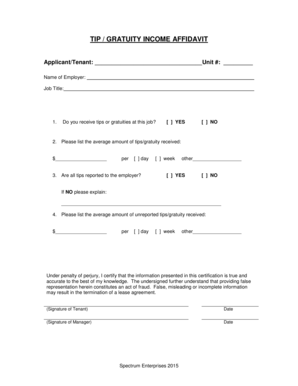

TIP GRATUITY INCOME AFFIDAVIT Form

What is the TIP GRATUITY INCOME AFFIDAVIT

The tip gratuity income affidavit is a legal document used primarily by employees in the service industry to declare their tip income. This affidavit serves as a formal declaration of the gratuities received, which may not be fully reported to employers or tax authorities. By completing this affidavit, individuals can ensure accurate reporting of their income for tax purposes, providing transparency and compliance with IRS regulations. It is essential for employees who rely on tips as a significant portion of their earnings.

How to use the TIP GRATUITY INCOME AFFIDAVIT

Using the tip gratuity income affidavit involves several straightforward steps. First, individuals must accurately document their tip income over a specified period. This may include cash tips, credit card tips, and any other gratuities received. Once the income is recorded, the affidavit should be filled out with the relevant details, including the employee's name, contact information, and the total amount of tips earned. After completing the affidavit, it should be signed and dated to validate the declaration. This document can then be submitted to the appropriate tax authority or employer as required.

Steps to complete the TIP GRATUITY INCOME AFFIDAVIT

Completing the tip gratuity income affidavit requires careful attention to detail. Here are the key steps to follow:

- Gather all records of tip income, including receipts and daily logs.

- Fill in personal information, such as name, address, and social security number.

- Calculate the total amount of tips received during the reporting period.

- Complete the affidavit by entering the total tip amount and any additional required information.

- Review the affidavit for accuracy before signing.

- Sign and date the affidavit to confirm the accuracy of the information provided.

Legal use of the TIP GRATUITY INCOME AFFIDAVIT

The legal use of the tip gratuity income affidavit is crucial for ensuring compliance with tax laws. This document can serve as evidence of income when filing taxes, applying for loans, or fulfilling other financial obligations. It is important to ensure that the affidavit is completed truthfully and accurately, as providing false information can lead to penalties or legal issues. Additionally, the affidavit may need to be notarized in some jurisdictions to enhance its legal standing.

IRS Guidelines

The IRS has specific guidelines regarding the reporting of tip income. Employees are required to report all tips received, whether in cash or through credit card transactions. The IRS mandates that tips be reported as income on tax returns, and the tip gratuity income affidavit can assist in accurately documenting this income. It is advisable for employees to keep detailed records of their tips to ensure compliance and avoid potential audits.

Required Documents

When preparing to complete the tip gratuity income affidavit, several documents may be necessary. These include:

- Daily tip records or logs.

- Receipts from credit card transactions that include tips.

- Any previous tax returns that reflect tip income.

- Identification documents, such as a driver's license or social security card.

Eligibility Criteria

Eligibility to use the tip gratuity income affidavit generally applies to employees in service-oriented positions where tips are customary. This includes roles such as waitstaff, bartenders, taxi drivers, and hairdressers, among others. Employees must be able to accurately report their tip income and have documentation to support their claims. It is essential for individuals to understand their specific state's regulations regarding the use of this affidavit to ensure compliance.

Quick guide on how to complete tip gratuity income affidavit

Complete TIP GRATUITY INCOME AFFIDAVIT effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your files quickly and without complications. Manage TIP GRATUITY INCOME AFFIDAVIT on any platform with the airSlate SignNow Android or iOS apps and simplify any document-related task today.

How to alter and eSign TIP GRATUITY INCOME AFFIDAVIT with ease

- Find TIP GRATUITY INCOME AFFIDAVIT and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign TIP GRATUITY INCOME AFFIDAVIT ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tip gratuity income affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TIP GRATUITY INCOME AFFIDAVIT?

A TIP GRATUITY INCOME AFFIDAVIT is a legal document used to declare the tip income earned by an individual. This affidavit is crucial for tax reporting purposes and can help ensure that your income is accurately reported to the IRS.

-

How does airSlate SignNow facilitate the creation of a TIP GRATUITY INCOME AFFIDAVIT?

AirSlate SignNow offers easy-to-use templates that allow you to create a TIP GRATUITY INCOME AFFIDAVIT quickly. Our platform simplifies the eSigning process, ensuring that you can complete and send your affidavit securely.

-

Is there a cost associated with creating a TIP GRATUITY INCOME AFFIDAVIT using airSlate SignNow?

While the basic features of airSlate SignNow are cost-effective, the pricing may vary based on the plan you choose. The platform offers various pricing plans that include the ability to create and manage TIP GRATUITY INCOME AFFIDAVIT efficiently.

-

What are the benefits of using airSlate SignNow for my TIP GRATUITY INCOME AFFIDAVIT?

Using airSlate SignNow for your TIP GRATUITY INCOME AFFIDAVIT allows for seamless electronic signing, which saves time and increases efficiency. Additionally, you can track the status of documents and manage them in one place.

-

Can I integrate airSlate SignNow with other tools for managing my TIP GRATUITY INCOME AFFIDAVIT?

Yes, airSlate SignNow offers integrations with various business tools such as CRM systems, cloud storage services, and more. This ensures that your TIP GRATUITY INCOME AFFIDAVIT can be easily managed alongside other business processes.

-

How secure is my TIP GRATUITY INCOME AFFIDAVIT when using airSlate SignNow?

AirSlate SignNow prioritizes security, employing encryption and strict compliance protocols to protect your TIP GRATUITY INCOME AFFIDAVIT and other documents. You can trust that your sensitive information is safe throughout the signing process.

-

Are there any customer support options if I need help with my TIP GRATUITY INCOME AFFIDAVIT?

Absolutely! airSlate SignNow provides various customer support options, including FAQs, live chat, and email support. Our team is here to assist you to ensure your TIP GRATUITY INCOME AFFIDAVIT is completed correctly.

Get more for TIP GRATUITY INCOME AFFIDAVIT

- Form ta 1 rev where can i print form

- Penndot sight distance form

- Massachusetts general durable power of attorney for property and finances or financial effective immediately form

- Var form 200 55074793

- Cra form

- Special accommodation requirements form

- Iso 18593 pdf download form

- Tvru complaint form garrett county government garrettcounty

Find out other TIP GRATUITY INCOME AFFIDAVIT

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online