2024 2025 Form 921 Application for Homestead Exemption 2023-2026

What is the 2 Form 921 Application For Homestead Exemption

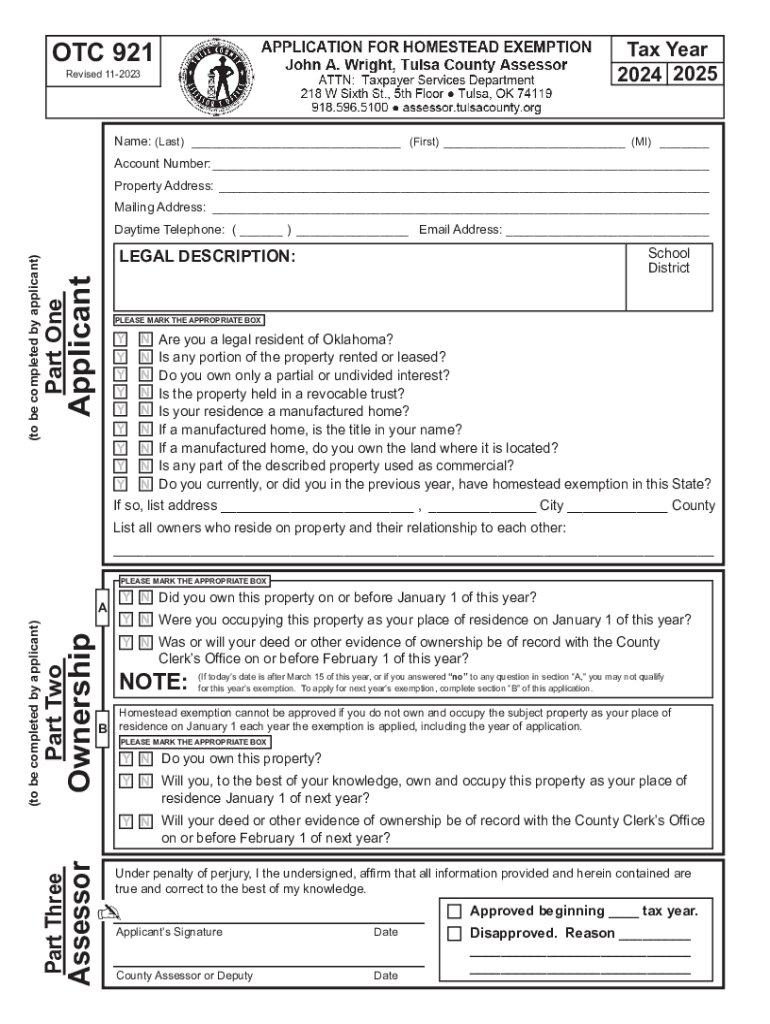

The 2 Form 921 Application for Homestead Exemption is a crucial document for homeowners in Oklahoma seeking to reduce their property tax burden. This form allows eligible homeowners to apply for a homestead exemption, which can provide significant savings on property taxes. The exemption applies to the primary residence of the homeowner and is designed to assist those who meet specific criteria, including income limits and residency requirements. Understanding the purpose and benefits of this form is essential for homeowners looking to maximize their tax savings.

Eligibility Criteria

To qualify for the Oklahoma Homestead Exemption, applicants must meet several criteria:

- The property must be the applicant's primary residence.

- The homeowner must be the legal owner of the property as of January 1 of the tax year.

- Applicants must meet income requirements set by the state.

- New homeowners must apply within a specific timeframe, typically within the first year of ownership.

It is important to review these eligibility criteria carefully to ensure compliance and maximize the potential benefits of the exemption.

Steps to Complete the 2 Form 921 Application For Homestead Exemption

Completing the 2 Form 921 Application involves several straightforward steps:

- Obtain the form from your county assessor's office or the Oklahoma Tax Commission website.

- Fill out the form with accurate information, including property details and owner information.

- Provide any required documentation, such as proof of residency or income verification.

- Review the completed form for accuracy to avoid delays in processing.

- Submit the form to your local county assessor's office by the designated deadline.

Following these steps can help ensure a smooth application process and timely approval of the homestead exemption.

How to Obtain the 2 Form 921 Application For Homestead Exemption

The 2 Form 921 Application can be obtained through multiple channels:

- Visit your local county assessor's office to request a physical copy.

- Download the form directly from the Oklahoma Tax Commission's official website.

- Contact the county assessor's office via phone or email to inquire about obtaining the form.

Having access to the correct form is the first step in applying for the homestead exemption, so it is advisable to choose the most convenient method for your needs.

Form Submission Methods

Once the 2 Form 921 Application is completed, homeowners have several options for submission:

- Mail the completed form to the local county assessor's office.

- Submit the form in person at the county assessor's office.

- Some counties may offer online submission options, so checking with your local office is recommended.

Choosing the right submission method can help ensure that your application is processed efficiently and within the required timeframe.

Filing Deadlines / Important Dates

To successfully apply for the homestead exemption, it is crucial to be aware of the filing deadlines:

- The application must typically be submitted by March 15 of the tax year for which the exemption is sought.

- New homeowners should apply within the first year of ownership to qualify for the exemption.

Missing these deadlines can result in the loss of potential tax savings, making it essential to stay informed about important dates.

Quick guide on how to complete 2024 2025 form 921 application for homestead exemption

Complete 2024 2025 Form 921 Application For Homestead Exemption effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage 2024 2025 Form 921 Application For Homestead Exemption on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign 2024 2025 Form 921 Application For Homestead Exemption effortlessly

- Obtain 2024 2025 Form 921 Application For Homestead Exemption and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks on any device of your choice. Edit and eSign 2024 2025 Form 921 Application For Homestead Exemption and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2024 2025 form 921 application for homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the 2024 2025 form 921 application for homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma homestead exemption?

The Oklahoma homestead exemption is a legal provision that allows homeowners to reduce their property taxes on their primary residence. This exemption can signNowly decrease the taxable value of your home, resulting in lower tax bills. Understanding this exemption can also help you maximize savings as a homeowner in Oklahoma.

-

Who qualifies for the Oklahoma homestead exemption?

To qualify for the Oklahoma homestead exemption, applicants must own their home and occupy it as their primary residence. Moreover, they must be at least 65 years old, disabled, or a member of a certain category of veterans. Ensuring you fit the criteria is essential to benefit from the Oklahoma homestead exemption.

-

How do I apply for the Oklahoma homestead exemption?

To apply for the Oklahoma homestead exemption, you need to submit an application to your county assessor's office. This process typically involves providing proof of ownership and residency. Completing the application accurately is crucial to ensure you receive the benefits of the Oklahoma homestead exemption.

-

When is the application deadline for the Oklahoma homestead exemption?

The application deadline for the Oklahoma homestead exemption is typically set for March 15 of each year. Submitting your application by this deadline ensures that you can benefit from the tax savings in the coming tax year. It's important to stay informed about any changes to these deadlines to maintain your eligibility.

-

What are the benefits of the Oklahoma homestead exemption?

The primary benefit of the Oklahoma homestead exemption is the reduction in property taxes, which can lead to signNow savings for homeowners. Additionally, it provides financial stability and peace of mind, especially for seniors and disabled veterans. Understanding these benefits can encourage homeowners to take full advantage of the Oklahoma homestead exemption.

-

Can I still qualify for the Oklahoma homestead exemption if I have a mortgage?

Yes, you can still qualify for the Oklahoma homestead exemption even if you have a mortgage on your property. The exemption is applicable as long as you occupy the home as your primary residence, regardless of the mortgage status. This can provide essential tax relief to many homeowners in Oklahoma.

-

What happens if I sell my home and buy a new one regarding the Oklahoma homestead exemption?

If you sell your home and purchase a new one, you will need to reapply for the Oklahoma homestead exemption on your new property. The exemption does not automatically transfer, so timely submission of the new application is necessary to maintain your tax benefits. Being proactive about this can help you continue to enjoy the advantages of the Oklahoma homestead exemption.

Get more for 2024 2025 Form 921 Application For Homestead Exemption

- Form 3588

- Intake and output form i o prometric

- Usa customs form ci28 supplemental declaration

- Application form 63441118

- Illinois limited liability company application 481 form

- International independent contractor agreement template form

- Independent contractors agreement template form

- Electrical maintenance contract template form

Find out other 2024 2025 Form 921 Application For Homestead Exemption

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free