Mortgage Deed for England and WalesNationwide Mortgage Deed for England and Wales Form

Understanding the Mortgage Deed for England and Wales

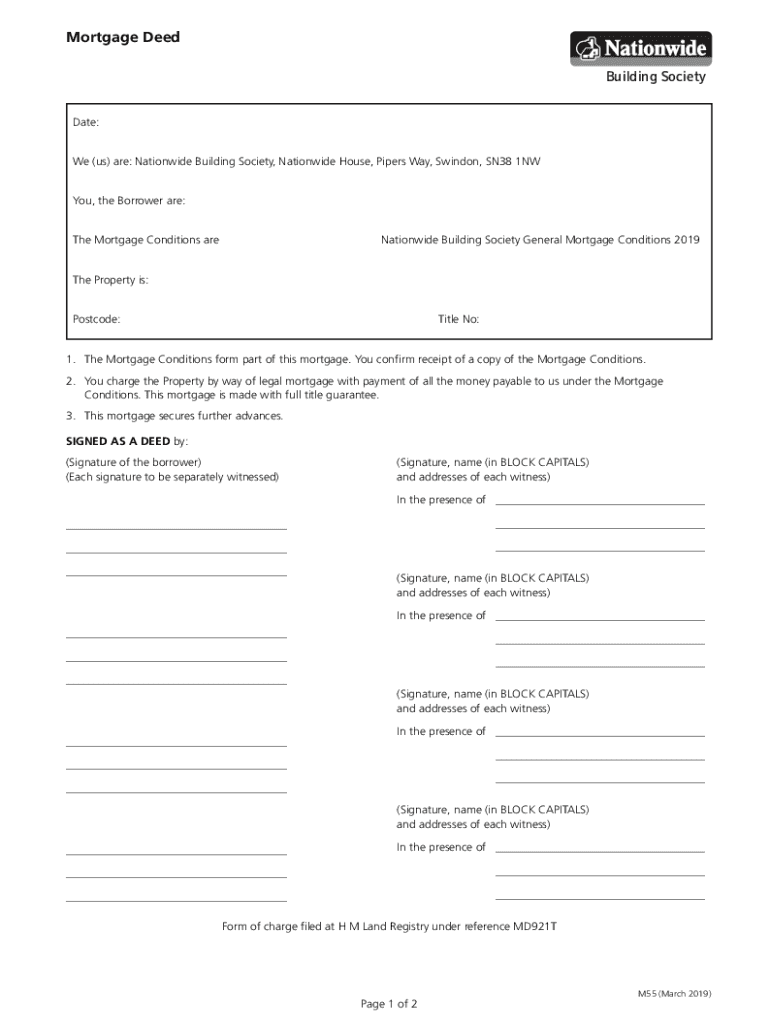

The mortgage deed serves as a critical legal document in property transactions within England and Wales. It outlines the terms of the mortgage agreement between the borrower and the lender, establishing the lender's rights over the property in case of default. This document is essential for securing a loan against a property and includes details such as the loan amount, interest rates, and repayment terms. Understanding the specific components of the mortgage deed is crucial for both parties to ensure clarity and compliance with legal standards.

Key Elements of the Mortgage Deed for England and Wales

A mortgage deed typically includes several key elements that define the agreement between the borrower and lender. These elements include:

- Borrower and Lender Information: Names and addresses of both parties involved.

- Property Details: Description of the property being mortgaged, including its address and title number.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Details on how and when the borrower will repay the loan.

- Default Clauses: Conditions under which the lender may take possession of the property.

Including these elements ensures that both parties have a clear understanding of their obligations and rights under the mortgage agreement.

Steps to Complete the Mortgage Deed for England and Wales

Completing a mortgage deed involves several important steps to ensure its validity and compliance with legal requirements. The process generally includes:

- Gather Necessary Information: Collect all relevant details about the property and the parties involved.

- Draft the Mortgage Deed: Prepare the document, ensuring all key elements are included and accurately represented.

- Review the Document: Both parties should carefully review the deed to confirm all terms are correct.

- Sign the Document: Both the borrower and lender must sign the mortgage deed in the presence of a witness.

- Register the Deed: Submit the signed deed to the appropriate land registry to officially record the mortgage.

Following these steps helps ensure that the mortgage deed is legally binding and protects the interests of both parties.

Legal Use of the Mortgage Deed for England and Wales

The legal use of a mortgage deed is governed by specific regulations that ensure its enforceability. In England and Wales, the deed must be executed in accordance with the Law of Property Act 1989, which outlines the necessary formalities for creating a valid mortgage. This includes proper signing, witnessing, and registration with the land registry. Failure to adhere to these legal requirements may result in the deed being deemed invalid, which can have significant consequences for both the borrower and lender.

How to Obtain the Mortgage Deed for England and Wales

Obtaining a mortgage deed typically involves working with a legal professional or a mortgage lender. The process generally includes:

- Consultation: Discuss your mortgage needs with a lender or solicitor who can guide you through the process.

- Application: Complete the necessary application forms to initiate the mortgage process.

- Drafting the Deed: Once approved, the lender or solicitor will draft the mortgage deed based on the agreed terms.

- Review and Sign: Review the drafted deed and sign it in the presence of a witness.

By following these steps, you can successfully obtain a mortgage deed that meets legal standards and protects your interests.

Quick guide on how to complete mortgage deed for england and walesnationwide mortgage deed for england and wales

Complete Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales seamlessly on any device

Digital document management has become popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales effortlessly

- Find Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Choose how you wish to share your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage deed for england and walesnationwide mortgage deed for england and wales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UK mortgage deed?

A UK mortgage deed is a legal document that formalizes the agreement between a borrower and a lender when securing a mortgage. It outlines the terms of the loan and transfers the legal interest in the property to the lender. Understanding the contents of a UK mortgage deed is crucial for homeowners to ensure their rights are protected.

-

How does airSlate SignNow simplify the signing process for UK mortgage deeds?

airSlate SignNow streamlines the signing process for UK mortgage deeds by allowing users to electronically sign documents from any device. This eliminates the need for physical signatures, reduces processing time, and enhances efficiency. With an intuitive interface, users can quickly navigate and complete their UK mortgage deed documentation.

-

What are the pricing options for using airSlate SignNow for my UK mortgage deed?

airSlate SignNow offers various pricing plans to cater to different needs, ensuring that signing your UK mortgage deed is cost-effective. Subscribers can choose from monthly or annual plans, which provide a range of features to suit both individual users and businesses. Check our website for the latest pricing details tailored to your requirements.

-

Can I integrate airSlate SignNow with other applications for managing UK mortgage deeds?

Yes, airSlate SignNow supports seamless integrations with various applications, enhancing bookkeeping and document management related to UK mortgage deeds. By integrating with platforms like CRM and accounting software, you can streamline your workflow and maintain organized records. This ensures that your mortgage processes are efficient and well-coordinated.

-

What security measures does airSlate SignNow have in place for UK mortgage deed transactions?

Security is a top priority at airSlate SignNow, particularly when handling sensitive documents like UK mortgage deeds. We employ advanced encryption methods to protect your documents during transmission and storage. Additionally, our compliance with industry standards safeguards your information, giving you peace of mind throughout the signing process.

-

What are the benefits of using airSlate SignNow for my UK mortgage deed?

Using airSlate SignNow for your UK mortgage deed simplifies the entire signing process, allowing for faster turnaround times and improved efficiency. Electronic signatures are legally binding and offer a green alternative to paper-based methods. Opting for airSlate SignNow not only saves time but also minimizes errors, ensuring a smoother transaction.

-

Is it legal to eSign a UK mortgage deed with airSlate SignNow?

Yes, it is legal to electronically sign a UK mortgage deed with airSlate SignNow, as our platform complies with the Electronic Communications Act 2000 and the UK eIDAS Regulation. This means that eSignatures on UK mortgage deeds hold the same legal weight as traditional handwritten signatures. Embracing this technology provides convenience without compromising legality.

Get more for Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales

- Affidavit of death form texas

- Expanse rpg character generator form

- Einsatzplanung fr arbeitgeber form

- Form for being musician

- Va form 29 541

- Cec nrca mch 18 a revised 0116 energy ca form

- Los angeles green building code form grn 4a tier 1 and tier 2 voluntary requirements checklist residential buildings

- Stakeholder register template form

Find out other Mortgage Deed For England And WalesNationwide Mortgage Deed For England And Wales

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy