Co Llc Form

What is the Co LLC?

The Co LLC, or Colorado Limited Liability Company, is a specific type of business entity formed under Colorado state law. This structure provides limited liability protection to its owners, known as members, meaning their personal assets are generally protected from business debts and liabilities. The Co LLC combines the flexibility of a partnership with the liability protection of a corporation, making it a popular choice for small business owners in the United States.

How to obtain the Co LLC

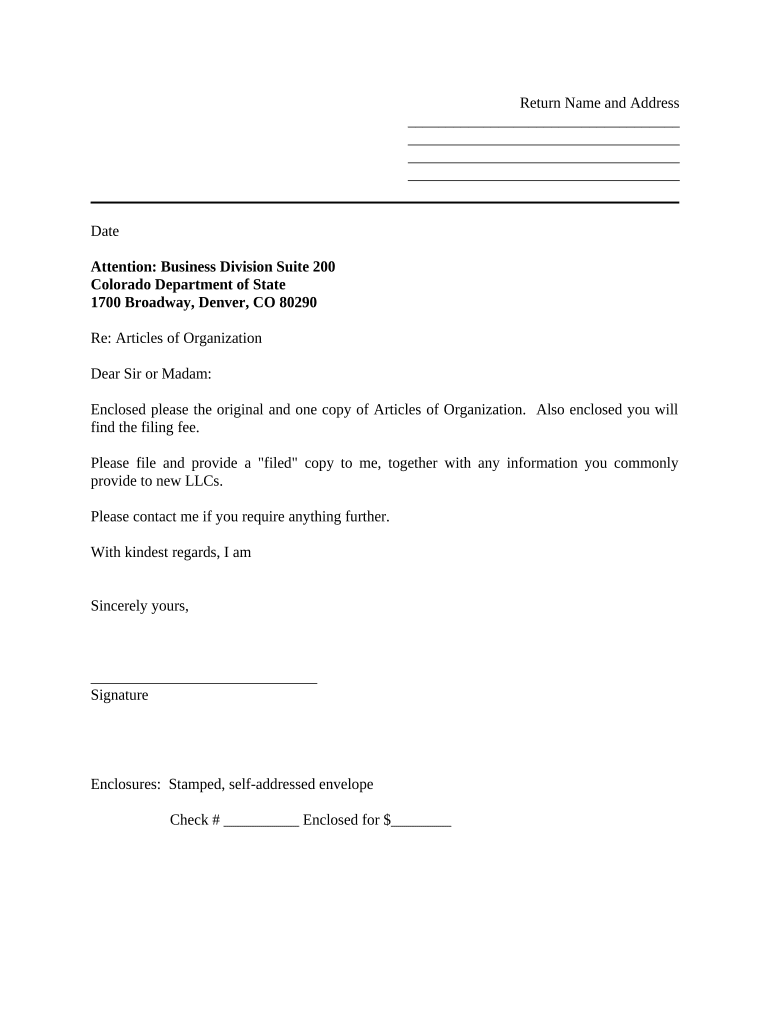

To obtain a Co LLC, you must follow a series of steps. First, choose a unique name for your LLC that complies with Colorado naming requirements. Next, file Articles of Organization with the Colorado Secretary of State, which can be done online. There is a filing fee associated with this process. After your application is approved, you will need to create an Operating Agreement to outline the management structure and operating procedures of your LLC. Lastly, consider obtaining an Employer Identification Number (EIN) from the IRS for tax purposes.

Steps to complete the Co LLC

Completing the Co LLC involves several key steps:

- Choose a unique name for your LLC.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the Colorado Secretary of State.

- Create an Operating Agreement that details the management and operational procedures.

- Obtain an EIN from the IRS if you plan to hire employees or if your LLC has more than one member.

Legal use of the Co LLC

The Co LLC is legally recognized as a separate entity, which means it can enter into contracts, own property, and be liable for debts. This structure is particularly beneficial for entrepreneurs seeking to limit their personal liability while maintaining operational flexibility. However, it is essential to adhere to state regulations, including annual reporting requirements and maintaining proper records, to ensure the LLC remains in good standing.

Key elements of the Co LLC

Several key elements define the Co LLC structure:

- Limited Liability: Protects members' personal assets from business liabilities.

- Pass-Through Taxation: Income is taxed at the member level, avoiding double taxation.

- Flexible Management: Members can choose to manage the LLC themselves or appoint managers.

- Compliance Requirements: Must file annual reports and maintain accurate records.

State-specific rules for the Co LLC

Each state has its own rules governing LLCs, and Colorado is no exception. In Colorado, LLCs must file Articles of Organization with the Secretary of State and pay the required fees. Additionally, Colorado requires LLCs to file periodic reports to maintain their status. It is important for business owners to familiarize themselves with these state-specific regulations to ensure compliance and avoid penalties.

Quick guide on how to complete co llc 497300605

Complete Co Llc effortlessly on any device

Online document management has become increasingly prevalent among enterprises and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without interruptions. Manage Co Llc on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Co Llc effortlessly

- Find Co Llc and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools available from airSlate SignNow tailored for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an original wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Decide how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Co Llc and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CO LLC and how does it benefit my business?

A CO LLC, or Colorado Limited Liability Company, provides personal liability protection for its owners while allowing for flexible management structures. This means that as an owner, your personal assets are generally safe from business debts and lawsuits. Choosing a CO LLC can also offer tax benefits, making it appealing for many business owners.

-

How much does it cost to form a CO LLC with airSlate SignNow?

The cost to form a CO LLC with airSlate SignNow is competitive and includes various packages that cater to different business needs. Basic services start at an affordable price, which covers essential filing and documentation. Additionally, our transparent pricing structure means there are no hidden fees, allowing you to manage your budget effectively.

-

What features does airSlate SignNow offer for CO LLC organizations?

airSlate SignNow provides a variety of features specifically tailored for CO LLC organizations, including secure eSigning, customizable templates, and document management tools. These features streamline your workflow and enhance collaboration among team members and clients. Utilizing our platform can signNowly reduce the time spent on paperwork.

-

Can I integrate airSlate SignNow with other business tools for my CO LLC?

Yes, airSlate SignNow offers seamless integration with a wide range of business tools, which is beneficial for CO LLCs. You can connect with tools like Google Workspace, Salesforce, and Microsoft Office to enhance your document management processes. This ensures a cohesive workflow that supports your business operations.

-

What are the legal requirements for setting up a CO LLC?

To set up a CO LLC, you need to file the Articles of Organization with the Colorado Secretary of State and pay the required fee. Additionally, it's essential to create an operating agreement that outlines the management structure and operating procedures of the CO LLC. Ensuring compliance with these requirements is key to maintaining your LLC's good standing.

-

How does airSlate SignNow enhance security for CO LLC transactions?

Security is a top priority for airSlate SignNow, especially for CO LLC transactions involving sensitive documents. Our platform employs bank-level encryption and complies with industry standards to safeguard your documents. This means you can confidently eSign and manage your paperwork knowing that your data is protected.

-

What are the tax implications of a CO LLC?

A CO LLC provides tax flexibility, allowing owners to choose how they want to be taxed—either as a sole proprietorship, partnership, or corporation. This helps CO LLC owners optimize their tax strategy based on their specific financial situation. Consulting a tax professional is recommended to understand the full implications of forming a CO LLC.

Get more for Co Llc

Find out other Co Llc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors