Distribution Form Return

What is the Distribution Form Return

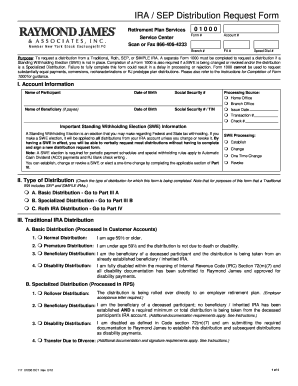

The Distribution Form Return is a crucial document used in the context of Individual Retirement Accounts (IRAs). It serves to report distributions made from an IRA account, ensuring compliance with tax regulations. This form is essential for both the account holder and the IRS, as it outlines the amounts withdrawn and any applicable tax implications. Understanding the purpose and requirements of this form helps individuals manage their retirement funds effectively and avoid potential penalties.

Steps to Complete the Distribution Form Return

Completing the Distribution Form Return involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information, including your personal details and IRA account information.

- Identify the type of distribution you are reporting, such as regular distributions, early withdrawals, or rollovers.

- Fill in the distribution amounts accurately, ensuring you include any taxes withheld.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate channel, whether online, by mail, or in person.

Legal Use of the Distribution Form Return

The legal use of the Distribution Form Return is governed by IRS regulations, which dictate how distributions from IRAs should be reported. To ensure that the form is legally binding, it must be filled out accurately and submitted in accordance with IRS guidelines. Failure to comply with these regulations can lead to penalties, including fines or additional taxes. Utilizing a reliable eSignature solution can enhance the legal validity of the form by providing a secure and compliant method for signing and submitting documents electronically.

Key Elements of the Distribution Form Return

Several key elements are essential when completing the Distribution Form Return. These include:

- Account Holder Information: Name, address, and Social Security number of the individual submitting the form.

- Distribution Details: Specific amounts withdrawn, the type of distribution, and any taxes withheld.

- Signature: A valid signature or eSignature to authenticate the submission.

- Date of Distribution: The date when the funds were withdrawn from the IRA.

How to Obtain the Distribution Form Return

Obtaining the Distribution Form Return is a straightforward process. Individuals can typically access the form through the IRS website or by contacting their IRA custodian. Many financial institutions provide downloadable forms on their websites, ensuring easy access for account holders. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax laws or regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Distribution Form Return are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most individuals. However, if you are filing for an extension, it is essential to adhere to the extended deadline. Keeping track of these important dates ensures compliance and helps in effective financial planning.

Quick guide on how to complete distribution form return

Effortlessly Prepare Distribution Form Return on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Handle Distribution Form Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Distribution Form Return effortlessly

- Obtain Distribution Form Return and click Get Form to initiate.

- Make use of the tools we provide to complete your form.

- Select relevant portions of your documents or hide sensitive information with tools that airSlate SignNow specially offers for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to secure your modifications.

- Decide how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Distribution Form Return and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the distribution form return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form IRA and how can airSlate SignNow help?

A form IRA is a specific document used to set up an Individual Retirement Account. With airSlate SignNow, you can easily create, send, and eSign form IRAs securely, ensuring that your retirement documentation is processed efficiently and compliant with regulations.

-

How much does it cost to use airSlate SignNow for form IRA processing?

airSlate SignNow offers a variety of pricing plans tailored to different business needs. Pricing for processing form IRAs is competitive and designed to provide value, ensuring that you have access to a range of features that streamline your document management processes.

-

What features does airSlate SignNow offer for form IRA management?

airSlate SignNow provides robust features for form IRA management, including templates for easy creation, automated workflows, and secure eSigning options. These features help businesses save time and ensure accuracy when handling important retirement documents.

-

Can airSlate SignNow integrate with other financial software to manage form IRAs?

Yes, airSlate SignNow integrates seamlessly with various financial software applications. This makes it easier for businesses to manage form IRAs alongside other essential financial documents, enhancing productivity and ensuring information consistency across platforms.

-

What benefits does airSlate SignNow provide for form IRA processing?

Using airSlate SignNow for form IRA processing offers several benefits, including increased efficiency, reduced paperwork, and improved security. The platform also enhances collaboration, allowing multiple stakeholders to review and sign documents quickly.

-

Is airSlate SignNow secure for handling sensitive form IRA documents?

Absolutely. airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect sensitive form IRA documents. This ensures that your retirement information remains confidential and safe from unauthorized access.

-

Can users customize their form IRA templates in airSlate SignNow?

Yes, airSlate SignNow allows users to fully customize their form IRA templates to match their unique business needs. This flexibility helps ensure that all required fields are included, making the process smoother for both businesses and clients.

Get more for Distribution Form Return

Find out other Distribution Form Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors