Sales Tax Form

What is the Sales Tax Form

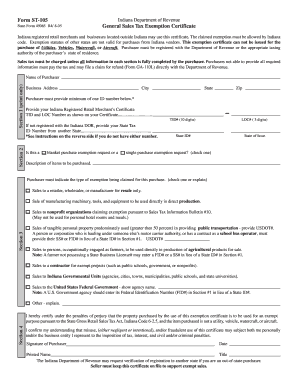

The sales tax form is a crucial document used by businesses to report and remit sales tax collected from customers to the appropriate state tax authority. This form varies by state, reflecting different tax rates, exemptions, and filing requirements. Typically, the sales tax form includes details such as the total sales amount, the sales tax collected, and any deductions for exempt sales. Understanding the specific requirements of your state is essential for accurate reporting and compliance.

Steps to Complete the Sales Tax Form

Completing the sales tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period, including invoices and receipts. Next, calculate the total sales amount and the corresponding sales tax collected. After that, fill out the form with these figures, ensuring that all required fields are completed. Finally, review the form for accuracy before submitting it to the state tax authority by the specified deadline.

Legal Use of the Sales Tax Form

The sales tax form is legally binding when completed and submitted according to state regulations. It serves as a formal declaration of sales tax obligations and must be filed accurately to avoid penalties. The electronic submission of the form is also recognized as legally valid, provided it complies with eSignature laws such as the ESIGN Act and UETA. Businesses should maintain records of submitted forms and any correspondence with tax authorities for compliance and audit purposes.

Filing Deadlines / Important Dates

Filing deadlines for the sales tax form vary by state and can depend on the frequency of tax reporting, such as monthly, quarterly, or annually. It is important for businesses to be aware of these deadlines to avoid late fees and penalties. Many states provide a calendar of important dates related to sales tax filing, including the due date for the sales tax form and any changes in tax rates or regulations. Keeping track of these dates is essential for maintaining compliance.

Required Documents

To complete the sales tax form, businesses typically need to gather several documents. These may include sales invoices, receipts, and any exemption certificates for tax-exempt sales. Additionally, businesses should have records of any prior sales tax filings and payments. Having these documents readily available ensures that the information reported on the sales tax form is accurate and substantiated, which is crucial for compliance and audit purposes.

Form Submission Methods

The sales tax form can usually be submitted through various methods, including online, by mail, or in-person at designated state tax offices. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. When submitting by mail, businesses should ensure they send the form to the correct address and consider using a trackable mailing service. In-person submissions may be required for certain situations, such as disputes or amendments.

State-Specific Rules for the Sales Tax Form

Each state has its own set of rules and regulations regarding the sales tax form, including filing frequency, tax rates, and exemptions. It is essential for businesses to familiarize themselves with their state's specific requirements to ensure compliance. Some states may offer additional resources, such as guides or webinars, to help businesses understand their obligations. Staying informed about state-specific rules can prevent costly mistakes and ensure timely filing.

Quick guide on how to complete sales tax form

Complete Sales Tax Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to find the necessary form and securely store it on the web. airSlate SignNow equips you with all the essential tools to create, alter, and electronically sign your documents swiftly without setbacks. Handle Sales Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and electronically sign Sales Tax Form seamlessly

- Locate Sales Tax Form and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information using the tools that airSlate SignNow provides specifically for that reason.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from your preferred device. Modify and electronically sign Sales Tax Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sales tax form and why is it important?

A sales tax form is a document required by tax authorities to report and remit sales tax collected from customers. It provides a detailed record of taxable sales and helps businesses comply with state and local tax regulations. Accurately completing your sales tax form is crucial to avoid potential penalties and ensure proper tax management.

-

How can airSlate SignNow help me manage my sales tax form processes?

airSlate SignNow streamlines the process of managing your sales tax form by allowing you to create, send, and eSign documents quickly and efficiently. With its user-friendly interface, you can easily collaborate with team members and ensure that all necessary information is accurately captured on your sales tax form. This reduces the risk of errors and saves your business time.

-

What features does airSlate SignNow offer for handling sales tax forms?

airSlate SignNow offers features such as customizable templates for sales tax forms, real-time tracking of document status, and secure storage for all your signed forms. Additionally, its integration capabilities with accounting and financial software make it easier to manage your sales tax documents within your existing workflow. These features enhance efficiency and accuracy in your sales tax management.

-

Is airSlate SignNow cost-effective for managing sales tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes managing their sales tax forms. With various pricing plans available, you can choose one that fits your budget while still benefiting from powerful eSigning and document management features. This helps you save money on paperwork and time spent on manual processes.

-

Can I integrate airSlate SignNow with my accounting software for sales tax forms?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software solutions, allowing you to streamline your sales tax form handling process. This integration enables automatic data transfer, reducing the risk of errors and ensuring that your sales tax information is always up-to-date. Enhancing your workflow with these integrations saves you valuable time.

-

How secure is airSlate SignNow when handling sensitive sales tax forms?

airSlate SignNow prioritizes security, utilizing advanced encryption methods to protect all documents, including sales tax forms. Our platform complies with industry standards and regulations, ensuring your sensitive data is safe from unauthorized access. You can confidently manage your sales tax documents knowing that security is at the forefront of our services.

-

What are the benefits of using airSlate SignNow for my sales tax forms?

Using airSlate SignNow for your sales tax forms brings several benefits, including improved efficiency, reduced processing time, and higher accuracy in tax reporting. The easy-to-use interface allows for quick document creation and signing, while centralized storage keeps all your forms organized and accessible. These aspects contribute to a smoother experience when managing your sales tax obligations.

Get more for Sales Tax Form

Find out other Sales Tax Form

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now