E595e Fillable Form

What is the E595e Fillable

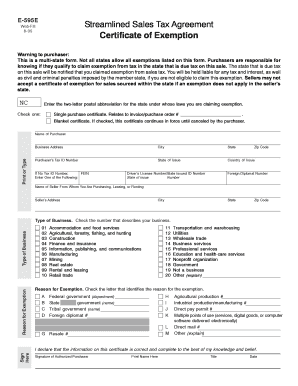

The E595e fillable form is a crucial document used primarily for tax exemption purposes in the United States. It allows businesses to claim exemption from sales and use tax on purchases made for resale. This form is essential for retailers and wholesalers who want to ensure compliance with state tax regulations while minimizing their tax liabilities. By completing the E595e fillable form, businesses can provide proof of their tax-exempt status to suppliers, facilitating smoother transactions and compliance with tax laws.

How to Use the E595e Fillable

Using the E595e fillable form is straightforward. First, access the form through a reliable platform that supports electronic signatures and fillable documents. Once you have the form, fill in the required fields, including your business information, tax identification number, and details about the items being purchased. After completing the form, review it for accuracy before submitting it to your supplier. Ensure that all necessary signatures are included, as this will validate the form and make it legally binding.

Steps to Complete the E595e Fillable

Completing the E595e fillable form involves several key steps:

- Access the form from a trusted source.

- Fill in your business name, address, and tax identification number.

- Specify the type of goods or services for which you are claiming tax exemption.

- Provide your supplier's information, including their name and address.

- Review all entries for accuracy to avoid delays.

- Sign the form electronically to validate it.

- Submit the completed form to your supplier.

Legal Use of the E595e Fillable

The legal use of the E595e fillable form hinges on its proper completion and submission. For the form to be considered valid, it must meet specific requirements set forth by state tax authorities. This includes ensuring that the information provided is accurate and that the form is signed by an authorized representative of the business. Additionally, businesses should retain copies of the completed form for their records, as they may need to present it during audits or inquiries from tax authorities.

IRS Guidelines

While the E595e fillable form is primarily a state-level document, it is essential to adhere to IRS guidelines regarding tax-exempt purchases. Businesses must ensure that they are eligible for tax exemption and that they are using the form correctly. The IRS provides resources and guidelines that outline the requirements for maintaining tax-exempt status, which can help businesses avoid penalties and ensure compliance with federal tax laws.

Form Submission Methods

Submitting the E595e fillable form can be done in several ways, depending on the supplier's requirements. Common submission methods include:

- Online submission through an electronic document platform.

- Emailing the completed form to the supplier.

- Mailing a printed copy of the form to the supplier's address.

- Delivering the form in person, if required.

It is important to confirm with the supplier which submission method they prefer to ensure timely processing of the tax exemption.

Quick guide on how to complete e595e fillable

Complete E595e Fillable effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage E595e Fillable on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign E595e Fillable seamlessly

- Find E595e Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device you prefer. Modify and eSign E595e Fillable and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e595e fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an e595e fillable form and how can airSlate SignNow help?

An e595e fillable form is a customizable document that can be completed electronically. With airSlate SignNow, you can easily create, send, and manage e595e fillable forms, streamlining your document workflow and ensuring all necessary information is captured efficiently.

-

How much does it cost to use airSlate SignNow for e595e fillable forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You'll find subscription models that allow you to create, manage, and store e595e fillable forms without breaking the bank, making it a cost-effective solution for any organization.

-

What features does airSlate SignNow offer for e595e fillable forms?

airSlate SignNow provides a variety of features for e595e fillable forms, such as drag-and-drop editing, automated workflows, and real-time collaboration tools. These features enhance productivity and ensure that your document processes are efficient and user-friendly.

-

Can I integrate airSlate SignNow with other applications for e595e fillable forms?

Yes, airSlate SignNow supports integrations with numerous third-party applications. This capability allows you to seamlessly integrate your e595e fillable forms with platforms like CRM systems, payment processors, and other tools, enhancing your operational efficiency.

-

What are the benefits of using e595e fillable forms with airSlate SignNow?

Using e595e fillable forms with airSlate SignNow streamlines your document signing process and reduces the risk of errors. The platform enhances accessibility and allows multiple users to collaborate in real-time, improving overall efficiency and saving time.

-

Is it secure to use e595e fillable forms in airSlate SignNow?

Yes, airSlate SignNow prioritizes security, ensuring that your e595e fillable forms and documents are protected with advanced encryption and compliance measures. You can trust that your sensitive information is handled securely throughout the signing process.

-

Can I track the status of my e595e fillable forms in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your e595e fillable forms. You’ll receive updates on document status, including when it's viewed, signed, or completed, giving you complete visibility into the signing process.

Get more for E595e Fillable

Find out other E595e Fillable

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure