Penn Mutual Forms

Understanding the Penn Mutual Forms

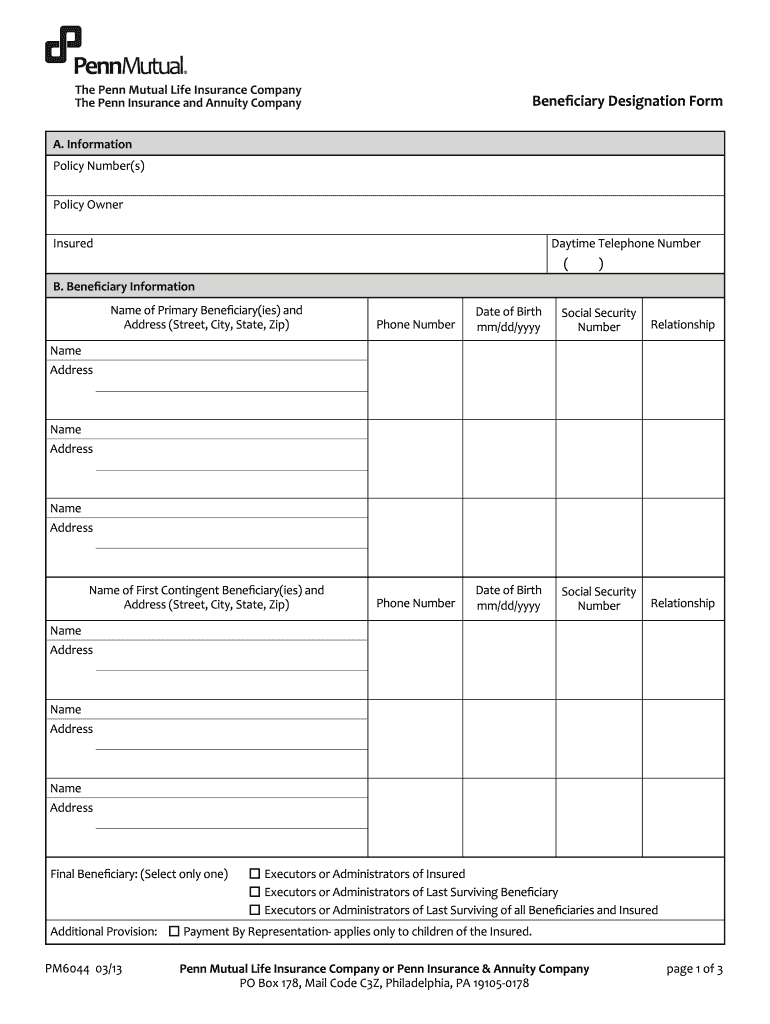

The Penn Mutual beneficiary designation form is a crucial document used to specify who will receive benefits from a life insurance policy upon the policyholder's death. This form is essential for ensuring that the policyholder's wishes are honored and that the benefits are distributed according to their preferences. It is important to understand that completing this form accurately can prevent disputes among potential beneficiaries and ensure a smooth claims process.

Steps to Complete the Penn Mutual Forms

Filling out the Penn Mutual beneficiary designation form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the policyholder and the intended beneficiaries, including full names, addresses, and relationships to the policyholder. Next, carefully fill out the form, ensuring that all sections are completed and that the information is legible. After completing the form, review it for any errors or omissions. Finally, sign and date the form as required, and submit it according to the instructions provided.

Legal Use of the Penn Mutual Forms

To ensure that the Penn Mutual beneficiary designation form is legally valid, it must comply with relevant regulations governing eSignatures and documentation. This includes adherence to the ESIGN Act and UETA, which establish the legality of electronic signatures in the United States. It is also important to maintain proper records and documentation to support the validity of the form in case of disputes. Utilizing a secure platform for electronic signing can enhance the legal standing of the completed form.

Key Elements of the Penn Mutual Forms

When completing the Penn Mutual beneficiary designation form, several key elements must be included. These typically consist of the policyholder's full name, policy number, and a clear designation of beneficiaries, including their names and relationships to the policyholder. Additionally, the form may require the policyholder's signature and the date of completion. Ensuring that all key elements are accurately filled out is essential for the form's acceptance and processing.

Obtaining the Penn Mutual Forms

The Penn Mutual beneficiary designation form can be obtained through various channels. Policyholders can typically access the form directly from the Penn Mutual website or by contacting their customer service department. It may also be available through financial advisors or insurance agents who work with Penn Mutual. Ensuring that you have the most current version of the form is important for compliance and accuracy.

Form Submission Methods

Once the Penn Mutual beneficiary designation form is completed, it can be submitted through several methods. Many policyholders choose to submit the form electronically via a secure online portal, which can streamline the process and provide immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate address provided by Penn Mutual or delivered in person to a local office. Each submission method has its own advantages, and policyholders should choose the one that best suits their needs.

Quick guide on how to complete penn mutual forms

Effortlessly prepare Penn Mutual Forms on any device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your files swiftly without delays. Manage Penn Mutual Forms on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Penn Mutual Forms with ease

- Locate Penn Mutual Forms and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, arduous form searches, or corrections that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Penn Mutual Forms while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the penn mutual forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Penn Mutual beneficiary designation process?

The Penn Mutual beneficiary designation process allows policyholders to specify individuals or entities that will receive benefits from their life insurance policy. This process ensures that your loved ones or chosen beneficiaries receive the intended financial support when needed. It’s important to keep your beneficiary designations updated to reflect any life changes.

-

How do I update my Penn Mutual beneficiary designation?

To update your Penn Mutual beneficiary designation, you typically need to complete a beneficiary designation form. This form can often be submitted online or through your insurance agent. Keeping your beneficiary information current is essential to ensure that your benefits are distributed according to your wishes.

-

Are there fees associated with the Penn Mutual beneficiary designation?

Generally, there are no fees associated with designating or changing beneficiaries on your Penn Mutual policy. This service is typically offered as part of your policy management. However, it's advisable to review your policy documents or consult with your insurance agent for specific details regarding fees.

-

What are the benefits of having a Penn Mutual beneficiary designation?

Having a clear Penn Mutual beneficiary designation ensures that your assets are distributed according to your wishes, preventing potential disputes among heirs. It provides peace of mind knowing that your loved ones will be financially supported in the event of your passing. This designation is a critical part of effective estate planning.

-

Can I designate multiple beneficiaries with Penn Mutual?

Yes, you can designate multiple beneficiaries with your Penn Mutual policy. This flexibility allows you to allocate specific percentages of the benefit to different individuals or entities as you see fit. It's important to clearly outline your intentions to avoid confusion later.

-

How does airSlate SignNow integrate with my Penn Mutual beneficiary designation process?

airSlate SignNow streamlines the process of eSigning and managing your Penn Mutual beneficiary designation documents. By using airSlate SignNow, you can quickly send, sign, and track important forms securely and efficiently, making your beneficiary designation process hassle-free.

-

What features does airSlate SignNow offer for managing beneficiary documents?

AirSlate SignNow offers features such as template creation, real-time tracking, and secure eSignature capabilities for managing beneficiary documents. These features ensure that your Penn Mutual beneficiary designation forms are handled efficiently and securely, providing you with a user-friendly experience.

Get more for Penn Mutual Forms

- Cudit form

- Tricare caribbean district form

- Remittance application form 201744303

- 7 ldp dwi court petitiondoc mobar form

- Rocky mountain power landlord agreement form

- Usef lease agreement form

- Ende des laufenden bewilligungs jobcenter gg form

- If a funeral home gives a copy of a death certificate to form

Find out other Penn Mutual Forms

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation