KANSAS DEPARTMENT of REVENUE AGRICULTURAL EXEMPTIO Form

What is the ST 28F Form?

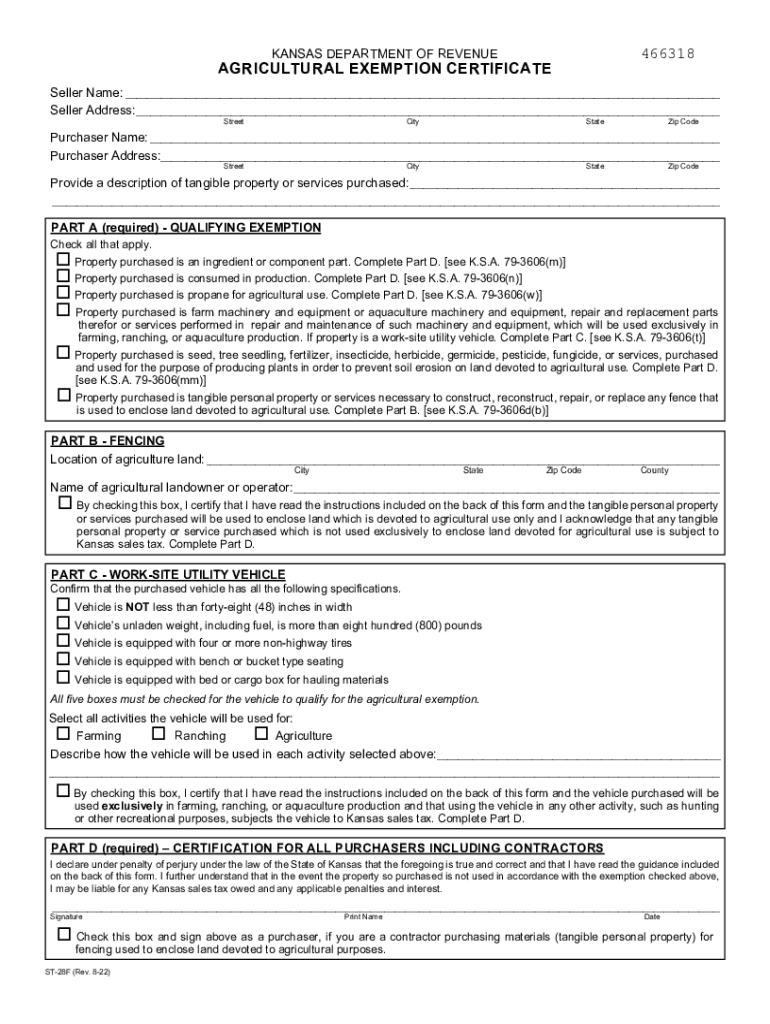

The ST 28F form is a crucial document issued by the Kansas Department of Revenue. It is primarily used for claiming agricultural exemptions on sales tax for certain purchases related to farming and agriculture. This form allows eligible farmers and agricultural producers to avoid paying sales tax on specific items necessary for their agricultural operations. Understanding the purpose and requirements of the ST 28F form is essential for those looking to benefit from these tax exemptions.

Eligibility Criteria for the ST 28F Form

To qualify for the agricultural exemption provided by the ST 28F form, applicants must meet specific eligibility criteria. Generally, this includes being a registered agricultural producer in Kansas and using the purchased items directly in agricultural production. The form requires the applicant to provide details about their farming operations and the items for which they seek exemption. It is important to ensure that all criteria are met to avoid complications during the application process.

Steps to Complete the ST 28F Form

Completing the ST 28F form involves several key steps:

- Gather necessary information, including your business details and the items for which you are claiming an exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide any supporting documentation that may be necessary to substantiate your claim.

- Review the form for accuracy before submission.

Following these steps carefully will help ensure a smooth application process.

Form Submission Methods for the ST 28F

The ST 28F form can be submitted through various methods, making it accessible for all applicants. Options typically include:

- Online submission through the Kansas Department of Revenue's official website.

- Mailing the completed form to the appropriate department.

- In-person submission at designated state offices.

Choosing the most convenient method for submission can help expedite the processing of your exemption claim.

Key Elements of the ST 28F Form

Understanding the key elements of the ST 28F form is essential for successful completion. Important components include:

- Identification of the applicant, including name and contact information.

- Description of the agricultural operation and the specific items for which the exemption is requested.

- Signature of the applicant, confirming the accuracy of the information provided.

Each element plays a vital role in ensuring that the form is processed correctly and efficiently.

Penalties for Non-Compliance with the ST 28F Form

Failure to comply with the regulations surrounding the ST 28F form can result in significant penalties. This may include back taxes owed on exempt purchases, as well as potential fines. It is crucial for applicants to ensure that they meet all requirements and submit accurate information to avoid these consequences. Understanding the implications of non-compliance helps reinforce the importance of proper form usage.

Quick guide on how to complete kansas department of revenueagricultural exemptio

Effortlessly Prepare KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to quickly create, modify, and eSign your documents without any delays. Handle KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to modify and eSign KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO with ease

- Obtain KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select essential sections of your documents or conceal sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas department of revenueagricultural exemptio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 28f feature in airSlate SignNow?

The st 28f feature in airSlate SignNow enhances the signing experience by streamlining document workflows. This feature allows users to send documents for eSignature seamlessly, ensuring that every signature is collected efficiently. It's designed to improve productivity and reduce turnaround times in the signing process.

-

How does pricing for st 28f in airSlate SignNow work?

Pricing for the st 28f feature in airSlate SignNow varies based on the plan you choose. Each plan includes access to eSigning capabilities and additional features that cater to different business needs. By evaluating your requirements, you can select the most cost-effective option for your organization.

-

What are the main benefits of using st 28f in airSlate SignNow?

The primary benefit of using st 28f in airSlate SignNow is the ability to simplify document management and signing processes. This feature provides users with a user-friendly interface that minimizes errors and speeds up document turnaround. Moreover, it enhances compliance and security, making it ideal for businesses.

-

Can st 28f be integrated with other applications?

Yes, st 28f in airSlate SignNow can easily integrate with various applications, enhancing its usability within existing workflows. This includes CRM systems, project management tools, and other software that businesses frequently use. The integrations help facilitate smoother operations and data sharing across platforms.

-

Is st 28f user-friendly for small businesses?

Absolutely! The st 28f feature in airSlate SignNow is designed with user-friendliness in mind, making it an excellent choice for small businesses. Users can quickly get started without extensive training or technical expertise, allowing them to focus on their core tasks while managing documents effectively.

-

What type of documents can I sign using st 28f?

With the st 28f feature in airSlate SignNow, you can sign a variety of documents, including contracts, agreements, and forms. The platform supports multiple document formats, ensuring you can handle all your eSigning needs in one place. This versatility enhances the overall efficiency of document management.

-

How secure is the st 28f signing process?

The st 28f signing process in airSlate SignNow prioritizes security, utilizing advanced encryption and authentication protocols. User data and document integrity are preserved throughout the signing process. This adherence to security best practices helps businesses comply with regulations and build trust with clients.

Get more for KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO

- Oakvillehydrocompap form

- V112 form 529207651

- Buffington hanouts ucla ptsd index past month1 ja cuyahogacounty form

- Construction permit application form city of atchison

- Global placement application form

- Locksmith key code books download form

- City letterhead bas dept for wpwin 67 161 149 221 form

- A prospective open labeled study of tattoo removal with form

Find out other KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTIO

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy