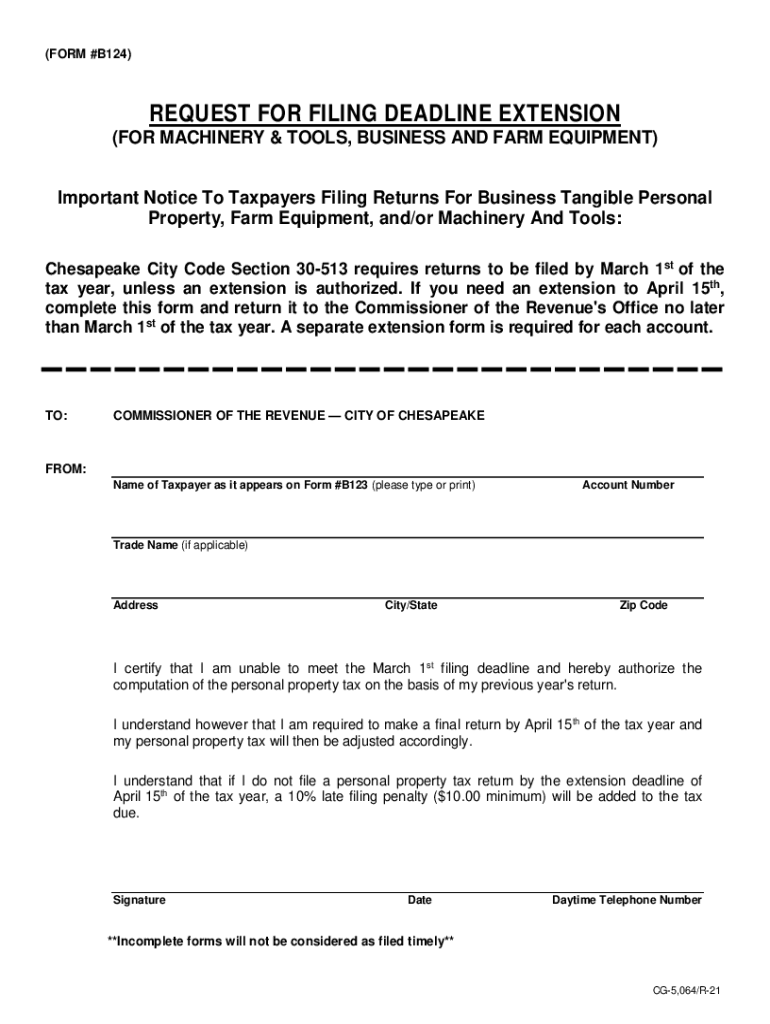

CITY of CHESAPEAKE, VIRGINIA Commissioner of Revenue Form

What is the Chesapeake, Virginia Commissioner of Revenue?

The Chesapeake Commissioner of Revenue is a local government office responsible for assessing property values and collecting various taxes within the city. This office plays a crucial role in ensuring that the city receives the necessary revenue to fund public services and infrastructure. The Commissioner’s responsibilities include managing real estate assessments, personal property taxes, and business licenses. Understanding the function of this office is essential for residents and business owners in Chesapeake, as it directly impacts their tax obligations and local services.

Steps to Complete the Chesapeake, Virginia Commissioner of Revenue Form

Completing the Chesapeake Commissioner of Revenue form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including your property details, tax identification number, and any relevant financial documents. Next, carefully fill out the form, ensuring all sections are completed accurately. It is important to double-check your entries for errors or omissions. Once completed, you can submit the form electronically or via mail, depending on the submission options available. Keeping a copy of the submitted form for your records is advisable.

Legal Use of the Chesapeake, Virginia Commissioner of Revenue Form

The Chesapeake Commissioner of Revenue form must meet specific legal criteria to be considered valid. Electronic submissions are legally binding if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This means that the form must include appropriate signatures and identifiers to verify the identity of the signer. Utilizing a secure eSignature platform can help ensure that your submission meets these legal requirements, providing peace of mind when filing your taxes or other related documents.

Form Submission Methods

Residents and businesses can submit the Chesapeake Commissioner of Revenue form through various methods. The most convenient option is online submission, which allows for quick processing and confirmation of receipt. Alternatively, forms can be mailed to the appropriate office address or submitted in person during business hours. Each submission method has its own advantages, so choosing the one that best fits your needs and timeline is essential for timely processing.

Required Documents

When completing the Chesapeake Commissioner of Revenue form, several documents may be required to support your application. These typically include proof of identity, property ownership documents, and any relevant financial statements. Business owners may also need to provide additional documentation, such as business licenses or tax identification numbers. Ensuring that you have all necessary documents ready will facilitate a smoother application process and help avoid delays.

Eligibility Criteria

Eligibility for certain tax exemptions or benefits related to the Chesapeake Commissioner of Revenue form may vary based on specific criteria. For instance, property owners may qualify for exemptions based on age, disability, or income level. Business owners should also be aware of eligibility requirements for different types of licenses or permits. It is important to review these criteria carefully to ensure compliance and maximize potential benefits.

Quick guide on how to complete city of chesapeake virginia commissioner of revenue

Complete CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue effortlessly on any device

The management of online documents has gained increased popularity among both organizations and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without complications. Handle CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue effortlessly

- Locate CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a moment and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your modifications.

- Choose the method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislocated documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Alter and electronically sign CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue to ensure excellent communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of chesapeake virginia commissioner of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Chesapeake Commissioner of Revenue?

The Chesapeake Commissioner of Revenue is responsible for assessing property values and ensuring the accurate collection of revenue in Chesapeake. This office plays a key role in managing local tax assessments, which can impact individuals and businesses alike. Understanding their functions can help you navigate your tax obligations more effectively.

-

How can I access services from the Chesapeake Commissioner of Revenue online?

Many services offered by the Chesapeake Commissioner of Revenue can now be accessed online. This includes property assessments and tax payment options. Utilizing these digital services can save you time and simplify your interactions with the office.

-

What documents do I need to prepare for the Chesapeake Commissioner of Revenue?

When engaging with the Chesapeake Commissioner of Revenue, you typically need various documents such as property deeds, tax returns, and identification. Preparing these documents in advance can expedite your process. Ensure you have all required documentation to avoid delays.

-

Are there any fees associated with services from the Chesapeake Commissioner of Revenue?

Fees may apply for specific services provided by the Chesapeake Commissioner of Revenue, such as property assessments and record retrieval. It's essential to check their official website for the latest fee schedule. Staying informed can help you budget accordingly.

-

How does airSlate SignNow integrate with services from the Chesapeake Commissioner of Revenue?

airSlate SignNow can streamline document signing and submission to the Chesapeake Commissioner of Revenue. By using our platform, you can easily create, send, and eSign necessary documents, making your interactions much more efficient. This integration ensures that you meet deadlines without hassle.

-

What are the benefits of using airSlate SignNow for my transactions with the Chesapeake Commissioner of Revenue?

Using airSlate SignNow provides a secure and efficient way to manage your documents related to the Chesapeake Commissioner of Revenue. Our solution allows for quick eSigning and document tracking, which enhances your productivity. This means you can focus more on your core business while ensuring compliance with local regulations.

-

Can I get customer support when dealing with the Chesapeake Commissioner of Revenue?

Yes, the Chesapeake Commissioner of Revenue offers customer support to assist residents and businesses with their inquiries. You can signNow out via phone or email for help with specific questions regarding your taxes or assessments. Utilizing this support can clarify any uncertainties you may have.

Get more for CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue

Find out other CITY OF CHESAPEAKE, VIRGINIA Commissioner Of Revenue

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe