Tax Income Return Form

What is the Tax Income Return

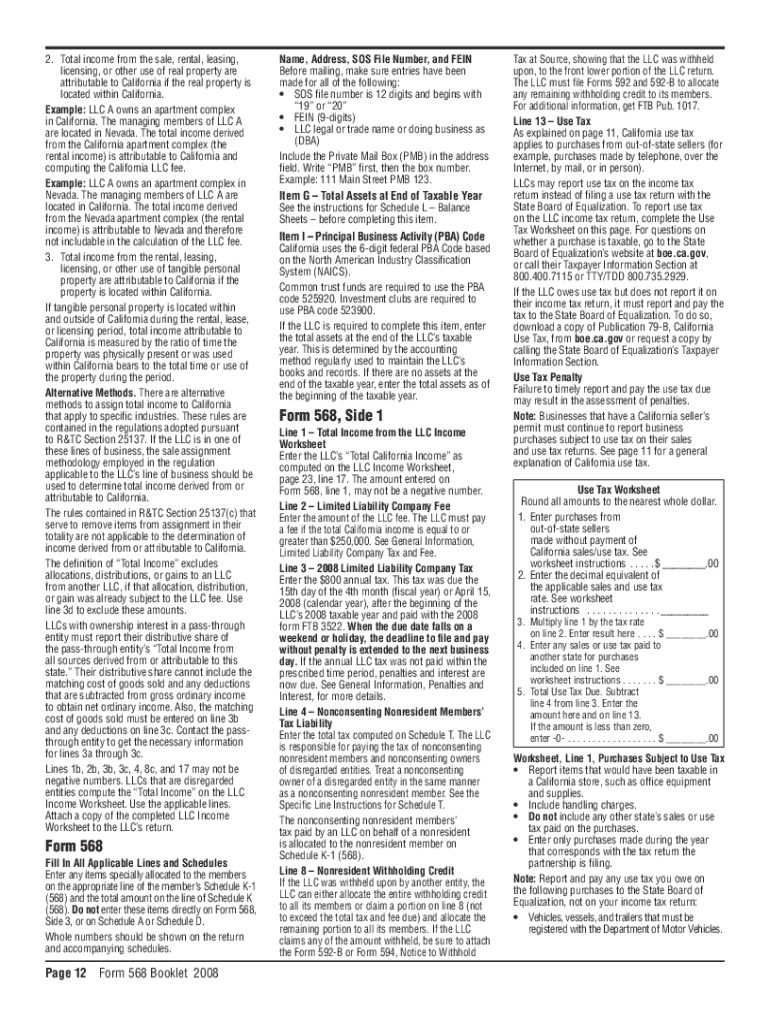

The Tax Income Return is a crucial document that individuals and businesses, including LLC limited companies, must file with the Internal Revenue Service (IRS) to report their income, expenses, and other relevant tax information. For LLCs, this form helps determine the tax obligations based on the income generated during the fiscal year. It is essential for maintaining compliance with federal tax laws and ensuring that the correct amount of tax is paid.

Steps to Complete the Tax Income Return

Completing the Tax Income Return involves several key steps. First, gather all necessary financial documents, including income statements, expense receipts, and any previous tax returns. Next, select the appropriate form based on your business structure; for LLCs, this may include Form 1065 or Schedule C, depending on how the LLC is taxed. Then, accurately fill out the form, ensuring that all income and deductions are reported correctly. Finally, review the completed return for accuracy before submitting it to the IRS by the designated deadline.

Key Elements of the Tax Income Return

Key elements of the Tax Income Return include the identification of the taxpayer, reporting of all sources of income, and detailed documentation of deductions and credits. For LLCs, it is vital to include information such as the total revenue, operating expenses, and any distributions made to members. Additionally, the return must reflect any applicable state taxes and compliance with local regulations, which may vary based on the state of operation.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Income Return can vary depending on the type of entity and the tax year. Generally, LLCs must file their returns by March 15 for partnerships or by April 15 for single-member LLCs treated as sole proprietorships. If additional time is needed, an extension can be requested, but it is important to note that this does not extend the time to pay any taxes owed. Keeping track of these dates is essential to avoid penalties and interest charges.

Required Documents

To complete the Tax Income Return, several documents are required. These typically include income statements, such as W-2s or 1099s, expense documentation, bank statements, and prior year tax returns. For LLCs, specific forms like Schedule K-1 may also be necessary to report income distributed to members. Ensuring that all documents are organized and readily available can streamline the filing process and help avoid errors.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Tax Income Return. These guidelines include instructions on how to report different types of income, claim deductions, and understand tax credits available to LLCs. Familiarizing oneself with these guidelines is crucial for accurate reporting and compliance. The IRS website offers resources and publications that can assist in understanding the requirements and best practices for filing.

Quick guide on how to complete tax income return

Finalize Tax Income Return effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Tax Income Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest method to modify and electronically sign Tax Income Return with ease

- Locate Tax Income Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers for that specific purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, frustrating form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Tax Income Return and ensure outstanding communication throughout the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax income return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an LLC limited company?

An LLC limited company is a business structure that combines the flexibility of a partnership with the liability protection of a corporation. It allows owners, known as members, to enjoy personal liability protection while benefiting from pass-through taxation. This makes it an attractive option for many entrepreneurs.

-

How can airSlate SignNow assist with setting up an LLC limited company?

airSlate SignNow offers tools that simplify the documentation process when creating your LLC limited company. You can easily send and eSign necessary forms, ensuring that all paperwork is legally compliant and submitted on time. This facilitates a smooth setup for your new business venture.

-

What features does airSlate SignNow provide for LLC limited company formation?

With airSlate SignNow, you'll have access to secure eSigning, customizable templates, and the ability to track document status in real-time. These features streamline the management of your LLC limited company documents, saving you time and effort in handling administrative tasks.

-

Is airSlate SignNow a cost-effective solution for LLC limited companies?

Yes, airSlate SignNow is known for its affordability, making it a competitive choice for LLC limited companies. Our pricing plans are designed to fit various business sizes and needs, allowing you to choose a package that best suits your budget while still enjoying robust features.

-

How can airSlate SignNow enhance my LLC limited company's workflow?

By integrating airSlate SignNow into your LLC limited company's workflow, you can automate document management processes and enhance team collaboration. The solution simplifies the collection of signatures and document sharing, leading to increased efficiency and reduced turnaround times.

-

What integrations does airSlate SignNow offer for LLC limited companies?

airSlate SignNow integrates with popular platforms like Google Drive, Dropbox, and Salesforce, making it easy for your LLC limited company to stay organized. These integrations allow for seamless document storage and management, all within one ecosystem, which can enhance productivity across your operations.

-

Can airSlate SignNow help with compliance for my LLC limited company?

Absolutely! airSlate SignNow provides tools that ensure your documentation is compliant with legal standards for LLC limited companies. Our platform helps maintain accurate records and sends reminders for important deadlines, so you can stay compliant with ease.

Get more for Tax Income Return

- Imm 5257 form

- Www templateroller comtemplate2049808form de1101id ampquotunemployment insurance applicationampquot california

- What are lpe1 enquiries and why do i need them form

- D 0 1 0 2 2 0 f 0 0 1residence homestead exemption form

- Mapsus netuschoctaw nation gaming commissionchoctaw nation gaming commission oklahoma united states form

- Republic of the philippinesoffice of the presiden form

- Ppf withdrawal form

- Real estate utility information sheet 101783974

Find out other Tax Income Return

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter