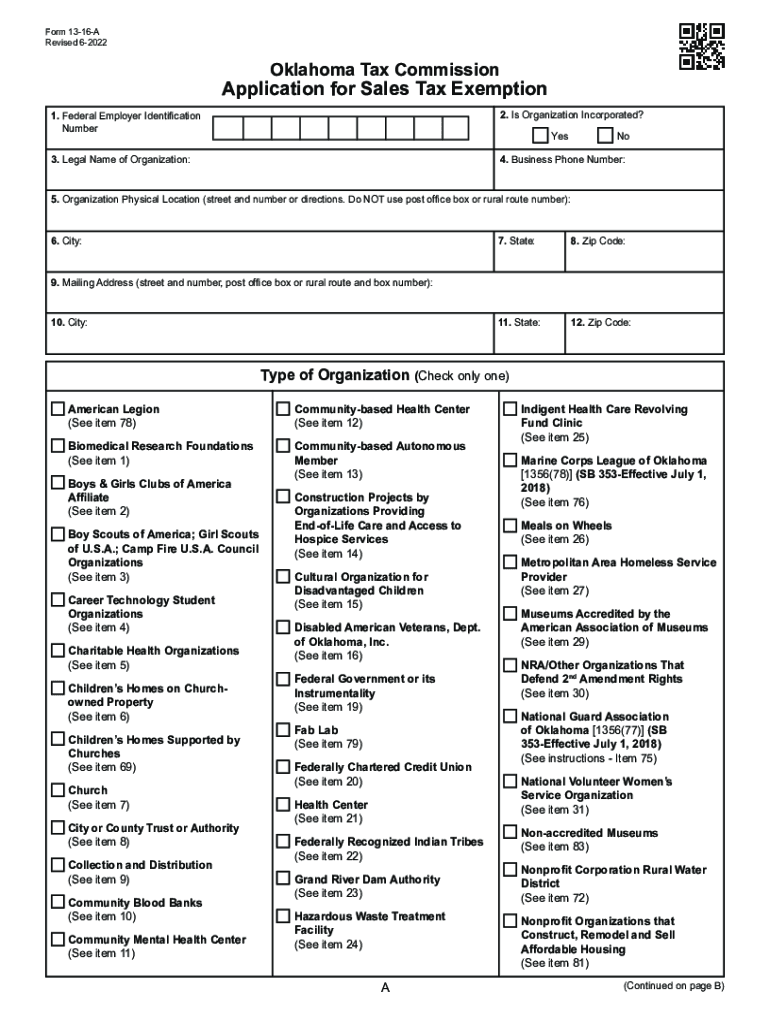

Oklahoma Sales Tax Exemption Form

What is the Oklahoma Sales Tax Exemption

The Oklahoma sales tax exemption allows certain individuals and organizations to purchase goods and services without paying sales tax. This exemption is designed to support specific sectors, such as non-profit organizations, educational institutions, and government entities. By obtaining an Oklahoma sales tax exemption certificate, eligible parties can avoid the additional costs associated with sales tax, which can significantly benefit their budgets and operational expenses.

How to Obtain the Oklahoma Sales Tax Exemption

To obtain the Oklahoma sales tax exemption, applicants must complete the necessary forms and provide required documentation. Typically, this involves filling out the Oklahoma sales tax exemption form, which may require details about the applicant's organization, its purpose, and the specific items for which the exemption is requested. It is essential to ensure that all information is accurate and complete to avoid delays in processing.

Steps to Complete the Oklahoma Sales Tax Exemption

Completing the Oklahoma sales tax exemption form involves several key steps:

- Gather necessary information about your organization, including its legal name, address, and tax identification number.

- Identify the specific goods or services for which you are seeking an exemption.

- Fill out the Oklahoma sales tax exemption form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state department, either online or via mail.

Eligibility Criteria

Eligibility for the Oklahoma sales tax exemption typically includes non-profit organizations, educational institutions, and government entities. Each category may have specific requirements that must be met. For instance, non-profits may need to provide proof of their tax-exempt status, while educational institutions might need to demonstrate their accreditation. Understanding these criteria is crucial for a successful application.

Required Documents

When applying for the Oklahoma sales tax exemption, certain documents are usually required to support your application. These may include:

- A completed Oklahoma sales tax exemption form.

- Proof of tax-exempt status, such as a 501(c)(3) letter for non-profits.

- Documentation that verifies the organization’s purpose and activities.

- Any additional forms or certifications as specified by the state.

Legal Use of the Oklahoma Sales Tax Exemption

The legal use of the Oklahoma sales tax exemption is governed by state laws and regulations. Organizations must ensure they use the exemption strictly for eligible purchases related to their exempt purposes. Misuse of the exemption can lead to penalties, including fines or revocation of the exemption status. It is important for organizations to maintain accurate records of their exempt purchases to demonstrate compliance if required.

Quick guide on how to complete oklahoma sales tax exemption

Effortlessly Prepare Oklahoma Sales Tax Exemption on Any Device

Managing documents online has gained immense traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Oklahoma Sales Tax Exemption on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and eSign Oklahoma Sales Tax Exemption with Ease

- Locate Oklahoma Sales Tax Exemption and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to share your form, either via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign Oklahoma Sales Tax Exemption to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma sales tax exemption

Create this form in 5 minutes!

How to create an eSignature for the oklahoma sales tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining an Oklahoma sales tax exemption?

To obtain an Oklahoma sales tax exemption, businesses must complete the appropriate forms and provide necessary documentation to the Oklahoma Tax Commission. This typically includes proof of the entity's eligibility for the exemption. Ensuring that all forms are filled out correctly can help expedite the process and secure the Oklahoma sales tax exemption efficiently.

-

How can airSlate SignNow help with managing Oklahoma sales tax exemption documentation?

airSlate SignNow simplifies the management of Oklahoma sales tax exemption documentation by allowing businesses to eSign and store all necessary documents securely. This not only speeds up the documentation process but also ensures compliance and easy retrieval when needed. Implementing airSlate SignNow promotes efficient handling of Oklahoma sales tax exemption obligations.

-

Are there any costs associated with using airSlate SignNow for Oklahoma sales tax exemption processes?

While airSlate SignNow offers various plans, there are no additional costs for addressing Oklahoma sales tax exemption processes specifically. Our pricing is transparent and designed to be cost-effective, allowing businesses to manage sales tax exemptions without hidden fees. By integrating SignNow, firms can save time and money while ensuring compliance.

-

What features of airSlate SignNow are beneficial for obtaining Oklahoma sales tax exemption?

Key features of airSlate SignNow that benefit businesses pursuing an Oklahoma sales tax exemption include an intuitive eSignature platform, customizable templates, and secure cloud storage. These features streamline the paperwork required and enhance collaboration among teams involved in submitting the exemption documents. Utilizing these tools ensures a smooth process for obtaining your Oklahoma sales tax exemption.

-

Can airSlate SignNow integrate with other software for handling Oklahoma sales tax exemptions?

Yes, airSlate SignNow integrates seamlessly with various software platforms to enhance the management of Oklahoma sales tax exemptions. This includes popular accounting and ERP systems, which can provide a holistic approach to sales tax management. By integrating with these tools, businesses can track their Oklahoma sales tax exemption status and related documents more efficiently.

-

What are the benefits of using airSlate SignNow for Oklahoma sales tax exemption management?

Using airSlate SignNow for Oklahoma sales tax exemption management offers several benefits, including improved efficiency through digital signatures, reduced paperwork, and enhanced organization of compliance documents. Businesses can save time while ensuring that they meet all required deadlines. Overall, it creates a more streamlined workflow for obtaining and maintaining necessary exemptions.

-

Is customer support available for assistance with Oklahoma sales tax exemption through airSlate SignNow?

Absolutely! airSlate SignNow provides robust customer support to assist users with any queries related to Oklahoma sales tax exemption processes. Our support team is knowledgeable and ready to help you navigate through documentation and compliance issues. We are committed to ensuring that our users can successfully manage their Oklahoma sales tax exemption needs.

Get more for Oklahoma Sales Tax Exemption

Find out other Oklahoma Sales Tax Exemption

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself