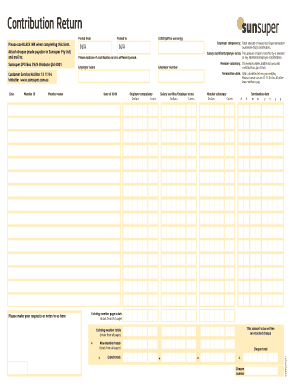

Contribution Return Sunsuper Form

What is the Contribution Return Sunsuper

The Contribution Return Sunsuper is a form used to report contributions made to a Sunsuper account. This document is essential for individuals managing their retirement savings, ensuring that all contributions are accurately recorded and compliant with relevant regulations. It serves as a record for both the contributor and the fund, facilitating transparency and accountability in retirement savings management.

Steps to complete the Contribution Return Sunsuper

Completing the Contribution Return Sunsuper involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including personal identification details and contribution amounts.

- Access the Contribution Return Sunsuper form through a reliable platform.

- Fill in the required fields carefully, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Sign the document electronically to validate your submission.

- Submit the form electronically or via the preferred method outlined by Sunsuper.

Legal use of the Contribution Return Sunsuper

The legal validity of the Contribution Return Sunsuper hinges on compliance with eSignature laws. When filled out electronically, the form must meet specific criteria to be considered legally binding. This includes using a trusted electronic signature solution that complies with the ESIGN Act and UETA, ensuring that the signature is verifiable and the document is securely stored.

How to obtain the Contribution Return Sunsuper

Obtaining the Contribution Return Sunsuper form can be done through various channels. Individuals can access the form directly from the Sunsuper website or through authorized financial service providers. It is essential to ensure that the version obtained is the most current to avoid any compliance issues.

Key elements of the Contribution Return Sunsuper

Understanding the key elements of the Contribution Return Sunsuper is crucial for accurate completion. Important components include:

- Personal Information: Details such as name, address, and account number.

- Contribution Details: The amount contributed and the period of contribution.

- Signature: An electronic signature to validate the submission.

- Date of Submission: The date when the form is completed and submitted.

Form Submission Methods

The Contribution Return Sunsuper can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online Submission: Using an electronic platform to fill out and submit the form.

- Mail: Printing the completed form and sending it to the designated Sunsuper address.

- In-Person: Delivering the form directly to a Sunsuper office or authorized representative.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for compliance with the Contribution Return Sunsuper. Generally, contributions must be reported within specific timeframes to ensure they are accounted for in the correct financial year. It is advisable to check the latest guidelines from Sunsuper for any updates on deadlines and important dates related to the submission of the form.

Quick guide on how to complete contribution return sunsuper

Complete Contribution Return Sunsuper effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Contribution Return Sunsuper on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign Contribution Return Sunsuper with ease

- Obtain Contribution Return Sunsuper and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to retain your adjustments.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Contribution Return Sunsuper and ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the contribution return sunsuper

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Contribution Return Sunsuper process?

The Contribution Return Sunsuper process involves submitting your contribution statement to ensure that your superannuation funds are accurate and compliant. Using airSlate SignNow simplifies this process through electronic signatures and document management, making it faster and more efficient for users.

-

How does airSlate SignNow support Contribution Return Sunsuper submissions?

airSlate SignNow allows users to easily fill out, sign, and submit their Contribution Return Sunsuper documents online. This digital solution saves time and reduces errors, ensuring that your forms are processed quickly and correctly.

-

What are the costs associated with using airSlate SignNow for Contribution Return Sunsuper?

airSlate SignNow offers a variety of pricing plans tailored for different business needs, including options for smaller firms managing Contribution Return Sunsuper. The pricing is competitive, making it a cost-effective choice for efficient document handling.

-

What features does airSlate SignNow provide for managing Contribution Return Sunsuper?

Among its many features, airSlate SignNow offers document templates, customizable workflows, and secure cloud storage specifically for managing Contribution Return Sunsuper. These features enhance your efficiency and ensure that sensitive information remains secure.

-

Can airSlate SignNow integrate with other platforms for Contribution Return Sunsuper?

Yes, airSlate SignNow seamlessly integrates with a variety of platforms such as accounting software and CRM systems, facilitating easier management of Contribution Return Sunsuper documents. This integration simplifies your workflow and enhances productivity.

-

What benefits does airSlate SignNow offer for professionals handling Contribution Return Sunsuper?

Using airSlate SignNow allows professionals to expedite their Contribution Return Sunsuper processes through streamlined electronic signatures and document workflows. This not only saves time but also increases overall accuracy and accountability in handling superannuation returns.

-

Is it easy to track the status of my Contribution Return Sunsuper documents with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking and notifications for all your Contribution Return Sunsuper documents. This ensures you're always updated on the status of your submissions, leading to more efficient processes.

Get more for Contribution Return Sunsuper

Find out other Contribution Return Sunsuper

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document