Fillable Application for Sales Tax Certificate of Exemption 2023-2026

Understanding the Fillable Application for Sales Tax Certificate of Exemption

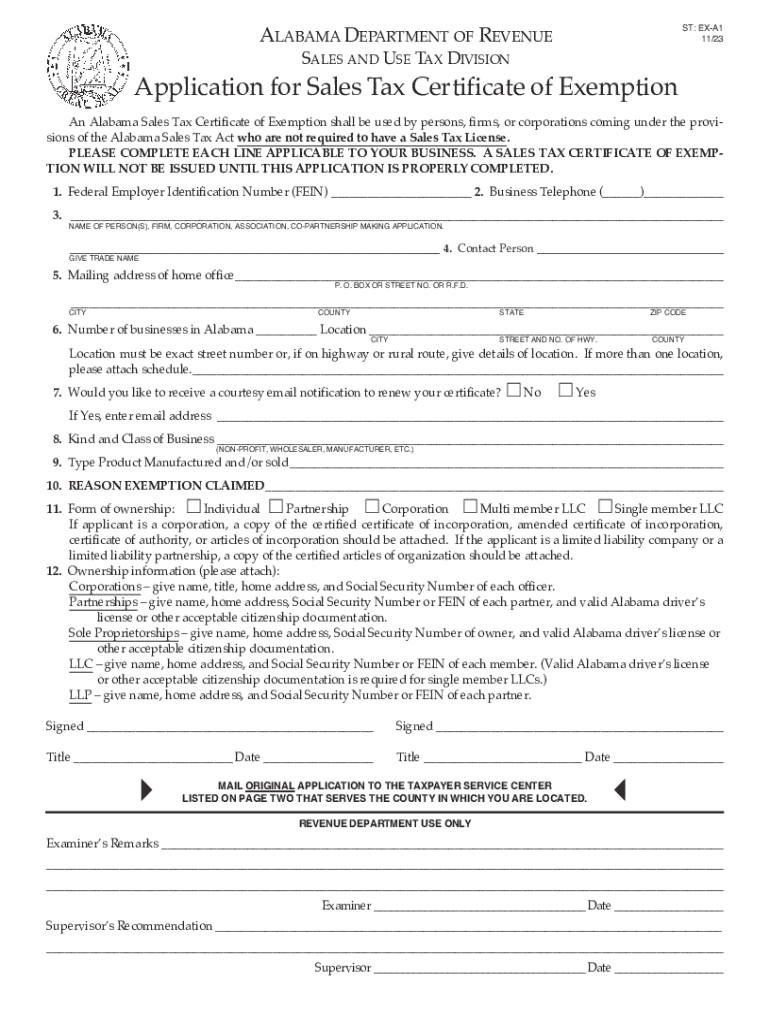

The Fillable Application for Sales Tax Certificate of Exemption is a crucial document used by businesses in Alabama to claim exemption from sales tax. This form is particularly relevant for organizations that purchase goods or services for resale or for specific exempt purposes. By completing this application, businesses can avoid paying sales tax on qualifying purchases, which can lead to significant savings. It is essential to understand the specific criteria that qualify an entity for this exemption, as well as the proper completion of the form itself.

Steps to Complete the Fillable Application for Sales Tax Certificate of Exemption

Completing the Fillable Application for Sales Tax Certificate of Exemption involves several key steps:

- Gather Required Information: Collect all necessary details about your business, including the legal name, address, and tax identification number.

- Identify the Exemption Type: Determine the reason for the exemption, such as resale or specific exempt purposes like charitable activities.

- Complete the Form: Fill out the application accurately, ensuring all fields are completed to avoid delays.

- Review for Accuracy: Double-check all information for correctness before submission.

- Submit the Application: Follow the appropriate submission method, whether online, by mail, or in person.

Eligibility Criteria for the Fillable Application for Sales Tax Certificate of Exemption

To qualify for the sales tax exemption in Alabama, applicants must meet specific eligibility criteria. Generally, the following conditions apply:

- The applicant must be a registered business entity in Alabama.

- The items purchased must be intended for resale or for use in exempt activities.

- Proper documentation must be provided to support the claim for exemption.

It is vital to ensure that your business aligns with these criteria to avoid potential penalties or issues during the application process.

Required Documents for the Fillable Application for Sales Tax Certificate of Exemption

When applying for the sales tax certificate of exemption, certain documents are typically required. These may include:

- A copy of the business's sales tax registration certificate.

- Proof of the nature of the business and the types of goods or services provided.

- Documentation supporting the claim for exemption, such as invoices or purchase orders.

Having these documents ready can streamline the application process and help ensure compliance with state regulations.

Form Submission Methods for the Fillable Application for Sales Tax Certificate of Exemption

Applicants have several options for submitting the Fillable Application for Sales Tax Certificate of Exemption:

- Online Submission: Many businesses opt to submit their applications electronically through the Alabama Department of Revenue's website.

- Mail: Completed forms can also be sent via postal service to the appropriate department.

- In-Person: Applicants may choose to deliver their applications directly to a local revenue office.

Choosing the right submission method can depend on factors such as convenience and urgency.

Legal Use of the Fillable Application for Sales Tax Certificate of Exemption

The legal use of the Fillable Application for Sales Tax Certificate of Exemption is governed by Alabama state tax laws. Businesses must ensure that they are using the form for its intended purpose and in compliance with all relevant regulations. Misuse of the exemption certificate can lead to penalties, including back taxes and fines. Therefore, it is essential to maintain accurate records and to use the exemption certificate only for qualifying purchases.

Quick guide on how to complete fillable application for sales tax certificate of exemption

Complete Fillable Application For Sales Tax Certificate Of Exemption effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Fillable Application For Sales Tax Certificate Of Exemption on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Fillable Application For Sales Tax Certificate Of Exemption without stress

- Find Fillable Application For Sales Tax Certificate Of Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Fillable Application For Sales Tax Certificate Of Exemption and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable application for sales tax certificate of exemption

Create this form in 5 minutes!

How to create an eSignature for the fillable application for sales tax certificate of exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AL sales tax certificate exemption?

An AL sales tax certificate exemption is a document that allows businesses to purchase goods or services without paying sales tax in Alabama. This exemption is typically granted to non-profit organizations, government entities, and certain businesses that meet specific criteria. Understanding how to obtain and use this certificate can help businesses save on costs.

-

How can airSlate SignNow help with AL sales tax certificate exemption documentation?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign documents related to AL sales tax certificate exemption. With its user-friendly interface, you can easily manage your exemption certificates and ensure compliance with state regulations. This efficiency can save time and reduce the risk of errors.

-

Are there any costs associated with obtaining an AL sales tax certificate exemption?

While obtaining an AL sales tax certificate exemption itself may not have a direct cost, businesses should consider potential fees associated with the application process or legal consultations. Using airSlate SignNow can help minimize administrative costs by simplifying the documentation process. This can lead to overall savings for your business.

-

What features does airSlate SignNow offer for managing AL sales tax certificate exemption?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for managing AL sales tax certificate exemption. These tools enhance efficiency and ensure that all necessary documentation is completed accurately. Additionally, the platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for AL sales tax certificate exemption management?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage AL sales tax certificate exemption documentation. This integration allows for better data flow and reduces the need for manual entry, making the process more efficient. Popular integrations include CRM systems and accounting software.

-

What are the benefits of using airSlate SignNow for AL sales tax certificate exemption?

Using airSlate SignNow for AL sales tax certificate exemption offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's ease of use allows businesses to focus on their core operations rather than getting bogged down in administrative tasks. Additionally, the secure eSigning feature ensures that your documents are legally binding.

-

Is airSlate SignNow suitable for small businesses dealing with AL sales tax certificate exemption?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing AL sales tax certificate exemption. Its user-friendly interface and affordable pricing make it accessible for smaller operations. This allows small businesses to efficiently handle their documentation without incurring high costs.

Get more for Fillable Application For Sales Tax Certificate Of Exemption

Find out other Fillable Application For Sales Tax Certificate Of Exemption

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors