1040 Form Schedule C Instructions

What is the 1040 Form Schedule C Instructions

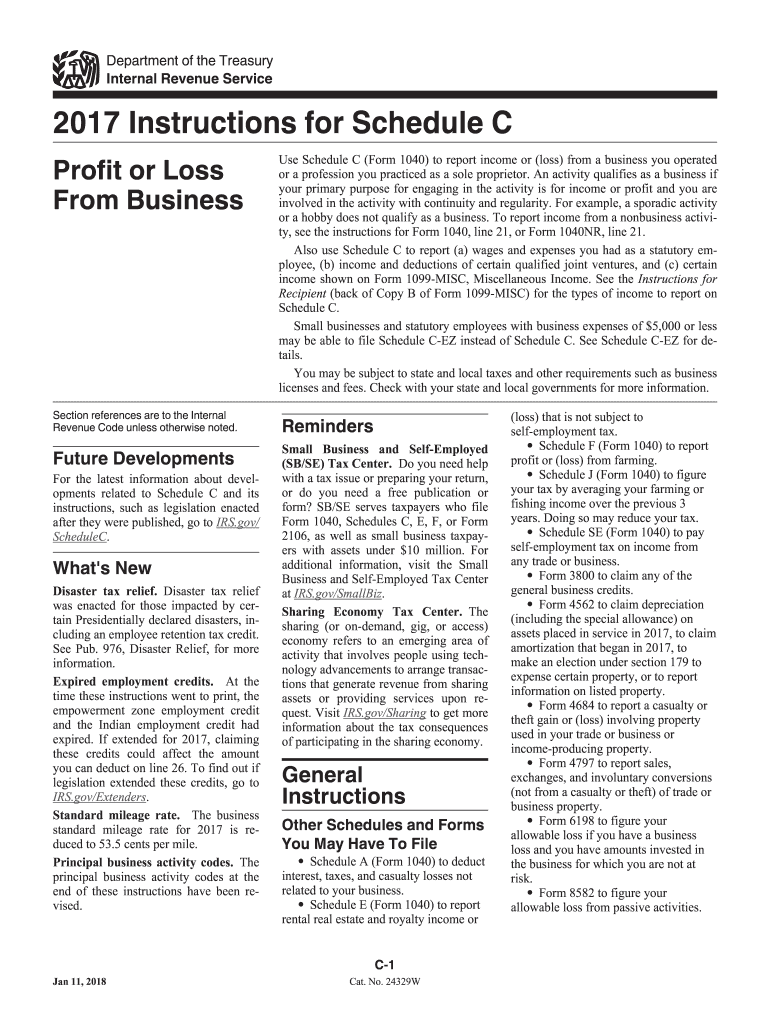

The 1040 Schedule C instructions provide guidance for self-employed individuals and sole proprietors on how to report income and expenses from their business activities. This form is essential for those who operate as independent contractors or freelancers, as it allows them to detail their business income, deduct eligible expenses, and calculate their net profit or loss. Understanding these instructions is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to complete the 1040 Form Schedule C Instructions

Completing the 1040 Schedule C requires careful attention to detail. Here are the key steps involved:

- Gather all necessary documentation, including income statements, receipts, and any relevant financial records.

- Begin by entering your business name and address at the top of the form.

- Report your gross receipts or sales in Part I, ensuring accuracy to avoid discrepancies.

- List all business expenses in Part II, categorizing them appropriately, such as advertising, utilities, and supplies.

- Calculate your net profit or loss by subtracting total expenses from gross income.

- Complete the remaining sections, including any additional information required for your specific business type.

- Review the completed form for accuracy before submission.

Legal use of the 1040 Form Schedule C Instructions

Understanding the legal implications of the 1040 Schedule C instructions is vital for compliance. The information provided must be accurate and truthful, as the IRS requires all taxpayers to report their income and expenses honestly. Failure to comply can result in penalties, including fines or audits. Additionally, the use of e-signatures is legally binding, ensuring that electronically submitted forms meet federal requirements.

Required Documents

To complete the 1040 Schedule C, several documents are necessary:

- Income statements, such as 1099 forms or invoices.

- Receipts for business expenses, including utilities, rent, and supplies.

- Bank statements that reflect business transactions.

- Previous year’s tax returns for reference and consistency.

IRS Guidelines

The IRS provides specific guidelines for completing the 1040 Schedule C. These guidelines include instructions on what qualifies as deductible expenses, how to report income accurately, and the importance of maintaining records. Taxpayers should refer to the official IRS documentation for the most current information and any updates regarding tax laws that may affect their filings.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for compliance. The standard deadline for submitting the 1040 Schedule C is typically April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, self-employed individuals may need to make estimated tax payments quarterly, with specific due dates throughout the year. Keeping track of these dates helps avoid late fees and penalties.

Quick guide on how to complete 1040 form schedule c instructions

Complete 1040 Form Schedule C Instructions effortlessly on any device

Digital document management has gained traction with businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents swiftly without interruptions. Handle 1040 Form Schedule C Instructions on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to adjust and eSign 1040 Form Schedule C Instructions with ease

- Locate 1040 Form Schedule C Instructions and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Edit and eSign 1040 Form Schedule C Instructions to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 form schedule c instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 Schedule C tax form used for?

The 1040 Schedule C tax form is used by self-employed individuals to report income or loss from their business. It outlines details such as profit, expenses, and net income. Properly filling out the 1040 Schedule C tax form 2018 instructions ensures that you meet IRS requirements and maximize your deductions.

-

Where can I find the 1040 Schedule C tax form 2018 instructions?

You can find the 1040 Schedule C tax form 2018 instructions on the official IRS website. This resource provides detailed guidance on how to accurately complete the form. Using these instructions is essential for proper tax reporting and compliance.

-

How much does it cost to use airSlate SignNow for signing tax forms?

airSlate SignNow offers various pricing plans, ensuring you find a cost-effective solution tailored to your needs. Pricing may vary depending on the features you select, but it remains affordable for both individuals and businesses. With airSlate SignNow, you can easily eSign your 1040 Schedule C tax form 2018 instructions, streamlining your tax filing process.

-

Can I integrate airSlate SignNow with other tools to manage my taxes?

Yes, airSlate SignNow seamlessly integrates with a variety of applications you may use for tax management. Integration with tools like accounting software simplifies the process of handling your 1040 Schedule C tax form 2018 instructions alongside your financial records. This enhances your workflow and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents offers numerous benefits, including real-time collaboration and document tracking. It simplifies the process of signing your 1040 Schedule C tax form 2018 instructions, ensuring everything is completed efficiently and securely. Additionally, the platform helps you maintain compliance with digital signature regulations.

-

Is airSlate SignNow secure for signing sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents are safely handled. With features like encryption and secure storage, you can confidently sign your 1040 Schedule C tax form 2018 instructions without worrying about unauthorized access. Your data privacy is our top concern.

-

What should I do if I have questions while filling out the 1040 Schedule C tax form 2018 instructions?

If you have questions while filling out the 1040 Schedule C tax form 2018 instructions, it's best to consult a tax professional or the IRS website for clarification. Additionally, airSlate SignNow provides helpful resources and support to enhance your experience. Utilizing expert guidance helps ensure accuracy in your tax submissions.

Get more for 1040 Form Schedule C Instructions

Find out other 1040 Form Schedule C Instructions

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form