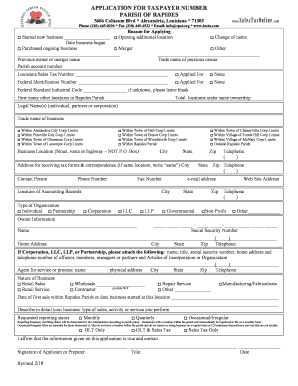

Parish Number Form

What is the Parish Number

The Parish Number is a unique identifier assigned to each parish in the United States, particularly for tax and administrative purposes. It is essential for various tax products, including the filing of tax returns and other official documents. Each parish has its own specific number that helps in tracking and managing tax-related activities within that jurisdiction.

How to use the Parish Number

The Parish Number is used primarily for identifying the correct parish when filing tax returns or submitting other official documents. When completing tax return products, including the federal return, it is crucial to include the correct Parish Number to ensure that the submission is processed accurately. This number helps tax offices, such as the tax office in Alexandria, to manage and allocate resources effectively.

How to obtain the Parish Number

To obtain a Parish Number, individuals or businesses typically need to contact their local parish tax office. The process may vary slightly depending on the specific parish, but generally, it involves providing basic information about the individual or business requesting the number. Some parishes may offer online resources or forms to facilitate this process.

Legal use of the Parish Number

The Parish Number must be used in compliance with local laws and regulations. It serves as a legal identifier for tax purposes, ensuring that all tax return products are correctly attributed to the appropriate parish. Misuse of the Parish Number can lead to complications, including penalties or delays in processing tax documents.

Filing Deadlines / Important Dates

Filing deadlines for tax returns and related documents are crucial for compliance. Each parish may have specific deadlines that align with federal and state requirements. It is important to stay informed about these dates to avoid penalties. Generally, the tax filing season in the United States runs from January to April, but specific deadlines can vary by parish.

Required Documents

When filing tax return products, certain documents are typically required. These may include income statements, previous tax returns, and any relevant forms that pertain to the specific tax situation. Ensuring that all required documents are prepared and submitted along with the Parish Number can help streamline the filing process.

Form Submission Methods (Online / Mail / In-Person)

Tax return products can often be submitted through various methods, including online platforms, mail, or in-person at local tax offices. Each method has its advantages; for example, online submissions can offer faster processing times, while in-person submissions allow for immediate assistance. Knowing the available submission methods can help taxpayers choose the most convenient option for their needs.

Quick guide on how to complete parish number

Complete Parish Number effortlessly on any device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Parish Number on any platform with the airSlate SignNow Android or iOS applications and simplify any document-based process today.

The easiest way to modify and eSign Parish Number effortlessly

- Obtain Parish Number and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Parish Number and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the parish number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in managing my tax LA return documents?

airSlate SignNow simplifies the process of managing your tax LA return documents by providing a secure platform for electronic signatures. With our solution, you can easily send and sign tax documents without the hassles of printing and mailing. This not only saves time but also enhances the security of your sensitive information.

-

How much does airSlate SignNow cost for handling tax LA returns?

airSlate SignNow offers various pricing plans tailored to suit different business needs. Whether you're a small business or a large enterprise, our solutions for handling tax LA returns are cost-effective, ensuring you only pay for what you need. Check our website for detailed pricing and plans that fit your requirements.

-

What features does airSlate SignNow offer for tax LA return processes?

Our platform includes features like automatic reminders, custom templates for tax LA returns, and secure cloud storage. These functionalities streamline the signing process, ensuring you never miss a deadline and that your documents are easily accessible. Additionally, signers can conveniently review and sign documents on any device.

-

Can I integrate airSlate SignNow with other tax management software for my tax LA return?

Yes, airSlate SignNow integrates seamlessly with many popular tax management software solutions. This allows you to enhance your workflow without disrupting your existing processes related to tax LA return documentation. Easily sync your data and manage your tax returns all in one cohesive environment.

-

What are the benefits of using airSlate SignNow for tax LA return submissions?

Using airSlate SignNow for your tax LA return submissions offers numerous benefits, including increased efficiency and reduced turnaround times. Electronic signatures expedite the process, helping you file your returns faster. Additionally, our platform ensures compliance with industry regulations, giving you peace of mind.

-

Is airSlate SignNow suitable for both individuals and businesses for tax LA returns?

Absolutely! airSlate SignNow caters to both individuals and businesses looking to manage their tax LA return documents efficiently. Our user-friendly interface allows anyone to adopt eSignatures easily, making it a versatile tool for different user needs in tax documentation.

-

How secure is airSlate SignNow for my sensitive tax LA return information?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to ensure that your tax LA return information remains confidential and protected. Our compliance with industry standards guarantees that your sensitive data is handled with the utmost care.

Get more for Parish Number

Find out other Parish Number

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement