Form 8860 Qualified Zone Academy Bond Credit Irs

What is the Form 8860 Qualified Zone Academy Bond Credit IRS

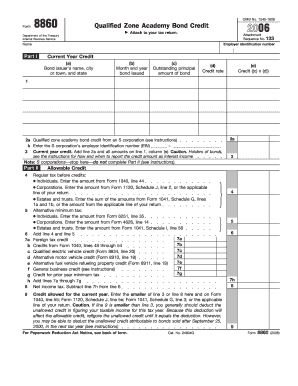

The Form 8860 is used to claim the Qualified Zone Academy Bond Credit, which is a tax credit available to eligible taxpayers in the United States. This credit is designed to encourage investment in qualified zone academies, which are public schools located in economically disadvantaged areas. The credit is based on the interest paid on qualified bonds issued for the purpose of financing the construction, rehabilitation, or renovation of these schools. Understanding the specifics of this form is essential for taxpayers looking to benefit from this incentive.

How to use the Form 8860 Qualified Zone Academy Bond Credit IRS

Using Form 8860 involves several steps to ensure accurate completion and submission. Taxpayers must first gather necessary information, including details about the bonds and the qualified zone academy. The form requires the taxpayer's identification information, the amount of interest paid on the qualified bonds, and the calculation of the credit. After filling out the form, it should be attached to the taxpayer's federal income tax return for the year in which the credit is being claimed.

Steps to complete the Form 8860 Qualified Zone Academy Bond Credit IRS

Completing Form 8860 requires careful attention to detail. Follow these steps for proper completion:

- Begin by entering your name, Social Security number, and other identifying information at the top of the form.

- Provide details about the qualified zone academy, including its name and location.

- Report the total amount of interest paid on the qualified bonds during the tax year.

- Calculate the credit by following the instructions provided on the form.

- Review the completed form for accuracy before attaching it to your tax return.

Eligibility Criteria

To qualify for the credit claimed on Form 8860, taxpayers must meet specific eligibility criteria. The bonds must be issued for a qualified zone academy, which is generally defined as a public school located in a low-income area. Additionally, the taxpayer must be the one who paid the interest on the bonds during the tax year. It is important to verify that the bonds meet all requirements set forth by the IRS to ensure eligibility for the credit.

Filing Deadlines / Important Dates

Filing deadlines for Form 8860 align with the general tax return deadlines. Taxpayers typically need to submit their federal income tax returns, including Form 8860, by April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, but it is crucial to ensure that Form 8860 is submitted within the extended deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8860. Taxpayers should refer to the instructions included with the form for detailed information on eligibility, required documentation, and calculations. It is important to stay updated with any changes in IRS regulations that may affect the use of this form. Adhering to these guidelines helps ensure compliance and maximizes the potential benefit of the tax credit.

Quick guide on how to complete form 8860 qualified zone academy bond credit irs

Effortlessly Prepare Form 8860 Qualified Zone Academy Bond Credit Irs on Any Device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly, without any holdups. Manage Form 8860 Qualified Zone Academy Bond Credit Irs on any device through the airSlate SignNow Android or iOS applications and enhance your document-centric workflows today.

The simplest method to edit and electronically sign Form 8860 Qualified Zone Academy Bond Credit Irs effortlessly

- Obtain Form 8860 Qualified Zone Academy Bond Credit Irs and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which requires only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8860 Qualified Zone Academy Bond Credit Irs to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8860 qualified zone academy bond credit irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8860 Qualified Zone Academy Bond Credit Irs?

The Form 8860 Qualified Zone Academy Bond Credit Irs is a tax form used by eligible taxpayers to claim a credit for interest expenses associated with qualified zone academy bonds. This initiative helps fund educational opportunities in low-income areas. Understanding this form is crucial for maximizing your tax benefits.

-

Who qualifies for the Form 8860 Qualified Zone Academy Bond Credit Irs?

Eligible taxpayers who have paid or incurred interest on qualified zone academy bonds may qualify for the Form 8860 Qualified Zone Academy Bond Credit Irs. This typically includes individuals and businesses that support schools in low-income areas through bond contributions. Make sure to review your eligibility to take advantage of this credit.

-

How can airSlate SignNow assist in managing the Form 8860 Qualified Zone Academy Bond Credit Irs documentation?

airSlate SignNow offers an easy-to-use platform that streamlines the documentation process for the Form 8860 Qualified Zone Academy Bond Credit Irs. Our e-signature features and secure document storage help ensure that your submissions are both compliant and efficient. With our solution, you can manage your tax forms seamlessly.

-

Are there any costs associated with using airSlate SignNow for the Form 8860 Qualified Zone Academy Bond Credit Irs?

airSlate SignNow is cost-effective and offers various pricing plans tailored to different business needs. While there may be subscription fees, the savings from efficient document management and e-signatures can far exceed these costs. Explore our pricing page for more details on how we can fit your budget.

-

What features does airSlate SignNow provide for handling Form 8860 Qualified Zone Academy Bond Credit Irs?

airSlate SignNow includes features such as document templates, secure e-signatures, and automated workflow options for managing the Form 8860 Qualified Zone Academy Bond Credit Irs. These tools help facilitate a faster and more organized filing process, ensuring you never miss an important deadline.

-

Can I integrate airSlate SignNow with other software while managing the Form 8860 Qualified Zone Academy Bond Credit Irs?

Yes, airSlate SignNow offers a wide range of integrations with popular applications, allowing you to manage the Form 8860 Qualified Zone Academy Bond Credit Irs alongside your existing tools. This ensures that your entire document workflow remains efficient and cohesive, enabling better productivity for your team.

-

What are the benefits of using airSlate SignNow for the Form 8860 Qualified Zone Academy Bond Credit Irs?

Using airSlate SignNow for the Form 8860 Qualified Zone Academy Bond Credit Irs offers numerous benefits, including improved accuracy, faster processing times, and enhanced security for sensitive information. Our platform also helps you stay organized and compliant, giving you peace of mind throughout the filing process.

Get more for Form 8860 Qualified Zone Academy Bond Credit Irs

Find out other Form 8860 Qualified Zone Academy Bond Credit Irs

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online