Nc Bd4 Form

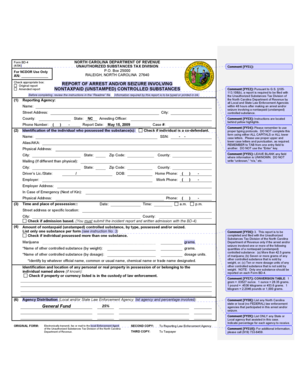

What is the Nc Bd4?

The Nc Bd4 form, officially known as the North Carolina Bd-4 form, is a tax-related document used primarily for reporting specific financial information to the North Carolina Department of Revenue. This form is essential for various taxpayers, including individuals and businesses, to ensure compliance with state tax regulations. It is particularly relevant for those dealing with certain tax credits, deductions, or other financial adjustments that may affect their overall tax liability in North Carolina.

How to use the Nc Bd4

Using the Nc Bd4 form involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents, such as income statements and previous tax returns. After obtaining the form, individuals should carefully fill it out, ensuring all sections are completed accurately. Once completed, the form can be submitted either electronically or via mail to the appropriate state tax office, depending on the taxpayer's preference and eligibility for e-filing.

Steps to complete the Nc Bd4

Completing the Nc Bd4 form requires attention to detail. Here are the key steps:

- Obtain the latest version of the Nc Bd4 form from the North Carolina Department of Revenue website.

- Gather all relevant financial documentation, including income statements and previous tax returns.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form electronically through an approved platform or mail it to the designated address.

Legal use of the Nc Bd4

The Nc Bd4 form is legally binding when completed and submitted according to North Carolina tax laws. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the North Carolina Department of Revenue. This includes providing accurate information, signing the form where required, and submitting it by the specified deadlines. Failure to comply with these regulations may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely submission of the Nc Bd4 form is crucial for compliance. Taxpayers should be aware of the following important dates:

- Annual filing deadline: typically April 15 for individual taxpayers.

- Quarterly deadlines for estimated tax payments, if applicable.

- Any specific extensions or changes announced by the North Carolina Department of Revenue.

Required Documents

To successfully complete the Nc Bd4 form, taxpayers must prepare several documents, including:

- W-2 forms or 1099s for income verification.

- Previous year’s tax return for reference.

- Documentation for any deductions or credits claimed.

- Any additional forms required by the North Carolina Department of Revenue.

Quick guide on how to complete nc bd4

Prepare Nc Bd4 effortlessly on any gadget

Digital document management has become increasingly embraced by companies and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle Nc Bd4 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Nc Bd4 with ease

- Obtain Nc Bd4 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Nc Bd4 and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc bd4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nc bd4 form and why is it important?

The nc bd4 form is a standard document used in North Carolina for various legal and business processes. Understanding the nc bd4 form is crucial as it ensures compliance with state regulations and helps streamline documentation.

-

How can airSlate SignNow help with the nc bd4 form?

airSlate SignNow enables users to easily create, send, and eSign the nc bd4 form digitally. This eliminates the hassle of paper documents and speeds up the entire process, ensuring accurate and timely submissions.

-

What are the pricing options for using airSlate SignNow for the nc bd4 form?

airSlate SignNow offers competitive pricing plans tailored to meet diverse business needs, starting with a free trial. Utilizing airSlate SignNow for the nc bd4 form can be a cost-effective solution, especially for high-volume users.

-

Does airSlate SignNow provide templates for the nc bd4 form?

Yes, airSlate SignNow offers customizable templates for the nc bd4 form. This feature allows users to quickly fill out the necessary information and expedite the eSigning process.

-

Is it easy to integrate the nc bd4 form with other applications?

Absolutely! airSlate SignNow provides seamless integrations with popular applications, allowing you to manage the nc bd4 form alongside your existing workflows. This enhances productivity and simplifies the document management process.

-

What are the benefits of using airSlate SignNow for the nc bd4 form?

Using airSlate SignNow for the nc bd4 form offers numerous benefits, including enhanced security, improved efficiency, and compliance with legal standards. This digital solution makes tracking and managing your documentation easy and reliable.

-

Can I track the status of the nc bd4 form after sending it?

Yes, airSlate SignNow allows users to track the status of the nc bd4 form in real-time. This feature ensures you stay updated on document progress and can take necessary actions promptly.

Get more for Nc Bd4

- Vertigo lighter warranty 448480369 form

- Confidential morbidity report cmr county of san luis obispo slocounty ca form

- State of texas application continuation sheet form

- Covered california fillable application form

- Stride duluth mn form

- Applications letter form

- Payday loans form

- Introduction agreement template form

Find out other Nc Bd4

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself