You Didn't File a Form 1040 Tax Return Irs

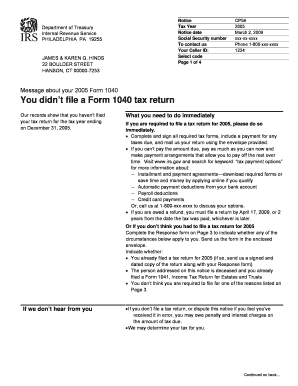

What is the IRS Notice CP59?

The IRS Notice CP59 is a communication issued by the Internal Revenue Service to inform taxpayers that they have not filed their required Form 1040 tax return for a specific tax year. This notice serves as a reminder and provides essential information regarding the implications of not filing. It is crucial for taxpayers to understand that failing to file can lead to penalties and interest on any taxes owed.

Steps to Respond to IRS Notice CP59

When you receive an IRS Notice CP59, it is important to take the following steps:

- Review the notice carefully to confirm the tax year in question.

- Determine whether you have already filed your tax return for that year.

- If you have not filed, gather the necessary documents to complete your Form 1040.

- File your tax return as soon as possible to minimize penalties.

- If you believe you filed your return, consider contacting the IRS to verify your filing status.

Legal Implications of Not Filing

Not filing a tax return can lead to serious legal consequences. The IRS may impose penalties for failure to file, which can accumulate over time. Additionally, taxpayers may face interest charges on any unpaid taxes. In extreme cases, the IRS may take further action, such as filing a substitute return on behalf of the taxpayer, which may not reflect all available deductions and credits.

Required Documents for Filing

To respond to an IRS Notice CP59 and file your tax return, you will need several key documents:

- Your W-2 forms from employers for the relevant tax year.

- Any 1099 forms for additional income.

- Records of deductible expenses, such as receipts and invoices.

- Any other relevant financial documents that support your income and deductions.

Filing Methods for Form 1040

Taxpayers have several options for submitting their Form 1040:

- Online filing through IRS-approved e-filing software.

- Mailing a paper return to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

IRS Guidelines for Filing

The IRS provides specific guidelines for filing your tax return, including deadlines and acceptable methods of submission. It is essential to adhere to these guidelines to avoid penalties. Taxpayers should also be aware of any changes in tax laws that may affect their filing obligations.

Quick guide on how to complete you didnt file a form 1040 tax return irs

Complete You Didn't File A Form 1040 Tax Return Irs with ease on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the needed form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without complications. Manage You Didn't File A Form 1040 Tax Return Irs on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The simplest way to modify and electronically sign You Didn't File A Form 1040 Tax Return Irs effortlessly

- Locate You Didn't File A Form 1040 Tax Return Irs and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize crucial sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and press the Done button to save your changes.

- Select your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form hunting, or mistakes that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign You Didn't File A Form 1040 Tax Return Irs and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you didnt file a form 1040 tax return irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if You Didn't File A Form 1040 Tax Return IRS?

If you didn't file a Form 1040 Tax Return IRS, it's important to take action as soon as possible. You may be subject to penalties and interest for late filing. Utilizing airSlate SignNow can streamline the process of filling out and submitting your tax return electronically from anywhere.

-

How can airSlate SignNow help with tax document management?

airSlate SignNow offers an efficient way to send and eSign important tax documents like Form 1040. By using our platform, you can easily manage your paperwork and ensure that you quickly address the issue of not filing a Form 1040 Tax Return IRS, reducing stress during tax season.

-

Is airSlate SignNow secure for filing tax documents?

Yes, airSlate SignNow utilizes advanced security measures to protect your sensitive information. Our platform is compliant with industry standards, ensuring that your Form 1040 documents are safely stored and transmitted, especially if You Didn't File A Form 1040 Tax Return IRS.

-

What features does airSlate SignNow offer for eSigning tax documents?

Our platform provides a variety of features for eSigning tax documents, including customizable templates, in-person signing, and real-time tracking of document status. This is particularly beneficial if you're in a situation where You Didn't File A Form 1040 Tax Return IRS, as it helps you get your documents ready efficiently.

-

How does pricing work for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to individuals and businesses alike. We provide a cost-effective solution for those who may have missed filing a Form 1040 Tax Return IRS, allowing them to manage their documentation without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software?

Yes, airSlate SignNow can easily integrate with various accounting and financial software that you may already be using. This feature enhances your ability to manage your tax obligations effectively, especially if you realize that You Didn't File A Form 1040 Tax Return IRS.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing brings numerous benefits, such as increased efficiency, ease of access, and enhanced security. This is crucial for anyone facing the issue of not filing a Form 1040 Tax Return IRS, as our platform streamlines the process and minimizes the potential for errors.

Get more for You Didn't File A Form 1040 Tax Return Irs

- 3 5 character sheet pdf form

- Resident parking permit application city of boston cityofboston form

- Purchase card holder list justice form

- Model acknowledgement of conditions for mitigation of form

- Formulir permohonan visa malaysia

- Spa membership form

- Course evaluation form physical therapy private practice

- Church funds request form 452262399

Find out other You Didn't File A Form 1040 Tax Return Irs

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free