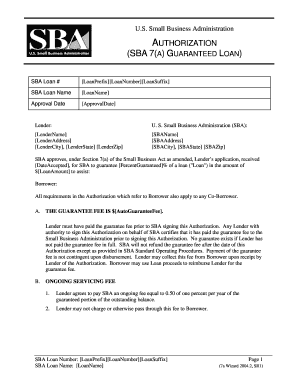

7a Authorization Sba Form

What is the 7(a) Authorization for SBA?

The 7(a) Authorization is a loan program offered by the Small Business Administration (SBA) designed to assist small businesses in obtaining financing. This program provides a guarantee to lenders, reducing their risk and encouraging them to lend to small businesses that may not qualify for traditional loans. The 7(a) loan can be used for various purposes, including working capital, purchasing equipment, and real estate acquisition. Understanding the specifics of this authorization is crucial for business owners seeking financial support.

How to Obtain the 7(a) Authorization for SBA

To obtain the 7(a) Authorization, a business must first find an SBA-approved lender. The application process typically involves submitting a detailed business plan, financial statements, and personal credit history. The lender will evaluate the application based on the business's financial health and the purpose of the loan. Once the lender approves the application, they will submit it to the SBA for final authorization. This process may take several weeks, so early preparation is essential for timely funding.

Steps to Complete the 7(a) Authorization for SBA

Completing the 7(a) Authorization involves several key steps:

- Identify an SBA-approved lender that fits your business needs.

- Prepare necessary documentation, including a business plan and financial statements.

- Submit the loan application to the lender, ensuring all information is accurate and complete.

- Work with the lender to address any questions or additional information requests.

- Receive the lender's decision and, if approved, await SBA authorization.

Following these steps diligently can enhance the chances of successful loan approval.

Key Elements of the 7(a) Authorization for SBA

The key elements of the 7(a) Authorization include the loan amount, interest rates, repayment terms, and eligible uses of funds. The maximum loan amount can reach up to five million dollars, with interest rates typically ranging from six to eight percent, depending on the lender and the loan's size. Repayment terms can extend up to 25 years for real estate purchases and up to ten years for equipment and working capital. Understanding these elements helps businesses plan effectively for their financing needs.

Required Documents for the 7(a) Authorization for SBA

When applying for the 7(a) Authorization, businesses must prepare several required documents, including:

- A completed loan application form.

- Personal and business financial statements.

- A detailed business plan outlining the purpose of the loan.

- Tax returns for the past three years.

- Ownership and affiliations disclosure.

Having these documents ready can streamline the application process and improve the likelihood of approval.

Eligibility Criteria for the 7(a) Authorization for SBA

Eligibility for the 7(a) Authorization is determined by several factors, including the size of the business, its operational history, and its ability to repay the loan. Generally, the business must be classified as a small business according to SBA standards, which vary by industry. Additionally, the business should demonstrate a need for the funds and a sound plan for their use. Meeting these criteria is essential for a successful application.

Quick guide on how to complete 7a authorization sba

Complete 7a Authorization Sba seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle 7a Authorization Sba on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign 7a Authorization Sba effortlessly

- Locate 7a Authorization Sba and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you’d like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign 7a Authorization Sba and maintain excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 7a authorization sba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan authorization letter?

A loan authorization letter is a document that grants permission for a lender to access a borrower's financial information. This letter is essential for processing loan applications and ensures that all parties involved have the necessary information to proceed. Understanding how to create a loan authorization letter can streamline your loan process.

-

How can airSlate SignNow help with loan authorization letters?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning loan authorization letters. With our solution, you can quickly generate professional documents that meet legal requirements. This efficiency helps you expedite the loan approval process.

-

What features does airSlate SignNow offer for loan authorization letters?

Our platform offers features such as customizable templates, secure eSigning, and real-time tracking for loan authorization letters. You can also integrate with various applications to streamline your workflow. These features ensure that your documents are handled efficiently and securely.

-

Is airSlate SignNow cost-effective for managing loan authorization letters?

Yes, airSlate SignNow is a cost-effective solution for managing loan authorization letters. We offer flexible pricing plans that cater to businesses of all sizes, allowing you to choose a plan that fits your budget. This affordability makes it easier for you to manage your document needs without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for loan authorization letters?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your ability to manage loan authorization letters. Whether you use CRM systems, cloud storage, or other document management tools, our integrations help streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for loan authorization letters?

Using airSlate SignNow for loan authorization letters offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our platform allows you to send and receive documents quickly, ensuring that your loan processes are not delayed. Additionally, the secure eSigning feature protects sensitive information.

-

How secure is the loan authorization letter process with airSlate SignNow?

The security of your loan authorization letter process is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage to protect your documents and data. This commitment to security ensures that your sensitive information remains confidential throughout the signing process.

Get more for 7a Authorization Sba

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential massachusetts form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property massachusetts form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497309728 form

- Ma termination form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497309732 form

- Ma lease tenant form

- Massachusetts provisions form

- Ma provisions form

Find out other 7a Authorization Sba

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free