ALABAMA DEPARTMENT of REVENUE SALES and USE TAX 2020

What is the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX

The Alabama Department of Revenue Sales and Use Tax is a tax imposed on the sale of tangible personal property and certain services within the state of Alabama. This tax is essential for funding various state services and infrastructure. The sales tax is typically collected at the point of sale, while the use tax applies to items purchased out of state but used within Alabama. Understanding this tax is crucial for businesses and individuals to ensure compliance with state regulations.

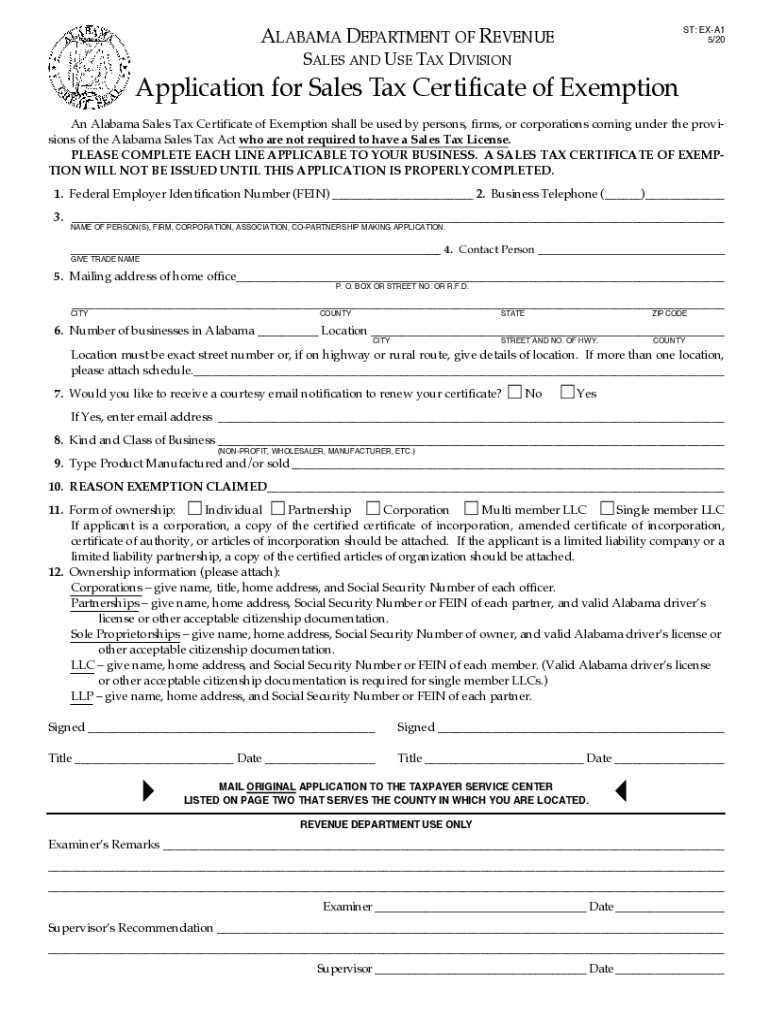

Steps to complete the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX

Completing the Alabama Department of Revenue Sales and Use Tax form involves several key steps:

- Gather necessary information, including business details and transaction records.

- Access the appropriate form from the Alabama Department of Revenue website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX

The legal use of the Alabama Department of Revenue Sales and Use Tax form requires adherence to specific guidelines set forth by the state. It is essential to ensure that the form is filled out correctly and submitted within the designated time frame. Failure to comply with these regulations may result in penalties or fines. Additionally, businesses must maintain accurate records to support the information reported on the form, which may be subject to audit by the Alabama Department of Revenue.

Form Submission Methods

The Alabama Department of Revenue Sales and Use Tax form can be submitted through various methods to accommodate different preferences:

- Online: Many businesses opt for electronic submission through the Alabama Department of Revenue's online portal, which provides a quick and efficient way to file.

- Mail: For those who prefer traditional methods, the form can be printed and mailed to the appropriate address provided by the department.

- In-Person: Some individuals may choose to submit their forms in person at designated Alabama Department of Revenue offices.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with the Alabama Department of Revenue Sales and Use Tax. Generally, the filing frequency can be monthly, quarterly, or annually, depending on the volume of sales. Key dates to remember include:

- The due date for monthly filers is typically the 20th of the following month.

- Quarterly filers should submit their forms by the 20th of the month following the end of the quarter.

- Annual filers need to adhere to the specific deadline set by the Alabama Department of Revenue.

Key elements of the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX

Understanding the key elements of the Alabama Department of Revenue Sales and Use Tax is vital for accurate reporting. Important components include:

- Tax Rate: The standard sales tax rate in Alabama is four percent, with additional local taxes that may apply.

- Exemptions: Certain items and services may be exempt from sales tax, such as food for home consumption and specific medical supplies.

- Record Keeping: Businesses must maintain detailed records of sales and purchases to substantiate their tax filings.

Quick guide on how to complete alabama department of revenue sales and use tax

Effortlessly Prepare ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, amend, and eSign your documents swiftly without delays. Handle ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX with Ease

- Find ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX while ensuring exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama department of revenue sales and use tax

Create this form in 5 minutes!

How to create an eSignature for the alabama department of revenue sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX on eSigning documents?

Understanding the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX is crucial when eSigning documents in Alabama. Businesses must ensure they comply with all applicable tax regulations, especially when the documents pertain to transactions involving taxable sales and use. airSlate SignNow provides a secure platform to help businesses manage their eSigning needs while remaining compliant.

-

How does airSlate SignNow help in managing ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX documentation?

airSlate SignNow simplifies the process of managing documentation related to the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX. With customizable templates, businesses can quickly prepare documents that adhere to state regulations, ensuring all necessary tax information is included. This streamlines the workflow and reduces the risk of errors.

-

What features does airSlate SignNow offer for handling ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX compliance?

airSlate SignNow offers several features that aid in ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX compliance, including customizable fields for tax details and automated workflows for document routing. These features allow businesses to efficiently gather required signatures and ensure proper documentation is submitted in accordance with state tax laws.

-

Are there any integrations available with airSlate SignNow for ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX compliance?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software to help businesses manage their ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX requirements. These integrations allow users to effortlessly import tax information into their eSigned documents, ensuring a more cohesive workflow. This not only saves time but also enhances accuracy.

-

What is the pricing structure for airSlate SignNow concerning ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX related features?

airSlate SignNow offers a variety of pricing plans that provide access to features beneficial for managing ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX documentation. Plans range from basic to advanced options, catering to the needs of businesses of all sizes. Each plan includes eSigning capabilities that help streamline tax-related documents.

-

How can airSlate SignNow benefit businesses facing ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX challenges?

By utilizing airSlate SignNow, businesses can effectively address challenges related to the ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX. The platform streamlines document preparation and signing, reduces the time spent on tax compliance tasks, and minimizes the risk of errors, thereby promoting efficient operations and peace of mind for business owners.

-

What customer support options are available for airSlate SignNow users dealing with ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX?

airSlate SignNow provides comprehensive customer support options, including live chat, email support, and an extensive help center tailored for users managing ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX. Our support team is well-versed in tax compliance issues and can assist users in navigating their specific needs effectively.

Get more for ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX

Find out other ALABAMA DEPARTMENT OF REVENUE SALES AND USE TAX

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA