Return Taxes Form

What is the 2016 Tax Return?

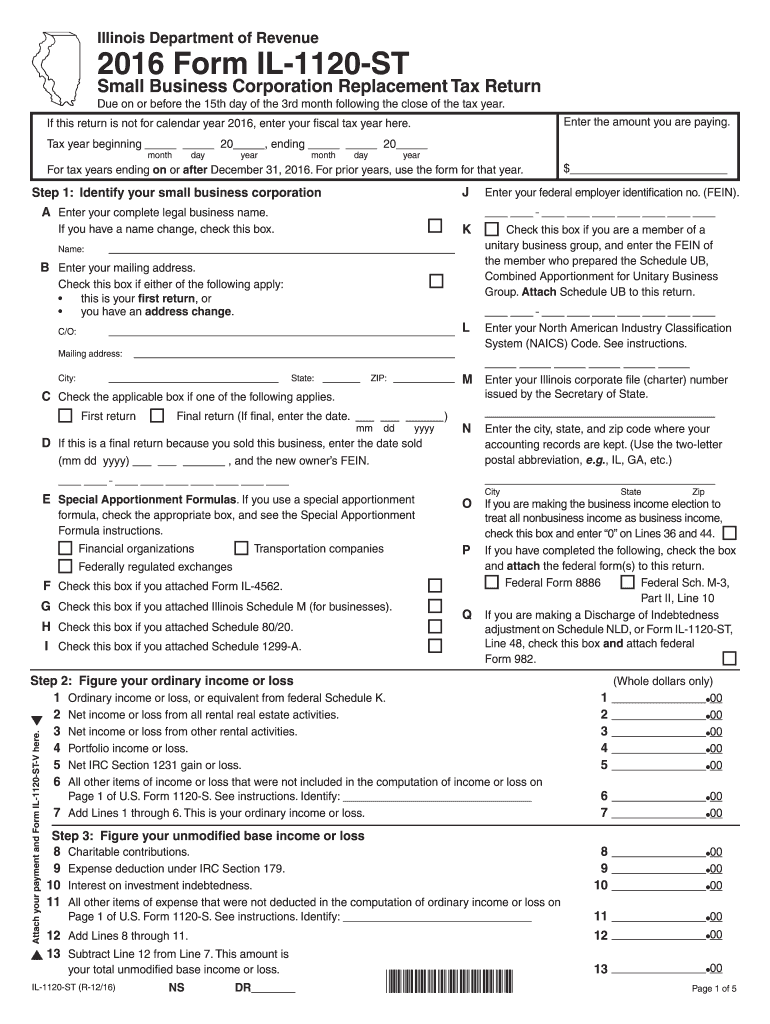

The 2016 tax return is a crucial document that individuals and businesses in the United States must file to report their income, claim deductions, and determine their tax liability for the year 2016. This form includes various sections where taxpayers provide personal information, income details, and any applicable credits or deductions. Understanding the components of the 2016 tax return is essential for accurate filing and compliance with IRS regulations.

Steps to Complete the 2016 Tax Return

Completing the 2016 tax return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and receipts for deductions.

- Choose the appropriate tax form, such as the 1040, 1040A, or 1040EZ, based on your financial situation.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Review the completed return for any errors or omissions.

- Sign and date the return before submission.

Following these steps can help ensure a smooth filing process and reduce the risk of errors that may lead to penalties.

Filing Deadlines / Important Dates

The deadline for filing the 2016 tax return was April 18, 2017. Taxpayers who needed additional time could file for an extension, which would have allowed them to submit their return by October 16, 2017. It is important to be aware of these dates to avoid late fees and penalties.

Required Documents

To complete the 2016 tax return, several documents are typically required:

- W-2 forms from employers to report wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses, including medical costs, charitable donations, and business expenses.

- Records of any tax credits you plan to claim.

Having these documents organized can streamline the filing process and ensure accurate reporting.

IRS Guidelines

The IRS provides specific guidelines for filing the 2016 tax return, including eligibility criteria for different forms, deductions, and credits. Taxpayers should refer to the IRS website or publications for detailed instructions on how to complete their return correctly and what documentation is necessary. Adhering to these guidelines is crucial for compliance and to avoid potential audits.

Legal Use of the 2016 Tax Return

The 2016 tax return is a legally binding document that must be filed truthfully and accurately. Misrepresentation or failure to report income can lead to significant penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of the information provided on the return and to use reliable methods, such as eSigning through a secure platform, to ensure the document is valid and protected.

Quick guide on how to complete return taxes

Effortlessly Prepare Return Taxes on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without holdups. Manage Return Taxes on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Return Taxes without hassle

- Locate Return Taxes and click Obtain Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Complete button to save your modifications.

- Choose your preferred method of delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Return Taxes and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the return taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax date return, and how can airSlate SignNow help with it?

The tax date return is the deadline for filing your income tax returns with the IRS. airSlate SignNow simplifies this process by allowing you to easily create, send, and eSign tax documents securely, ensuring that you meet your tax obligations on time.

-

Is airSlate SignNow suitable for small businesses to manage tax date returns?

Absolutely! airSlate SignNow is a cost-effective solution that empowers small businesses to efficiently handle tax date returns. It streamlines the document signing process, allowing you to focus on what matters most—growing your business.

-

What features does airSlate SignNow offer to assist with tax date returns?

airSlate SignNow provides features such as document templates, bulk sending, and real-time tracking, which are beneficial for managing tax date returns. These tools ensure that your tax documents are prepared, sent, and signed promptly, allowing for a smooth filing process.

-

How secure is airSlate SignNow when handling documents for tax date returns?

Security is a top priority for airSlate SignNow, especially for sensitive documents like tax date returns. The platform employs industry-standard encryption and compliance measures to protect your data at all times.

-

Can I integrate airSlate SignNow with other accounting software for tax date returns?

Yes, airSlate SignNow integrates seamlessly with various accounting tools such as QuickBooks and Xero. This integration allows for efficient management of your tax date returns, making it easier to keep track of important financial documents.

-

What is the pricing structure of airSlate SignNow for businesses needing to manage tax date returns?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you're a freelancer or a large enterprise, you'll find a plan that fits your budget and offers the necessary features to handle tax date returns effectively.

-

How does airSlate SignNow improve the efficiency of filing tax date returns?

With airSlate SignNow, the efficiency of filing tax date returns is notably improved through automated workflows and easy document sharing. This means less time spent on paperwork and more time focusing on your core business activities.

Get more for Return Taxes

Find out other Return Taxes

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document