Tax Information Documents

What are tax information documents?

Tax information documents are essential forms that provide necessary details about an individual's or business's financial activities. These documents include various forms such as the W-2, 1099, and other relevant tax filings that report income, deductions, and credits to the Internal Revenue Service (IRS). They play a crucial role in ensuring compliance with tax laws and are vital for accurate tax return preparation.

How to use tax information documents

Using tax information documents effectively involves several steps. First, gather all relevant documents, including W-2s and 1099s, to ensure you have a complete picture of your income. Next, review each document for accuracy, checking that all information matches your records. Once verified, use these documents to fill out your tax return, ensuring that you report all income and claim any applicable deductions. Lastly, keep copies of these documents for your records, as they may be needed for future reference or audits.

Steps to complete tax information documents

Completing tax information documents requires careful attention to detail. Start by identifying the specific forms you need based on your income sources. Next, collect all necessary financial records, such as pay stubs and bank statements. Follow these steps:

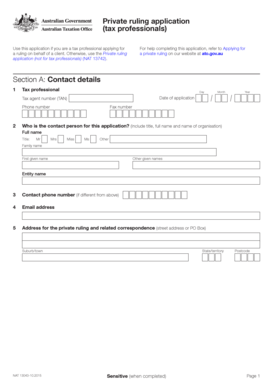

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that figures match your financial records.

- Include any deductions or credits you are eligible for, based on the instructions provided with the forms.

- Review the completed documents for accuracy before submission.

Legal use of tax information documents

Tax information documents must be used in accordance with federal and state laws. They serve as official records of income and tax liability, and improper use can lead to penalties. It is important to ensure that all information is accurate and submitted on time to avoid issues with the IRS. Additionally, electronic submissions of these documents must comply with eSignature laws to maintain their legal validity.

Filing deadlines and important dates

Filing deadlines for tax information documents are crucial for compliance. Typically, the IRS requires individuals to file their tax returns by April 15 each year. However, deadlines may vary based on specific circumstances, such as weekends or holidays. It is important to stay informed about any changes to these dates, as late submissions can result in penalties and interest on owed taxes.

IRS guidelines

The IRS provides comprehensive guidelines for the completion and submission of tax information documents. These guidelines outline the required forms, instructions for filling them out, and the necessary documentation needed to support claims. Familiarizing yourself with IRS guidelines can help ensure that you meet all requirements and avoid common mistakes that could lead to audits or penalties.

Quick guide on how to complete tax information documents

Complete Tax Information Documents effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Tax Information Documents on any device using airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The easiest way to modify and eSign Tax Information Documents seamlessly

- Locate Tax Information Documents and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize relevant text in the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Tax Information Documents and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax information documents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for using airSlate SignNow in a tax agent office?

The pricing for airSlate SignNow in a tax agent office is designed to be cost-effective and flexible, catering to various business needs. We offer monthly and annual subscription plans that provide unlimited document signing, ensuring you find a suitable option for your budget.

-

How can airSlate SignNow improve workflow in a tax agent office?

airSlate SignNow streamlines the document signing process, helping tax agent offices enhance their workflow efficiency. With real-time collaboration features and instant notifications, your team can easily manage client documents, reducing turnaround times and improving overall productivity.

-

What features does airSlate SignNow offer specifically for tax agent offices?

airSlate SignNow includes features tailored for tax agent offices such as customizable templates, secure document storage, and advanced security measures. These functionalities ensure that your sensitive client information is protected while maintaining ease of access for your team.

-

How does airSlate SignNow integrate with other tools commonly used in a tax agent office?

airSlate SignNow integrates seamlessly with various tools commonly found in tax agent offices, such as accounting software and customer relationship management (CRM) systems. This enables you to combine document management with other essential tasks, enhancing your overall efficiency.

-

Can airSlate SignNow help my tax agent office comply with industry regulations?

Yes, airSlate SignNow helps tax agent offices maintain compliance with industry regulations by offering secure signing and storage solutions. With built-in audit trails and compliant eSignature options, you can ensure that your documents adhere to legal standards and best practices.

-

Is training available for tax agent offices using airSlate SignNow?

Absolutely. airSlate SignNow provides extensive training resources for tax agent offices, including online tutorials, live webinars, and dedicated customer support. This ensures your team can quickly become proficient in using the platform to its full potential.

-

What are the benefits of using airSlate SignNow for a tax agent office?

The benefits of using airSlate SignNow for a tax agent office include increased efficiency, reduced operational costs, and improved client satisfaction. By digitizing the signing process, you can save time, reduce paper use, and deliver a more modern service to your clients.

Get more for Tax Information Documents

- Chemistry form ws9 4 1a

- Philly pd form

- Signature declaration form

- Form 300 withdrawal request utah educational savings plan uesp

- Deemed surrender certificate indian passport form

- Wabb membership form 14 15 pages west aurora high school bands wahsvpa

- Pour over will doc fabf form

- Dancer application form

Find out other Tax Information Documents

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template