Liberty Mutual Direct DepositACH Credit Authorization 2017-2026

What is the Liberty Mutual Direct Deposit ACH Credit Authorization

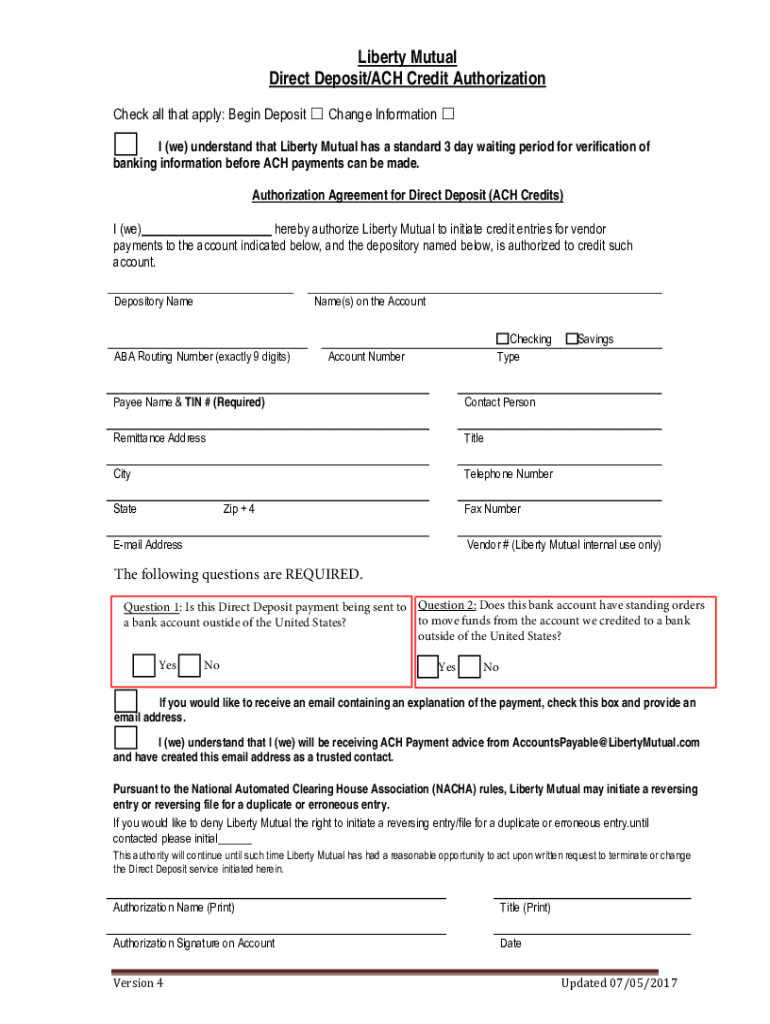

The Liberty Mutual Direct Deposit ACH Credit Authorization is a formal document that allows Liberty Mutual to deposit funds directly into a designated bank account. This process streamlines the payment method for policyholders, ensuring timely and secure transactions. By authorizing this arrangement, individuals can receive their payments, such as claims or refunds, directly into their bank accounts without the need for physical checks.

How to use the Liberty Mutual Direct Deposit ACH Credit Authorization

To utilize the Liberty Mutual Direct Deposit ACH Credit Authorization, policyholders must complete the required form accurately. This includes providing personal information, such as the policyholder's name, address, and Liberty Mutual policy number. Additionally, the form requires the bank account details where the deposits will be made. Once the form is filled out, it can be submitted electronically or via mail, depending on the preferences of the policyholder and the guidelines provided by Liberty Mutual.

Steps to complete the Liberty Mutual Direct Deposit ACH Credit Authorization

Completing the Liberty Mutual Direct Deposit ACH Credit Authorization involves several straightforward steps:

- Obtain the form from Liberty Mutual's official website or customer service.

- Fill in your personal details, including your name, address, and policy number.

- Provide your bank account information, including the account number and routing number.

- Review the information for accuracy to avoid any issues with processing.

- Sign and date the form to validate your authorization.

- Submit the completed form as instructed, either online or by mailing it to the appropriate address.

Legal use of the Liberty Mutual Direct Deposit ACH Credit Authorization

The Liberty Mutual Direct Deposit ACH Credit Authorization is legally binding when executed correctly. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures hold the same legal weight as traditional handwritten signatures. This means that once the form is signed and submitted, it is considered a valid authorization for Liberty Mutual to process direct deposits into the specified bank account.

Key elements of the Liberty Mutual Direct Deposit ACH Credit Authorization

Several key elements must be included in the Liberty Mutual Direct Deposit ACH Credit Authorization to ensure its effectiveness:

- Policyholder Information: Complete name, address, and contact details.

- Policy Number: The specific Liberty Mutual policy number associated with the account.

- Bank Account Details: Accurate bank account and routing numbers for direct deposits.

- Signature: The policyholder's signature confirming the authorization.

- Date: The date on which the authorization is signed.

Form Submission Methods

The Liberty Mutual Direct Deposit ACH Credit Authorization can be submitted through various methods to accommodate different preferences:

- Online Submission: Many users opt to complete and submit the form electronically through Liberty Mutual's secure online portal.

- Mail: Alternatively, the completed form can be printed and mailed to the designated address provided by Liberty Mutual.

- In-Person: Some policyholders may choose to deliver the form in person at a local Liberty Mutual office.

Quick guide on how to complete liberty mutual direct depositach credit authorization

Accomplish Liberty Mutual Direct DepositACH Credit Authorization effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing for easy access to the right form and secure online storage. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delay. Manage Liberty Mutual Direct DepositACH Credit Authorization on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Liberty Mutual Direct DepositACH Credit Authorization with ease

- Find Liberty Mutual Direct DepositACH Credit Authorization and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Liberty Mutual Direct DepositACH Credit Authorization and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct liberty mutual direct depositach credit authorization

Create this form in 5 minutes!

How to create an eSignature for the liberty mutual direct depositach credit authorization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is liberty mutual tdu ach pt?

Liberty Mutual TDU ACH PT refers to a transaction processing method offered by Liberty Mutual for automated clearing house (ACH) transactions. This service allows for efficient processing of payments, enhancing financial transactions' speed and reliability. Utilizing this method with airSlate SignNow can streamline your documentation and payment processes.

-

How can airSlate SignNow integrate with liberty mutual tdu ach pt?

AirSlate SignNow can easily integrate with Liberty Mutual TDU ACH PT to facilitate seamless transaction documentation and signing. This integration allows businesses to manage their financial documents within a single platform, ensuring that all signatures and approvals are securely captured. It's a hassle-free way to enhance your payment processes.

-

What are the benefits of using liberty mutual tdu ach pt with airSlate SignNow?

The combination of Liberty Mutual TDU ACH PT with airSlate SignNow provides businesses the benefits of faster transactions, enhanced security, and improved compliance. Businesses can easily track and manage their documents while ensuring timely payments. This integration also helps minimize errors, which can save businesses time and money.

-

What pricing options are available for using liberty mutual tdu ach pt with airSlate SignNow?

Pricing for using Liberty Mutual TDU ACH PT in conjunction with airSlate SignNow varies based on the specific services chosen and transaction volumes. Generally, businesses can expect competitive pricing plans catering to different sizes and needs. It's advisable to contact airSlate SignNow for a personalized quote tailored to your business's requirements.

-

Can I use airSlate SignNow for documents related to liberty mutual tdu ach pt?

Yes, airSlate SignNow is perfectly suited for handling all documents related to Liberty Mutual TDU ACH PT. This includes contracts, payment authorizations, and transaction records that require signing. The platform provides an easy-to-use interface to manage, sign, and send these crucial documents efficiently.

-

What features does airSlate SignNow offer that complement liberty mutual tdu ach pt?

AirSlate SignNow offers several features that complement Liberty Mutual TDU ACH PT, including customizable templates, document tracking, and automated notifications. These features ensure that all parties are well-informed throughout the document signing and transaction process. Additionally, users can benefit from robust security features to protect sensitive financial information.

-

Is it secure to use liberty mutual tdu ach pt with airSlate SignNow?

Absolutely, using Liberty Mutual TDU ACH PT with airSlate SignNow is highly secure. The platform employs advanced encryption and compliance measures to protect sensitive data and ensure that transactions are safe. Your paperwork, payment information, and signed documents are kept confidential and secure throughout the process.

Get more for Liberty Mutual Direct DepositACH Credit Authorization

- Nonretirement account investment form vanguard

- New york state bar association official oca forms waiver renunciation and consent to appoint administrator

- Tabe reading practice test form

- Canadian visa application form imm 5256 canadian visa application form imm 5256 imm 5256 is a form of application for a

- Great fun rebate form

- Capago application form

- Step 3 grievance appeal form american postal workers union

- Booth rental contract template form

Find out other Liberty Mutual Direct DepositACH Credit Authorization

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later