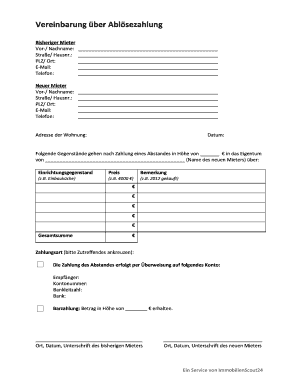

Vereinbarung Ber Abl Sezahlung Form

What is the SOC 831?

The SOC 831 is a specialized form used primarily in the context of financial transactions and reporting. This form is designed to capture essential information regarding the financial activities of individuals or entities, ensuring compliance with relevant regulations. It serves as a crucial document for both taxpayers and the IRS, facilitating accurate reporting and transparency in financial dealings.

How to use the SOC 831

To effectively utilize the SOC 831, individuals or businesses must first gather all necessary financial information relevant to the reporting period. This includes income statements, expense reports, and any other documentation that supports the figures reported on the form. Once the information is compiled, users can complete the SOC 831 by filling in the required fields accurately. It is important to review the completed form for any discrepancies before submission to ensure compliance and avoid potential penalties.

Steps to complete the SOC 831

Completing the SOC 831 involves several key steps:

- Gather all relevant financial documents, including income and expense records.

- Access the SOC 831 form through the appropriate channels, either online or in printed format.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed SOC 831 by the designated deadline, either electronically or via mail.

Legal use of the SOC 831

The SOC 831 must be used in accordance with applicable laws and regulations. This includes adhering to IRS guidelines for financial reporting and ensuring that all submitted information is truthful and accurate. Misuse of the SOC 831, such as providing false information or failing to file by the deadline, can result in penalties or legal repercussions. By following the established guidelines, users can maintain compliance and avoid issues with regulatory authorities.

Required Documents for the SOC 831

When preparing to complete the SOC 831, individuals should have the following documents on hand:

- Income statements for the reporting period.

- Expense records, including receipts and invoices.

- Any relevant tax documents that support the financial information provided.

- Previous year's SOC forms, if applicable, for reference.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the SOC 831 can lead to significant penalties. These may include fines, interest on unpaid amounts, and potential legal action from regulatory bodies. It is essential for individuals and businesses to understand the importance of timely and accurate submissions to avoid these consequences.

Quick guide on how to complete vereinbarung ber abl sezahlung

Finish Vereinbarung Ber Abl Sezahlung effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the correct template and securely preserve it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and electronically sign your papers swiftly without delays. Manage Vereinbarung Ber Abl Sezahlung on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Vereinbarung Ber Abl Sezahlung effortlessly

- Locate Vereinbarung Ber Abl Sezahlung and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize essential parts of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs within a few clicks from your chosen device. Edit and electronically sign Vereinbarung Ber Abl Sezahlung and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vereinbarung ber abl sezahlung

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SOC 831 in the context of airSlate SignNow?

SOC 831 refers to a specific Service Organization Control report that demonstrates the security and compliance of airSlate SignNow's eSignature solutions. It provides assurance to customers that their sensitive data is handled in accordance with industry standards, making it a vital consideration for businesses concerned about compliance and security.

-

How does airSlate SignNow ensure compliance with SOC 831?

airSlate SignNow adheres to strict security protocols and regularly undergoes audits to maintain SOC 831 compliance. This commitment to security ensures that all eSigned documents are processed securely, providing peace of mind for businesses that prioritize compliance and data protection.

-

What pricing plans are available for airSlate SignNow with SOC 831 compliance?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options that emphasize SOC 831 compliance. The plans are designed to be cost-effective while ensuring that all users benefit from the robust security features that come with SOC 831 certification.

-

What features does airSlate SignNow provide for users concerned about SOC 831?

airSlate SignNow includes a range of features that align with SOC 831 standards, such as advanced authentication, document encryption, and audit trails. These features help businesses maintain compliance while ensuring that the eSigning process is both secure and user-friendly.

-

What are the benefits of choosing airSlate SignNow in light of SOC 831?

By choosing airSlate SignNow, businesses gain the confidence that comes with SOC 831 compliance, ensuring their eSignature processes meet industry standards. This not only protects sensitive information but also enhances customer trust and improves operational efficiency.

-

Can airSlate SignNow integrate with other software while maintaining SOC 831 standards?

Yes, airSlate SignNow offers seamless integrations with various software applications, all while maintaining SOC 831 compliance. These integrations facilitate smooth workflows and help businesses create a secure digital ecosystem without compromising on security.

-

How does SOC 831 impact the user experience with airSlate SignNow?

The SOC 831 certification enhances the overall user experience by ensuring that airSlate SignNow is secure and reliable. Users can confidently send and eSign documents without worrying about the potential risks associated with data bsignNowes or compliance violations.

Get more for Vereinbarung Ber Abl Sezahlung

- Make a high quality logo for you by workkruchok7 fiverr form

- Update my address welcome to the state of new york form

- Aish open government form

- Form k 89 vehicle storage rates requirements application

- 83039 adoc form

- Illinois parking program for persons with disabilities law enforcement guide form

- Reg 256 statement of facts california department of form

- Illinois paratrooper license plates request form

Find out other Vereinbarung Ber Abl Sezahlung

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement