KiwiSaver Significant Financial Hardship Withdrawal Form

What is the KiwiSaver Significant Financial Hardship Withdrawal Form

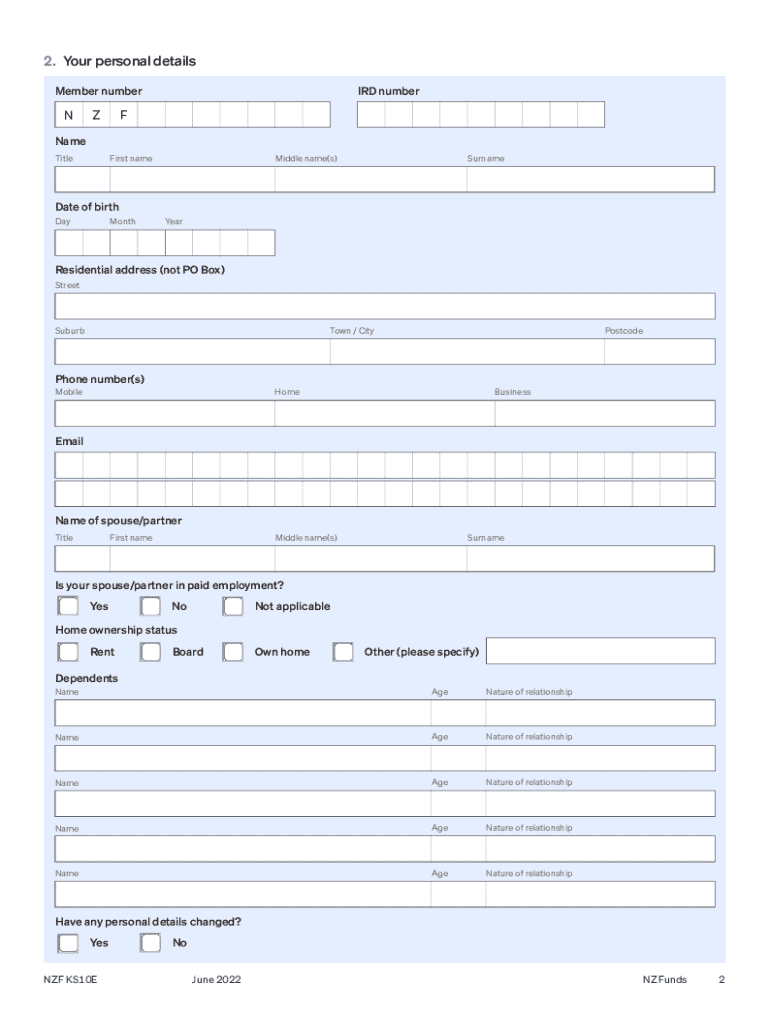

The KiwiSaver Significant Financial Hardship Withdrawal Form is a specialized document designed for individuals seeking to withdraw funds from their KiwiSaver account due to significant financial hardship. This form allows members to access their savings when facing severe financial difficulties, such as unemployment, medical expenses, or other critical financial obligations. It is essential to complete this form accurately to ensure that the application is processed smoothly.

Eligibility Criteria for the KiwiSaver Significant Financial Hardship Withdrawal Form

To qualify for a withdrawal using the KiwiSaver Significant Financial Hardship Withdrawal Form, applicants must meet specific eligibility criteria. Generally, individuals must demonstrate that they are experiencing significant financial hardship, which may include:

- Inability to meet minimum living expenses

- Unforeseen medical expenses

- Loss of employment

- Significant debt obligations

Applicants may be required to provide documentation supporting their claims of financial hardship, ensuring that their situation meets the necessary requirements for withdrawal.

Steps to Complete the KiwiSaver Significant Financial Hardship Withdrawal Form

Completing the KiwiSaver Significant Financial Hardship Withdrawal Form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary documentation, including proof of income and expenses.

- Fill out the form with accurate personal information, ensuring all sections are completed.

- Attach supporting documents that demonstrate your financial hardship.

- Review the form for accuracy before submission.

- Submit the completed form through the designated method, whether online or by mail.

Taking these steps can help streamline the application process and increase the likelihood of approval.

How to Obtain the KiwiSaver Significant Financial Hardship Withdrawal Form

The KiwiSaver Significant Financial Hardship Withdrawal Form can be obtained through various channels. Members can typically access the form via:

- The official KiwiSaver provider's website, where downloadable forms are often available.

- Contacting the KiwiSaver provider directly for a physical copy.

- Financial advisors or institutions that offer KiwiSaver services may also provide the form.

Ensuring you have the correct version of the form is crucial for a successful application.

Legal Use of the KiwiSaver Significant Financial Hardship Withdrawal Form

The legal use of the KiwiSaver Significant Financial Hardship Withdrawal Form is governed by specific regulations. It is important for applicants to understand that submitting this form constitutes a formal request for access to their retirement savings under conditions defined by law. Misrepresentation or failure to provide accurate information may result in penalties or denial of the application. Therefore, it is essential to adhere to all legal guidelines when completing and submitting the form.

Required Documents for the KiwiSaver Significant Financial Hardship Withdrawal Form

When applying for a withdrawal using the KiwiSaver Significant Financial Hardship Withdrawal Form, applicants must provide several required documents to support their claim. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Documentation of financial hardship, including recent bank statements and bills.

- Evidence of income, such as pay stubs or tax returns.

Providing these documents helps substantiate the claim and facilitates a smoother review process.

Quick guide on how to complete kiwisaver significant financial hardship withdrawal form

Effortlessly Prepare KiwiSaver Significant Financial Hardship Withdrawal Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, enabling you to find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Manage KiwiSaver Significant Financial Hardship Withdrawal Form on any device using airSlate SignNow's Android or iOS applications and improve your document-related tasks today.

The Easiest Method to Edit and Electronically Sign KiwiSaver Significant Financial Hardship Withdrawal Form Without Stress

- Find KiwiSaver Significant Financial Hardship Withdrawal Form and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searching, or mistakes that require new printed copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and electronically sign KiwiSaver Significant Financial Hardship Withdrawal Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kiwisaver significant financial hardship withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for a kiwisaver application withdrawal?

The process for a kiwisaver application withdrawal typically involves submitting your withdrawal request through your kiwisaver provider. It's essential to provide all necessary documentation, such as identification and proof of eligibility, to expedite the process. Once submitted, you can expect a confirmation and timeline for the withdrawal to be processed.

-

What documents are required for kiwisaver application withdrawal?

To complete a kiwisaver application withdrawal, you'll need to provide identification, such as a driver's license or passport, and additional documents that confirm your eligibility, like proof of financial hardship or first home purchase. It’s advisable to check with your kiwisaver provider for any specific documentation needed.

-

How long does it take to process a kiwisaver application withdrawal?

The processing time for a kiwisaver application withdrawal can vary, but it generally takes a few days to a few weeks. Your provider will review your application and documents, so providing accurate and complete information can help speed up the process. If you have concerns, contacting your kiwisaver provider can provide you with updates.

-

Are there any fees associated with kiwisaver application withdrawal?

Most kiwisaver providers do not charge fees for processing a kiwisaver application withdrawal, but it’s essential to check your specific provider’s policies. Some may have administrative fees or charges for expedited services. Always review the terms before initiating your withdrawal to avoid any surprises.

-

What are the benefits of a kiwisaver application withdrawal?

A kiwisaver application withdrawal allows you to access your savings for specific purposes like buying your first home or dealing with financial hardship. This withdrawal provides an opportunity to improve your financial situation, helping you to achieve critical life goals. It's designed to support your financial needs when they arise.

-

Can I withdraw kiwisaver funds for retirement?

Yes, you can withdraw funds from your kiwisaver account for retirement purposes. Typically, these withdrawals can begin when you signNow the age of 65, allowing you to enjoy your hard-earned savings. It’s crucial to consider the long-term impacts on your retirement goals before making any withdrawals.

-

What limitations apply to kiwisaver application withdrawal?

There are specific limitations on kiwisaver application withdrawal, such as eligibility criteria based on age, purpose of withdrawal, and the amount available. Certain conditions apply depending on whether you are withdrawing for purchasing your first home or experiencing financial hardship. Always confirm the requirements with your provider before initiating a withdrawal.

Get more for KiwiSaver Significant Financial Hardship Withdrawal Form

Find out other KiwiSaver Significant Financial Hardship Withdrawal Form

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe