5068 Form

What is the 5068 Form

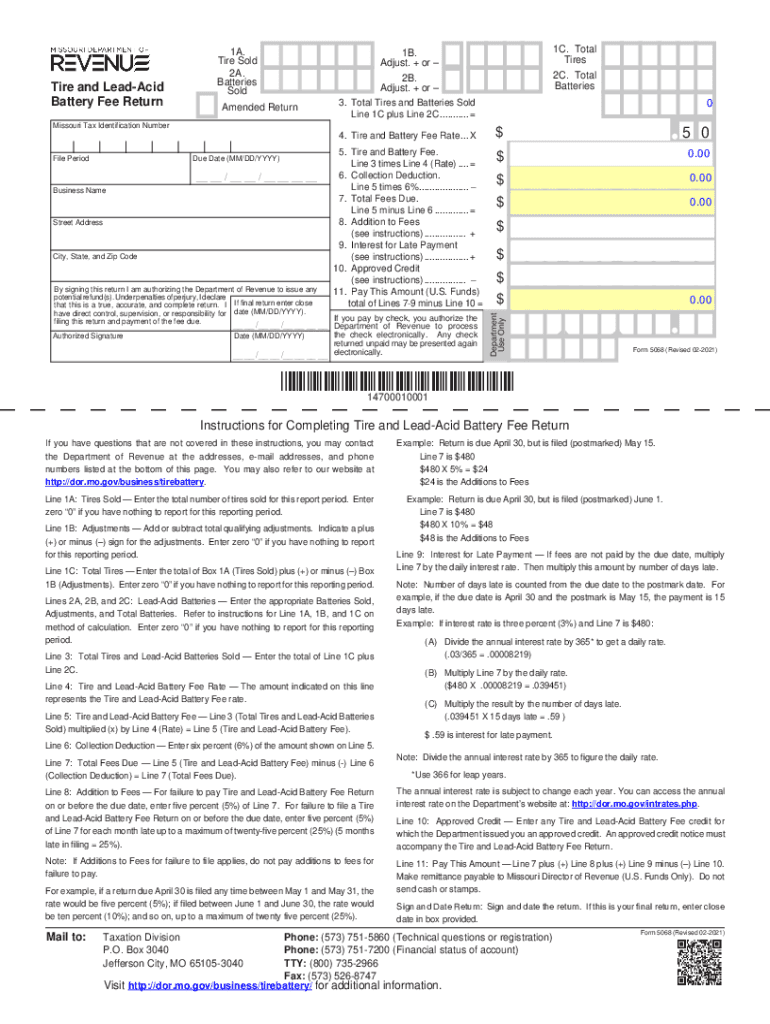

The 5068 form, officially known as the 5068 tire acid battery fee return, is a document used in the United States to report and remit fees associated with the sale of tire acid batteries. This form is essential for businesses that handle these products, ensuring compliance with state regulations regarding environmental and safety standards. The completion of the 5068 form is a critical step in maintaining proper records for tax and regulatory purposes.

How to obtain the 5068 Form

To obtain the 5068 form, businesses can visit the official state revenue department website or contact their local tax office. The form is typically available for download in a PDF format, allowing for easy access and printing. It is advisable to ensure that the most recent version of the form is used to comply with current regulations.

Steps to complete the 5068 Form

Completing the 5068 form involves several key steps:

- Gather necessary information, including business details and sales data related to tire acid batteries.

- Fill out the form accurately, ensuring that all required fields are completed.

- Calculate the total fees owed based on the sales figures provided.

- Review the form for accuracy before submission.

- Submit the completed form by the specified deadline, either online or via mail.

Legal use of the 5068 Form

The 5068 form is legally binding when completed and submitted according to state regulations. It serves as an official record of fees collected and remitted for tire acid batteries, which is crucial for compliance with environmental laws. Businesses must ensure that they adhere to the legal requirements associated with the form to avoid potential penalties.

Form Submission Methods

The 5068 form can be submitted through various methods, including:

- Online submission via the state revenue department’s website, if available.

- Mailing the completed form to the designated address provided by the state.

- In-person submission at local tax offices, which may offer assistance in completing the form.

Penalties for Non-Compliance

Failure to submit the 5068 form on time or inaccuracies in reporting can lead to penalties. These may include fines, interest on unpaid fees, or other legal repercussions. It is essential for businesses to be aware of the deadlines and ensure that their submissions are accurate to avoid such penalties.

Quick guide on how to complete 5068 form

Effortlessly Prepare 5068 Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the right template and securely keep it online. airSlate SignNow delivers all the tools necessary to create, modify, and electronically sign your documents swiftly and without complications. Manage 5068 Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Adjust and Electronically Sign 5068 Form with Ease

- Find 5068 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 5068 Form to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5068 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary function of 5068?

The primary function of 5068 is to empower businesses by allowing them to send and eSign documents seamlessly. This feature reduces the time and effort needed for document management and increases overall productivity.

-

How does pricing work for 5068?

Pricing for 5068 is designed to be cost-effective, accommodating different business sizes and needs. You can choose from various plans that include essential features, ensuring that you only pay for what you truly need.

-

What features are included in 5068?

5068 includes a variety of features such as document templates, tracking, and secure cloud storage. These features are tailored to streamline your document workflow and enhance collaboration among team members.

-

What are the benefits of using 5068 for my business?

Using 5068 can signNowly speed up your document signing process, reduce paper usage, and improve accuracy in transactions. Companies that implement 5068 often experience increased customer satisfaction due to faster turnaround times.

-

Can 5068 integrate with other software platforms?

Yes, 5068 offers seamless integrations with various software platforms, including CRM and project management tools. This flexibility allows you to enhance your existing workflows without disruption.

-

Is 5068 secure for handling sensitive documents?

Absolutely, 5068 prioritizes security and uses advanced encryption methods to protect your documents. This makes it a reliable choice for businesses handling sensitive information that requires compliance with industry regulations.

-

How can I get started with 5068?

Getting started with 5068 is quick and straightforward. You can sign up for a free trial to explore its features and see how it fits your business needs before making a commitment.

Get more for 5068 Form

- Peco claim registration form

- Supervisee evaluation of supervisor form camft camft

- Jics reclassification tree northpointe inc form

- Pr check stub form

- Insurance certificates for the dividend unlimited world cibc form

- Publication 4134sp rev 03 form

- Interpreter agreement template form

- Interview confidentiality agreement template form

Find out other 5068 Form

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy