Tax Truck Form

What is the Tax Truck

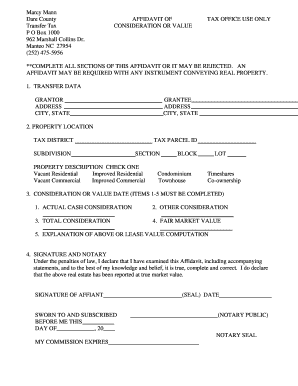

The tax truck is a specific form used for reporting various tax-related information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately report their income, deductions, and credits to ensure compliance with federal tax laws. This form serves as a crucial document in the tax filing process, allowing taxpayers to communicate their financial situation to the IRS effectively. Understanding the purpose and requirements of the tax truck is vital for anyone involved in tax preparation.

How to use the Tax Truck

Using the tax truck involves several steps to ensure that all required information is accurately provided. First, gather all necessary financial documents, including income statements, receipts for deductions, and any previous tax returns. Next, fill out the form carefully, ensuring that all sections are completed according to IRS guidelines. It is advisable to double-check all entries for accuracy before submission. Finally, submit the completed tax truck form to the IRS through the preferred method, whether electronically or by mail.

Steps to complete the Tax Truck

Completing the tax truck requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather your financial documents, including W-2s, 1099s, and receipts.

- Review the instructions for the tax truck to understand what information is required.

- Fill out the form, ensuring that all income and deductions are reported accurately.

- Verify the entries for any errors or omissions.

- Sign and date the form, as required.

- Submit the form to the IRS by the designated deadline.

Legal use of the Tax Truck

The legal use of the tax truck is governed by federal tax laws and regulations. To ensure that the form is legally valid, it must be completed accurately and submitted within the specified deadlines. Additionally, the use of electronic signatures is permissible under the ESIGN Act, provided that the eSignature solution complies with legal standards. It is crucial to maintain records of the submitted form and any supporting documentation for future reference and compliance.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the tax truck. These guidelines include instructions on eligibility, required documentation, and deadlines for submission. Taxpayers should familiarize themselves with these guidelines to avoid errors that could lead to penalties or delays in processing. Staying informed about any updates or changes to IRS regulations is also essential for accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the tax truck are critical to avoid penalties and interest on unpaid taxes. Typically, individual tax returns are due on April fifteenth of each year, while extensions may be available under certain circumstances. Businesses may have different deadlines based on their entity type. It is important to mark these dates on your calendar and ensure that all necessary documents are prepared in advance to facilitate timely filing.

Required Documents

To complete the tax truck, several documents are required to substantiate the information reported. These documents may include:

- W-2 forms for wage earners

- 1099 forms for independent contractors

- Receipts for deductible expenses

- Previous year's tax return for reference

- Any relevant schedules or additional forms as required by the IRS

Having these documents organized and readily available will streamline the process of completing the tax truck and ensure compliance with IRS requirements.

Quick guide on how to complete tax truck

Effortlessly Prepare Tax Truck on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can locate the appropriate form and safely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without hold-ups. Handle Tax Truck on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Tax Truck with Ease

- Locate Tax Truck and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that function.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Tax Truck to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax truck

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax truck and how can airSlate SignNow assist with it?

A tax truck is a specialized vehicle used for transporting goods related to tax purposes, such as logistics for tax filings or financial documents. airSlate SignNow can facilitate the efficient signing and sending of necessary documents, ensuring a smooth process that keeps everything organized and compliant.

-

How does airSlate SignNow help automate tax truck documentation?

With airSlate SignNow, you can automate your tax truck documentation needs by creating templates for frequently used agreements. This reduces the time spent on paperwork and ensures that all necessary documents are correctly signed and stored.

-

What features of airSlate SignNow benefit tax truck operations?

airSlate SignNow offers features such as electronic signatures, document tracking, and template solutions that directly benefit tax truck operations. These features streamline the collection and management of essential documents, minimizing errors and enhancing compliance.

-

Is airSlate SignNow cost-effective for managing tax truck paperwork?

Yes, airSlate SignNow provides a cost-effective solution for managing tax truck paperwork. By digitizing the signing process, businesses can save on printing and mailing costs, allowing for better budget management while handling tax-related documents.

-

Can I integrate airSlate SignNow with other tools for my tax truck business?

Absolutely! airSlate SignNow integrates seamlessly with various software tools that may be essential for your tax truck business, such as CRM systems and accounting software. This integration helps streamline workflows and enhances the efficiency of your operations.

-

What are the benefits of using airSlate SignNow for tax truck eSigning?

Using airSlate SignNow for tax truck eSigning ensures quicker document turnaround, improved accuracy, and enhanced security. With protected digital signatures, you can trust that your tax-related documents are securely managed and easily accessible when needed.

-

How user-friendly is the airSlate SignNow platform for tax truck users?

The airSlate SignNow platform is designed to be user-friendly, catering to all levels of tech-savviness. For tax truck users, this means they can quickly navigate the platform, upload documents, and request signatures without any technical hurdles.

Get more for Tax Truck

Find out other Tax Truck

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo