Trust Required Form

What is the Trust Required

The trust required form is a crucial document often used in financial and legal transactions. It establishes a formal agreement between parties, outlining the responsibilities and obligations involved. This form is particularly important in contexts where trust is essential, such as in fiduciary relationships or when handling sensitive financial information. Understanding its purpose and implications is vital for ensuring compliance and legal protection.

Steps to Complete the Trust Required

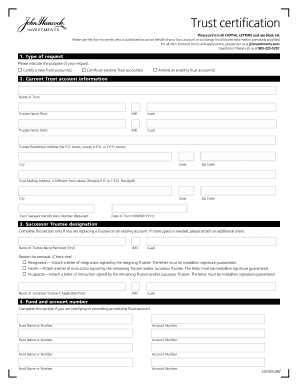

Completing the trust required form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the parties involved, including names, addresses, and any relevant identification numbers. Next, carefully fill out each section of the form, ensuring that all details are correct and complete. It is essential to review the form for any errors before submission. Finally, sign and date the document, and ensure that any required witnesses or notarization are completed as per the legal requirements.

Legal Use of the Trust Required

The legal use of the trust required form is governed by various state and federal regulations. This form must adhere to applicable laws to be considered valid in a legal context. It is essential to ensure that the form meets all requirements set forth by the relevant legal frameworks, such as the Uniform Trust Code or specific state statutes. This compliance helps protect the interests of all parties involved and ensures that the document can be enforced in a court of law if necessary.

Key Elements of the Trust Required

Several key elements must be included in the trust required form to ensure its validity. These elements typically include:

- Identifying Information: Names and addresses of all parties involved.

- Terms of the Trust: Clear definitions of the responsibilities and obligations of each party.

- Duration: The time frame for which the trust is effective.

- Signatures: Required signatures of all parties, along with dates.

Including these elements helps to create a comprehensive and legally binding document.

Examples of Using the Trust Required

The trust required form can be utilized in various scenarios, including:

- Establishing a trust fund for minors or dependents.

- Creating a living trust to manage assets during a person's lifetime.

- Documenting fiduciary responsibilities in estate planning.

These examples illustrate the versatility of the trust required form in facilitating trust-based agreements across different contexts.

Required Documents

When preparing to complete the trust required form, several supporting documents may be necessary. These can include:

- Identification documents for all parties involved.

- Previous trust agreements, if applicable.

- Financial statements or asset inventories relevant to the trust.

Having these documents ready can streamline the completion process and ensure that all necessary information is accurately represented.

Form Submission Methods

The trust required form can typically be submitted through various methods, including:

- Online Submission: Many jurisdictions allow electronic filing of trust forms.

- Mail: Physical copies can be sent to the appropriate office or agency.

- In-Person: Submitting the form directly at a designated office may be required in some cases.

Choosing the appropriate submission method can depend on local regulations and personal preferences.

Quick guide on how to complete trust required

Complete Trust Required effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Trust Required on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Trust Required without hassle

- Locate Trust Required and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that reason.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Trust Required and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trust required

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of documents can be signed using airSlate SignNow?

airSlate SignNow allows users to eSign a variety of documents, including contracts, agreements, and forms. With the trust required functionality, you can ensure that your documents are secure and legally binding. This flexibility makes it an ideal solution for businesses of all sizes.

-

How does airSlate SignNow ensure document security?

At airSlate SignNow, we prioritize security and compliance, ensuring that trust required is central to our operations. Our platform uses high-level encryption standards to protect your data, along with secure digital signatures that meet legal requirements. This means your documents are safe from unauthorized access.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows prospective customers to explore the features with no commitment. This trial helps you understand the level of trust required in our service, as you'll experience firsthand how easy and secure our eSigning process is. Start your trial today to see if it's the right fit for your business.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various applications and platforms, including CRM systems, cloud storage providers, and productivity tools. This capability enhances the user experience by reducing the trust required to switch between different services. You'll enjoy a streamlined workflow that saves time and boosts efficiency.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business needs and sizes. Each plan is designed to deliver value while ensuring that trust required is maintained through transparent pricing without hidden fees. You can choose a plan that best aligns with your document signing requirements.

-

Can I customize my documents for eSigning?

Absolutely! airSlate SignNow allows users to customize documents with fields for signatures, dates, and other information. This flexibility reduces the trust required when sending documents, as recipients know exactly what to do. Customization enhances the overall signing experience for both senders and signers.

-

How does airSlate SignNow improve productivity?

By utilizing airSlate SignNow, businesses can signNowly enhance their productivity. The features offered streamline the signing process, requiring less time while ensuring that all signatures are legally binding with trust required. This means your team can focus on core tasks instead of tedious paperwork.

Get more for Trust Required

Find out other Trust Required

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF