Kind & Location of Form

What is the Schedule E Rental Income Worksheet?

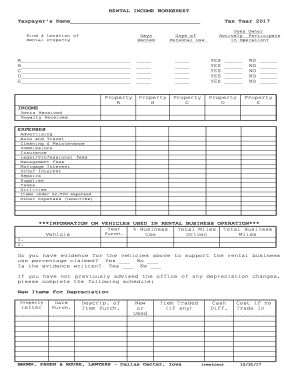

The Schedule E Rental Income Worksheet is a tax form used by individuals in the United States to report income or loss from rental real estate. This form is essential for landlords and property owners to accurately calculate their taxable income from rental properties. It allows taxpayers to detail their rental income, associated expenses, and deductions, ensuring compliance with IRS requirements. The worksheet is part of the IRS Form 1040, which is the standard individual income tax return form.

Key Elements of the Schedule E Rental Income Worksheet

Understanding the key elements of the Schedule E Rental Income Worksheet is vital for accurate reporting. The primary components include:

- Rental Income: This section captures all income received from rental properties, including rent payments and any additional fees.

- Expenses: Taxpayers can deduct various expenses related to property management, such as repairs, maintenance, property taxes, and mortgage interest.

- Depreciation: This allows property owners to recover the cost of their property over time, providing a significant tax benefit.

- Net Income or Loss: The worksheet calculates the net income or loss by subtracting total expenses from total rental income, which is then reported on Form 1040.

Steps to Complete the Schedule E Rental Income Worksheet

Completing the Schedule E Rental Income Worksheet involves several steps to ensure accuracy:

- Gather all relevant documents, including rental agreements, receipts for expenses, and mortgage statements.

- Report your total rental income in the designated section, including all sources of income from the property.

- List all allowable expenses related to the rental property, ensuring to keep detailed records for each expense.

- Calculate depreciation for the property, if applicable, and include this in your expenses.

- Subtract total expenses from total rental income to determine your net income or loss.

- Transfer the net income or loss figure to your Form 1040.

IRS Guidelines for the Schedule E Rental Income Worksheet

The IRS provides specific guidelines for completing the Schedule E Rental Income Worksheet. Taxpayers should ensure they adhere to the following:

- Report all rental income accurately to avoid penalties.

- Keep thorough documentation of all income and expenses to support claims during audits.

- Understand the eligibility criteria for deductions, such as those for repairs versus improvements.

- Be aware of the IRS deadlines for submitting the Schedule E along with your Form 1040.

Filing Deadlines for the Schedule E Rental Income Worksheet

Timely filing of the Schedule E Rental Income Worksheet is crucial to avoid penalties. The standard deadline for filing individual tax returns, including Schedule E, is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can also file for an extension, allowing more time to prepare their tax returns, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods for the Schedule E Rental Income Worksheet

Taxpayers have several options for submitting the Schedule E Rental Income Worksheet:

- Online Filing: Many taxpayers choose to e-file their returns using tax preparation software, which often includes the Schedule E.

- Mail: Taxpayers can complete the worksheet and mail it along with their Form 1040 to the appropriate IRS address.

- In-Person: Some individuals may prefer to visit a tax professional who can assist in completing and submitting the forms.

Quick guide on how to complete kind amp location of

Complete Kind & Location Of seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents swiftly without interruptions. Handle Kind & Location Of on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Kind & Location Of effortlessly

- Find Kind & Location Of and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Kind & Location Of and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kind amp location of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule E rental income worksheet?

A schedule E rental income worksheet is a document used for reporting income and expenses related to rental properties on your tax return. This worksheet helps landlords itemize their income, allowing for deductions related to maintenance, utilities, and other expenses. Understanding how to properly fill out this worksheet is crucial for accurate tax reporting.

-

How can airSlate SignNow help with a schedule E rental income worksheet?

airSlate SignNow streamlines the process of completing and signing your schedule E rental income worksheet by providing an easy-to-use digital platform. With our eSignature capabilities, you can quickly send, sign, and save your documents all in one place. This simplifies tax preparation and ensures that your forms are processed securely and efficiently.

-

Is airSlate SignNow cost-effective for managing tax documents like the schedule E rental income worksheet?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents, including the schedule E rental income worksheet. Our pricing plans are designed to meet the needs of businesses of all sizes, ensuring you get great value for streamlined document handling and eSigning. This eliminates the need for expensive printing and courier services.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features to assist with document management, including customizable templates, automated workflows, and secure cloud storage. These tools make it easier to complete the schedule E rental income worksheet, ensuring accuracy and compliance with tax regulations. Our platform also supports multiple file formats and integrates with various applications for seamless user experience.

-

Can I integrate airSlate SignNow with my accounting software for managing schedule E rental income worksheets?

Absolutely! airSlate SignNow can easily integrate with popular accounting software, making it simple to manage your schedule E rental income worksheet alongside your financial data. This integration helps keep all your documents organized and accessible, enhancing your workflow and reducing manual entry errors when preparing tax documents.

-

What benefits do I gain by using airSlate SignNow for my rental income documentation?

Using airSlate SignNow for your rental income documentation, including the schedule E rental income worksheet, offers numerous benefits such as improved efficiency and enhanced security. You can quickly send documents for signature, track their status in real-time, and ensure that sensitive information is handled securely. Overall, it simplifies the process and saves you valuable time during tax season.

-

Is it easy to collaborate with others using airSlate SignNow for the schedule E rental income worksheet?

Yes, collaboration is made easy with airSlate SignNow. You can invite multiple parties to review and sign your schedule E rental income worksheet, allowing for efficient teamwork. Our platform enables users to comment and track changes, ensuring everyone is on the same page as you prepare your tax documents.

Get more for Kind & Location Of

- Arkansas juvenile law handbook form

- Ca 1032 form pdf 308124

- Royal caribbean guest ticket booklet form

- Statement of diligent effort form

- Form 70 001 17 1 1 000 rev 05 17

- Landscape design contract form

- Horse training contract template fill online printable form

- Horse training contract template 442540741 form

Find out other Kind & Location Of

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking