applying can help determine eligibility and streamline the process.

Form Submission Methods for the OTC 921

The OTC 921 form can typically be submitted through various methods, including:

- Online submission via the county tax assessor's website.

- Mailing the completed form to the appropriate county office.

- In-person submission at the local tax office.

Choosing the right method can depend on personal preference and the specific requirements of your county.

Legal Use of the OTC 921 Form

The OTC 921 form is legally binding once it is completed and submitted according to state regulations. It is important to ensure that:

- The form is filled out accurately and truthfully.

- All required signatures are present.

- It is submitted before the deadline set by local authorities.

Understanding these legal aspects can help avoid complications and ensure compliance with tax laws.

Quick guide on how to complete otc 921 tax year 2024 revised 11 name

Effortlessly Create OTC 921 Tax Year 2024 Revised 11 Name on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary features to generate, modify, and eSign your documents swiftly without delays. Handle OTC 921 Tax Year 2024 Revised 11 Name on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to alter and eSign OTC 921 Tax Year 2024 Revised 11 Name without hassle

- Locate OTC 921 Tax Year 2024 Revised 11 Name and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign OTC 921 Tax Year 2024 Revised 11 Name and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct otc 921 tax year 2024 revised 11 name

Create this form in 5 minutes!

How to create an eSignature for the otc 921 tax year 2024 revised 11 name

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a county homestead exemption form?

A county homestead exemption form is a document that property owners can submit to their local tax authority to potentially reduce property taxes. By applying for this exemption, you can benefit from lowered assessed property value, resulting in lower tax bills. Understanding how to properly complete and submit this form is crucial for maximizing your tax savings.

-

How can airSlate SignNow help with the county homestead exemption form?

airSlate SignNow simplifies the process of obtaining and signing the county homestead exemption form by providing a streamlined eSignature solution. Our platform allows you to easily fill out, sign, and send the form electronically, ensuring faster processing and minimizing paperwork. This can save you time and increase the efficiency of your application.

-

What are the benefits of using airSlate SignNow for my county homestead exemption form?

Using airSlate SignNow to manage your county homestead exemption form offers numerous benefits, including ease of use and quick turnaround times. With our cost-effective solution, you can electronically sign documents from anywhere, eliminating the hassle of physical paperwork. Moreover, our secure platform ensures that your information remains confidential and protected.

-

Is it expensive to use airSlate SignNow for the county homestead exemption form?

No, using airSlate SignNow for your county homestead exemption form is very affordable. Our pricing plans are designed to accommodate various business needs, making it a cost-effective choice for individuals and businesses alike. By using our service, you can save on time and resources, making it a worthwhile investment.

-

Can airSlate SignNow integrate with other applications for my county homestead exemption form?

Yes, airSlate SignNow offers integration capabilities with various applications to facilitate the management of your county homestead exemption form. This means you can connect our platform with your existing software to streamline data entry and workflows. Integrations help ensure that your documents are organized and easily accessible.

-

What features does airSlate SignNow offer to assist with the county homestead exemption form?

airSlate SignNow provides several features to assist with the county homestead exemption form, including customizable templates, automatic reminders, and real-time tracking of document status. These features enhance your experience by making it easier to manage your documents efficiently and keeping you informed throughout the process. Additionally, eSignature capabilities allow for quick approvals and submissions.

-

How can I ensure my county homestead exemption form is submitted correctly?

To ensure your county homestead exemption form is submitted correctly, utilize airSlate SignNow's guided workflow and template options. Our platform offers intuitive features that direct you through the completion process, minimizing errors and omissions. Furthermore, you can easily review all details before submission to avoid complications.

Get more for OTC 921 Tax Year 2024 Revised 11 Name

- Ars 14 5506 form

- Dmacc class schedule template form

- Human cheek cell lab report introduction form

- Pesky gnats cbt workbook 212661748 form

- Appraisal note format for bank guarantee fully secured by

- Late payment notice child care lounge form

- Huntingdon regional fire and rescue gun raffle form

- Dog adoption application 816 greenmore farm animal rescue greenmorerescue form

Find out other OTC 921 Tax Year 2024 Revised 11 Name

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document