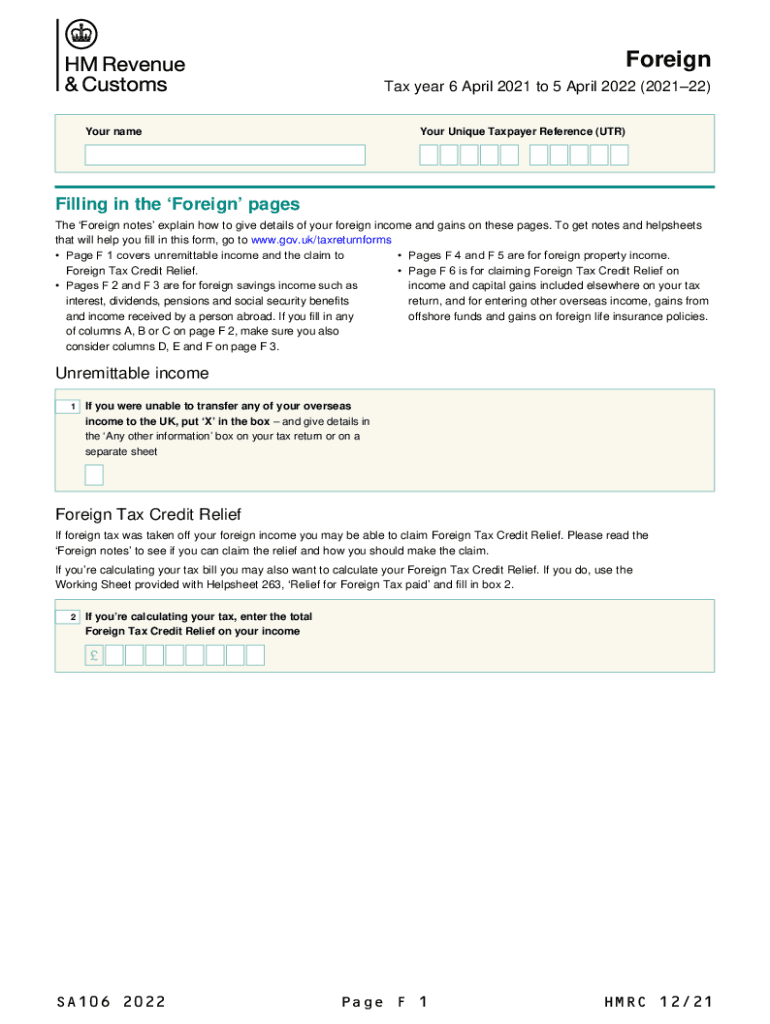

Self Assessment Foreign Form

What is the Self Assessment Foreign?

The Self Assessment Foreign form, often referred to as the HMRC SA106 form, is a crucial document for individuals in the United Kingdom who have foreign income or gains. This form is part of the self-assessment tax return process, allowing taxpayers to report income earned outside the UK. It is essential for those who have lived or worked abroad and need to declare their foreign earnings to Her Majesty's Revenue and Customs (HMRC).

How to use the Self Assessment Foreign

Using the Self Assessment Foreign form involves several key steps. First, gather all necessary information regarding your foreign income, including bank statements, payslips, and any other relevant financial documents. Next, complete the form accurately, ensuring that you include all sources of foreign income. After filling out the form, review it for any errors before submitting it to HMRC. It is advisable to keep copies of all submitted documents for your records.

Steps to complete the Self Assessment Foreign

Completing the Self Assessment Foreign form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents that detail your foreign income.

- Fill out the form with accurate information, specifying the type and amount of foreign income.

- Include any foreign tax paid, as this may affect your UK tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form to HMRC by the required deadline, either online or by mail.

Legal use of the Self Assessment Foreign

The legal use of the Self Assessment Foreign form is governed by UK tax laws. It is essential to ensure that the information provided is truthful and complete to avoid penalties. The form serves as a declaration of your foreign income and is legally binding. Failure to submit the form or providing false information can lead to legal repercussions, including fines and additional tax assessments.

Filing Deadlines / Important Dates

Filing deadlines for the Self Assessment Foreign form are crucial for compliance. Generally, the deadline for submitting your self-assessment tax return, including the SA106 form, is January thirty-first following the end of the tax year. For example, for the tax year ending April fifth, the deadline would be January thirty-first of the following year. It is important to mark these dates to avoid late filing penalties.

Required Documents

When completing the Self Assessment Foreign form, several documents are required to support your claims. These may include:

- Bank statements showing foreign income deposits.

- Payslips or income statements from foreign employers.

- Tax certificates or documents proving foreign tax paid.

- Any other relevant financial records that detail your foreign earnings.

Quick guide on how to complete self assessment foreign

Effortlessly prepare Self Assessment Foreign on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Handle Self Assessment Foreign on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Self Assessment Foreign easily

- Locate Self Assessment Foreign and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious searches for forms, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Self Assessment Foreign while ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self assessment foreign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HMRC SA106 form and why is it important?

The HMRC SA106 form is a supplementary page of the self-assessment tax return used by taxpayers to report income from property or partnerships. Completing the HMRC SA106 form correctly is crucial to ensure accurate tax calculations and compliance with HMRC regulations.

-

How can airSlate SignNow help me with the HMRC SA106 form?

airSlate SignNow simplifies the process of completing the HMRC SA106 form by providing an intuitive eSigning solution. With airSlate SignNow, you can easily send, eSign, and store your HMRC SA106 form efficiently, reducing paperwork and streamlining your tax preparation.

-

Is airSlate SignNow cost-effective for managing the HMRC SA106 form?

Yes, airSlate SignNow offers competitive pricing plans that make managing your HMRC SA106 form affordable and efficient. By choosing airSlate SignNow, you’ll benefit from a cost-effective solution that simplifies document management without sacrificing quality.

-

What features does airSlate SignNow offer for the HMRC SA106 form?

airSlate SignNow provides features like electronic signatures, document templates, and secure cloud storage tailored for the HMRC SA106 form. These features enhance productivity and ensure that your documents are easily accessible and legally binding.

-

Can I integrate airSlate SignNow with other tools for handling the HMRC SA106 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and more, making it easier to manage your HMRC SA106 form alongside other tools you already use. This integration enhances your workflow and keeps all your documents synchronized.

-

What are the benefits of eSigning the HMRC SA106 form through airSlate SignNow?

By eSigning the HMRC SA106 form with airSlate SignNow, you enjoy faster turnaround times and increased convenience. The eSignature feature eliminates the need for printing and scanning, allowing you to complete your tax obligations quickly and securely from anywhere.

-

Is my information secure when using airSlate SignNow for the HMRC SA106 form?

Yes, airSlate SignNow prioritizes the security of your documents and personal information, including the HMRC SA106 form. The platform employs advanced encryption and compliance measures to ensure your data remains protected throughout the signing process.

Get more for Self Assessment Foreign

- Army registretion form

- Evalueringsskema skabelon form

- Arizona warranty deed to community property with rights of survivorship form

- Check reissue in order to process we must have the form

- Maryland form 502ae subtraction for income derived within arts and entertainment districts

- St louis county hazardous materials response team form

- Cloud computing agreement template form

- Cloud service level agreement template form

Find out other Self Assessment Foreign

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile