Meals Tax Form Louisa County 2012

What is the Meals Tax Form Louisa County

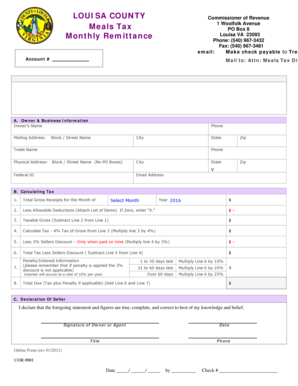

The Meals Tax Form Louisa County is a specific document used by businesses and individuals in Louisa County, Virginia, to report and remit meals tax. This tax applies to the sale of prepared food and beverages within the county. The form serves as a means for local authorities to collect the necessary revenue from food service establishments, ensuring compliance with local tax regulations. Understanding this form is essential for any business involved in the sale of meals to avoid penalties and ensure proper tax reporting.

How to obtain the Meals Tax Form Louisa County

To obtain the Meals Tax Form Louisa County, individuals and businesses can visit the official Louisa County website or contact the local tax office directly. The form is typically available for download in a PDF format, allowing users to print it for completion. Additionally, local government offices may provide physical copies of the form upon request. Ensuring you have the latest version of the form is crucial, as tax regulations may change.

Steps to complete the Meals Tax Form Louisa County

Completing the Meals Tax Form Louisa County involves several key steps:

- Gather necessary information, including business details, sales figures, and tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total meals tax owed based on the reported sales.

- Review the form for accuracy and completeness.

- Sign and date the form, confirming the information is truthful and correct.

Once completed, the form can be submitted according to the specified submission methods.

Legal use of the Meals Tax Form Louisa County

The Meals Tax Form Louisa County is legally binding when filled out correctly and submitted on time. It is important to adhere to local tax laws and regulations to avoid any legal repercussions. The form must be signed by an authorized representative of the business, and any discrepancies or errors may lead to audits or penalties. Utilizing a reliable e-signature solution can enhance the legal validity of the form, ensuring compliance with applicable laws.

Form Submission Methods

The Meals Tax Form Louisa County can be submitted through various methods to accommodate different preferences:

- Online Submission: Many jurisdictions allow for electronic submission through their official websites.

- Mail: Completed forms can be mailed to the designated tax office address.

- In-Person: Submissions can also be made in person at local government offices during business hours.

Choosing the appropriate submission method can streamline the process and ensure timely compliance with tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Meals Tax Form Louisa County can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses that do not file their forms on time or provide inaccurate information may face audits, which can lead to further complications. It is essential to stay informed about filing deadlines and ensure that all submissions are accurate and timely to avoid these consequences.

Quick guide on how to complete meals tax form louisa county

Prepare Meals Tax Form Louisa County effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Manage Meals Tax Form Louisa County on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Meals Tax Form Louisa County with ease

- Find Meals Tax Form Louisa County and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Meals Tax Form Louisa County and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct meals tax form louisa county

Create this form in 5 minutes!

How to create an eSignature for the meals tax form louisa county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Meals Tax Form Louisa County?

The Meals Tax Form Louisa County is a document that local businesses must fill out to report and remit taxes collected on food and beverage sales. This form ensures compliance with the county's tax regulations and is essential for maintaining good standing with local authorities.

-

How can airSlate SignNow help with the Meals Tax Form Louisa County?

airSlate SignNow simplifies the process of completing and submitting the Meals Tax Form Louisa County by providing an intuitive platform for electronic signatures and document management. You can easily fill out the form, gain necessary approvals, and submit it, all from one user-friendly interface.

-

Is there a cost associated with using airSlate SignNow for the Meals Tax Form Louisa County?

Yes, while airSlate SignNow offers various pricing plans, it provides a cost-effective solution for managing the Meals Tax Form Louisa County efficiently. Customers can choose from plans that best fit their business needs while ensuring compliance with local tax laws.

-

What features does airSlate SignNow offer for the Meals Tax Form Louisa County?

airSlate SignNow includes features such as electronic signatures, document templates, real-time collaboration, and secure cloud storage, all of which streamline the process of filling out and submitting the Meals Tax Form Louisa County. These features help save time, reduce errors, and enhance compliance.

-

Can I integrate airSlate SignNow with other tools for handling the Meals Tax Form Louisa County?

Absolutely! airSlate SignNow offers integrations with various business tools and platforms, making it easy to manage your finances and paperwork related to the Meals Tax Form Louisa County. You can connect with accounting software or other document management systems to facilitate seamless workflows.

-

What are the benefits of using airSlate SignNow for my Meals Tax Form Louisa County?

Using airSlate SignNow for your Meals Tax Form Louisa County provides numerous benefits, including improved efficiency, easier compliance tracking, and enhanced security. The electronic signature capability eliminates the need for paper forms, helping you save time and resources while ensuring timely submissions.

-

How secure is the information submitted through airSlate SignNow for the Meals Tax Form Louisa County?

airSlate SignNow prioritizes security and uses advanced encryption technology to protect sensitive information related to the Meals Tax Form Louisa County. You can trust that your data is safe, and the platform adheres to industry standards for security and privacy.

Get more for Meals Tax Form Louisa County

- Special power attorney 497429660 form

- Power attorney purchase form

- Washington consumer tax form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant washington form

- Wa deed trust form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase washington form

- Deed trust amended form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services washington form

Find out other Meals Tax Form Louisa County

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter