Texas Hotel Occupancy Tax Report Form

What is the Texas Hotel Occupancy Tax Report

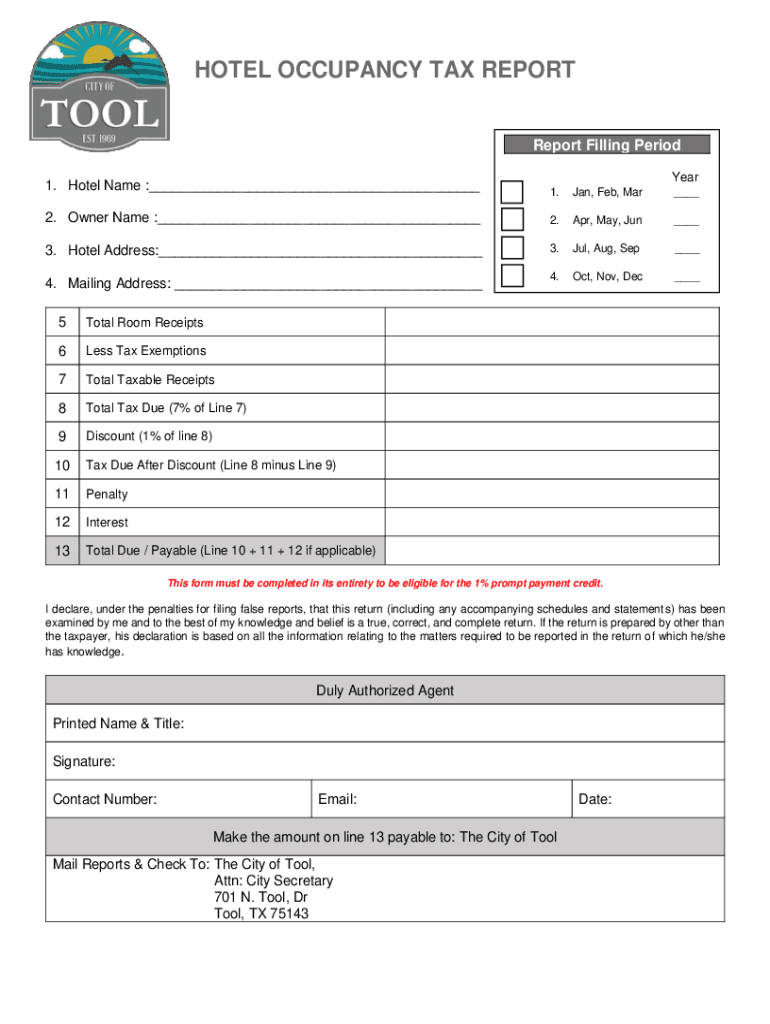

The Texas Hotel Occupancy Tax Report is a document that hotels and similar establishments must file to report the collection of hotel occupancy taxes. This report is essential for compliance with state tax regulations. The tax is levied on the rental of rooms in hotels, motels, and other lodging facilities, and the revenue generated supports local projects and tourism initiatives. Understanding this report is crucial for hotel operators to ensure they meet their tax obligations and avoid penalties.

Steps to complete the Texas Hotel Occupancy Tax Report

Completing the Texas Hotel Occupancy Tax Report involves several key steps. First, gather all necessary financial records, including total room revenue and the amount of tax collected. Next, accurately fill out the report, ensuring that all figures reflect the correct amounts. It is important to double-check calculations to avoid errors. Once completed, the report must be submitted by the designated deadline, which varies based on the reporting period. Utilizing digital tools can streamline this process, making it easier to manage and submit the report.

Legal use of the Texas Hotel Occupancy Tax Report

The Texas Hotel Occupancy Tax Report must be used in accordance with state laws governing tax collection and reporting. This includes adhering to deadlines and accurately reporting all taxable revenue. Legal compliance ensures that the report is recognized by tax authorities and can be used in case of audits or disputes. Utilizing a reliable electronic signature solution can further enhance the legal standing of the submitted report, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Hotel Occupancy Tax Report are critical for compliance. Typically, reports are due on a monthly basis, but some establishments may qualify for quarterly or annual reporting depending on their revenue. It is essential to stay informed about these deadlines to avoid late fees or penalties. Keeping a calendar with important dates can help hotel operators manage their filing schedule effectively.

Form Submission Methods (Online / Mail / In-Person)

The Texas Hotel Occupancy Tax Report can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient and allows for quicker processing. For those who prefer traditional methods, mailing the completed report is an option, though it may take longer to process. In-person submissions can be made at designated tax offices, providing an opportunity to ask questions or clarify any uncertainties regarding the report.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Texas Hotel Occupancy Tax Report can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is vital for hotel operators to understand the implications of non-compliance and to take proactive steps to ensure timely and accurate reporting. Regular training and updates on tax regulations can help minimize the risk of penalties.

Key elements of the Texas Hotel Occupancy Tax Report

The Texas Hotel Occupancy Tax Report includes several key elements that must be accurately reported. These elements typically consist of total room revenue, the amount of tax collected, and any exemptions that may apply. Additionally, the report requires details about the lodging establishment, including its name, address, and tax identification number. Ensuring that all information is complete and correct is essential for compliance and to avoid issues during audits.

Quick guide on how to complete texas hotel occupancy tax report

Effortlessly Complete Texas Hotel Occupancy Tax Report on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional paper-based documents that require printing and signing, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Texas Hotel Occupancy Tax Report on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Texas Hotel Occupancy Tax Report with Ease

- Locate Texas Hotel Occupancy Tax Report and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important parts of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Texas Hotel Occupancy Tax Report to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas hotel occupancy tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas hotel occupancy tax report?

A Texas hotel occupancy tax report is a document required by the state for lodging providers to report and remit collected hotel occupancy taxes. This report provides details of the taxable income generated from room rentals. It's essential for compliance with Texas tax laws to avoid penalties.

-

How can airSlate SignNow help with filing a Texas hotel occupancy tax report?

airSlate SignNow streamlines the process of filing a Texas hotel occupancy tax report by allowing businesses to digitize and automate their document workflows. Our platform simplifies the collection of necessary data and facilitates eSigning, making it faster and more efficient to submit your report accurately.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and automated workflows, specifically designed to manage tax documents like the Texas hotel occupancy tax report. These tools enhance accuracy, reduce processing time, and ensure compliance with state regulations.

-

Is airSlate SignNow affordable for small hotels needing to file a Texas hotel occupancy tax report?

Yes, airSlate SignNow provides a cost-effective solution for small hotels that need to file a Texas hotel occupancy tax report. It offers flexible pricing plans that cater to different business sizes, ensuring that even small operations can manage their tax reporting efficiently without overspending.

-

Can airSlate SignNow integrate with accounting software for tax reporting?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier for hotels to sync financial data when preparing their Texas hotel occupancy tax report. This integration ensures that all relevant information is readily available, streamlining the reporting process.

-

What are the benefits of using airSlate SignNow for tax reporting?

Using airSlate SignNow for tax reporting, including the Texas hotel occupancy tax report, signNowly improves efficiency and accuracy. The platform allows for real-time collaboration, reduces paperwork, and provides secure storage for essential documents, ensuring that your tax filing is always compliant and organized.

-

How does airSlate SignNow ensure compliance with Texas tax laws?

airSlate SignNow is designed to help businesses comply with Texas tax laws by providing compliant templates and an easy-to-navigate interface for filing reports. By leveraging our platform, users can be confident that their Texas hotel occupancy tax report meets the state's requirements, minimizing the risk of audits or penalties.

Get more for Texas Hotel Occupancy Tax Report

Find out other Texas Hotel Occupancy Tax Report

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement