Arizona Form a 4

What is the Arizona Form A 4

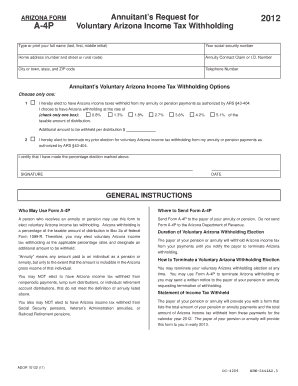

The Arizona Form A 4 is a state-specific tax withholding form used by employers to determine the amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with Arizona tax laws and helps employees manage their tax obligations effectively. It is crucial for both employers and employees to understand the implications of this form, as it directly affects take-home pay and tax liabilities.

How to use the Arizona Form A 4

To use the Arizona Form A 4, employers must provide the form to their employees, who will complete it to indicate their withholding preferences. Employees should consider their personal financial situations, including any additional income or deductions, when filling out the form. Once completed, the form should be submitted to the employer, who will then use the information to calculate the appropriate withholding amounts from each paycheck.

Steps to complete the Arizona Form A 4

Completing the Arizona Form A 4 involves several key steps:

- Obtain the form: Employees can access the Arizona Form A 4 through the Arizona Department of Revenue website or from their employer.

- Fill out personal information: Employees should provide their name, address, and Social Security number.

- Select withholding allowances: Employees must indicate the number of allowances they wish to claim based on their personal tax situation.

- Additional withholding: If desired, employees can specify an additional amount to be withheld from their paychecks.

- Sign and date the form: The form must be signed and dated to be valid.

Key elements of the Arizona Form A 4

The Arizona Form A 4 includes several important elements that affect tax withholding:

- Personal information: Essential details such as name, address, and Social Security number.

- Withholding allowances: The number of allowances claimed, which influences the withholding amount.

- Additional withholding options: Employees can request extra amounts to be withheld if they anticipate owing more taxes.

Legal use of the Arizona Form A 4

The Arizona Form A 4 is legally binding when completed accurately and submitted to the employer. It is important for both employers and employees to understand that the information provided on this form must reflect the employee's true financial situation to ensure compliance with state tax laws. Failure to adhere to the guidelines may result in penalties or incorrect withholding amounts.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Arizona Form A 4 is crucial for both employers and employees. The form should be completed and submitted to the employer before the first paycheck of the year to ensure proper withholding. Additionally, employees should review and update their form whenever there are significant life changes, such as marriage or the birth of a child, to maintain accurate withholding throughout the year.

Quick guide on how to complete arizona form a 4

Complete Arizona Form A 4 effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Arizona Form A 4 on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Arizona Form A 4 with ease

- Obtain Arizona Form A 4 and click Get Form to begin.

- Utilize the tools we supply to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Arizona Form A 4 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form a 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona Form A 4 and how can airSlate SignNow help?

Arizona Form A 4 is a state-specific form used for employee withholding purposes. With airSlate SignNow, you can easily fill, sign, and manage Arizona Form A 4 digitally, ensuring compliance while simplifying the process. Our platform allows you to streamline document management and achieve efficient workflow.

-

How much does airSlate SignNow cost for using Arizona Form A 4?

airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions include features tailored for managing documents like Arizona Form A 4, with pricing that scales according to the number of users and features you require. You can start with a free trial to see how it fits your needs.

-

What features does airSlate SignNow provide for Arizona Form A 4?

With airSlate SignNow, you get features like customizable templates, electronic signatures, and real-time document tracking specifically for Arizona Form A 4. These tools help you save time and reduce errors associated with manual processing. Our user-friendly interface facilitates smooth and efficient management of all forms.

-

Can I integrate airSlate SignNow with other applications for Arizona Form A 4?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow for Arizona Form A 4 and other documents. Whether you need to connect with CRM systems, cloud storage, or other productivity tools, our platform supports these integrations to streamline your processes.

-

Is airSlate SignNow secure for handling Arizona Form A 4?

Absolutely, airSlate SignNow prioritizes security for all documents, including Arizona Form A 4. We implement industry-standard encryption and compliance with legal regulations to keep your information safe. You can trust our platform to handle sensitive data securely.

-

How does airSlate SignNow improve the signing process for Arizona Form A 4?

airSlate SignNow enhances the signing process for Arizona Form A 4 by providing a fast and efficient electronic signature solution. Users can sign documents from any device, anywhere, which accelerates approvals and reduces turnaround times. This convenience is key to boosting productivity and efficiency.

-

Can my team collaborate on Arizona Form A 4 using airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration on Arizona Form A 4 documents. Team members can comment, edit, and track changes in real-time, ensuring everyone is aligned and informed throughout the process. This collaborative feature helps streamline team efforts and improve documentation accuracy.

Get more for Arizona Form A 4

- In state dept health form 47970

- Kansas immunization recore form

- Fillable online return form suunto fax email print

- Louisiana concealed handgun application concealed carry nola form

- Diocese of lafayette form

- Mass voter registration form

- Carrabec high school sports contract msadrsu 74 form

- Time report western michigan university wmich form

Find out other Arizona Form A 4

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word