Commissioner of the RevenueLouisa County, VATaxesLouisa County, VACommissioner of the RevenueLouisa County, VA 2016-2026

What is the Commissioner of the Revenue in Louisa County, VA?

The Commissioner of the Revenue in Louisa County, Virginia, is a key official responsible for assessing property values and collecting local taxes. This office plays a vital role in ensuring that the county's tax system operates fairly and efficiently. The Commissioner oversees the evaluation of real estate, personal property, and business taxes, ensuring compliance with state laws and regulations. Understanding the functions of this office is essential for residents and business owners, as it directly impacts local funding for services such as education, public safety, and infrastructure.

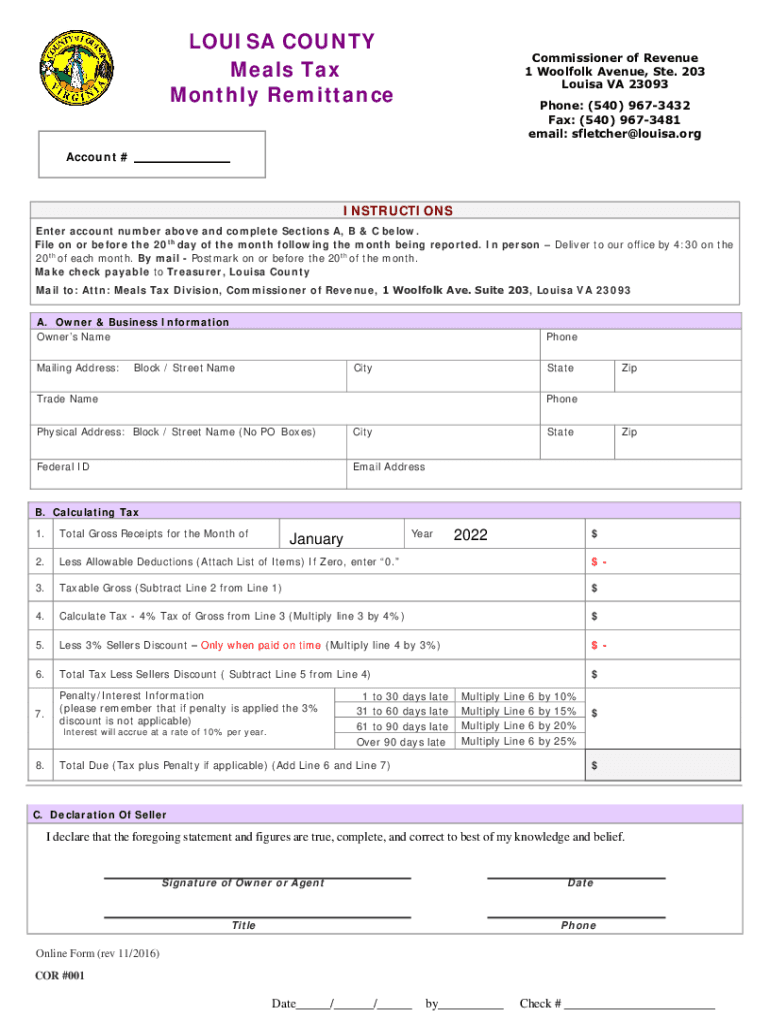

Steps to Complete the Commissioner of the Revenue Form

Filling out the Commissioner of the Revenue form in Louisa County involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as property deeds, vehicle titles, and business licenses. Next, carefully fill out the form, providing detailed information regarding property descriptions, ownership, and any applicable exemptions. It is crucial to review the completed form for any errors before submission. Once finalized, the form can be submitted electronically or via mail, depending on your preference and the specific requirements outlined by the office.

Legal Use of the Commissioner of the Revenue Form

The Commissioner of the Revenue form must be completed in accordance with Virginia state laws to be considered legally valid. This includes ensuring that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. The form serves as an official document that impacts tax assessments and liabilities, making it essential for individuals and businesses to understand their legal obligations when completing and submitting it. Utilizing a secure electronic signature solution can further enhance the legal standing of the document.

Required Documents for Submission

When submitting the Commissioner of the Revenue form, specific documents are required to support the information provided. These may include:

- Property deeds or titles for real estate.

- Vehicle registration documents for personal property assessments.

- Business licenses and financial statements for business tax assessments.

- Any applicable exemption certificates or claims.

Having these documents ready will facilitate a smoother submission process and help ensure compliance with local tax regulations.

State-Specific Rules for the Commissioner of the Revenue Form

Each state, including Virginia, has specific rules governing the completion and submission of the Commissioner of the Revenue form. It is important for residents and business owners in Louisa County to familiarize themselves with these regulations. This includes understanding deadlines for submission, the types of taxes assessed, and any exemptions that may apply. Staying informed about state-specific rules helps ensure compliance and can potentially reduce tax liabilities.

Examples of Using the Commissioner of the Revenue Form

There are various scenarios in which the Commissioner of the Revenue form is utilized. For instance, homeowners may need to complete the form when reporting changes in property ownership or when applying for tax exemptions. Business owners may use the form to report personal property assets or to declare their business for tax purposes. Understanding these examples can help individuals and businesses navigate their tax responsibilities more effectively.

Quick guide on how to complete commissioner of the revenuelouisa county vataxeslouisa county vacommissioner of the revenuelouisa county va

Complete Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to locate the proper form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and eSign Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA effortlessly

- Obtain Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct commissioner of the revenuelouisa county vataxeslouisa county vacommissioner of the revenuelouisa county va

Create this form in 5 minutes!

How to create an eSignature for the commissioner of the revenuelouisa county vataxeslouisa county vacommissioner of the revenuelouisa county va

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Commissioner Of The Revenue in Louisa County, VA provide?

The Commissioner Of The Revenue in Louisa County, VA, offers a range of services, including assessing local taxes, maintaining tax records, and providing property tax information. Their goal is to ensure fair and equitable tax assessments for residents and businesses in Louisa County, VA.

-

How can airSlate SignNow facilitate the work with the Commissioner Of The Revenue in Louisa County, VA?

airSlate SignNow streamlines document management and eSigning processes, allowing users to easily submit tax documents to the Commissioner Of The Revenue in Louisa County, VA. This efficiency minimizes delays and improves communication with the tax office, making tax-related tasks straightforward.

-

What are the pricing options for using airSlate SignNow when dealing with tax documents for Louisa County, VA?

airSlate SignNow offers various pricing plans to suit different needs, ensuring that users can find an affordable solution while managing documents for the Commissioner Of The Revenue in Louisa County, VA. These plans provide flexibility and scalability for businesses of all sizes.

-

Are there any integrations available for airSlate SignNow with tools relevant to the Commissioner Of The Revenue in Louisa County, VA?

Yes, airSlate SignNow integrates seamlessly with various software tools that can assist users in tax preparation and submission related to the Commissioner Of The Revenue in Louisa County, VA. This allows for a smooth workflow and efficient document handling.

-

What are the benefits of using airSlate SignNow for handling taxes in Louisa County, VA?

Using airSlate SignNow for navigating taxes in Louisa County, VA, provides signNow benefits, including enhanced security for document handling and efficiency in signing processes. This results in quicker turnaround times for tax submissions to the Commissioner Of The Revenue in Louisa County, VA.

-

How does airSlate SignNow ensure the security of documents submitted to the Commissioner Of The Revenue in Louisa County, VA?

airSlate SignNow prioritizes security by offering features such as encrypted document storage and secure eSignatures. This ensures that all communications and documents shared with the Commissioner Of The Revenue in Louisa County, VA, are protected and confidential.

-

Is airSlate SignNow suitable for both individuals and businesses managing taxes in Louisa County, VA?

Absolutely! airSlate SignNow caters to both individuals and businesses needing to manage taxes for the Commissioner Of The Revenue in Louisa County, VA. The platform's versatility makes it an ideal choice regardless of the user's specific needs.

Get more for Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA

Find out other Commissioner Of The RevenueLouisa County, VATaxesLouisa County, VACommissioner Of The RevenueLouisa County, VA

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document