Form Sc 1310 Statement of Person Claiming Refund Due a

What is the Form Sc 1310 Statement Of Person Claiming Refund Due A

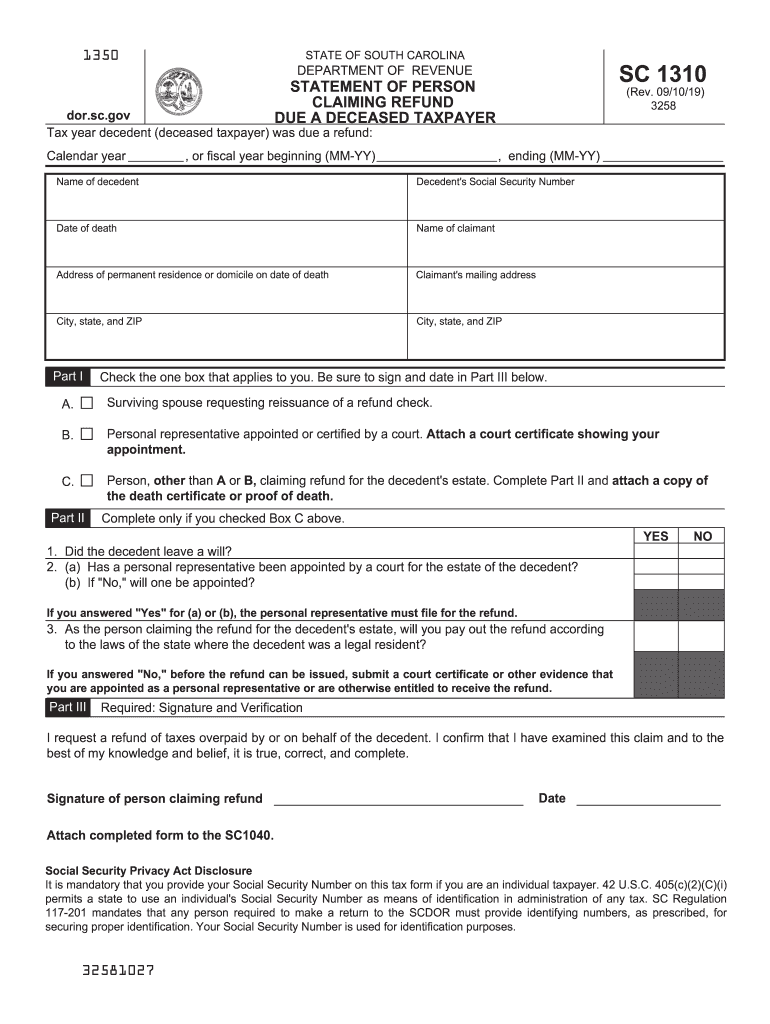

The Form Sc 1310 Statement Of Person Claiming Refund Due A is a document used by individuals to claim a tax refund on behalf of a deceased taxpayer. This form is essential for ensuring that the rightful beneficiary receives any funds owed to the deceased from the IRS. It provides the necessary information to verify the claimant's identity and their relationship to the deceased, facilitating the processing of the refund request.

How to use the Form Sc 1310 Statement Of Person Claiming Refund Due A

Using the Form Sc 1310 involves filling out the required sections accurately. Claimants must provide personal information about themselves and the deceased, including names, addresses, and Social Security numbers. It is crucial to ensure that all details are correct to avoid delays in processing. Once completed, the form should be submitted along with any other required tax documents to the IRS.

Steps to complete the Form Sc 1310 Statement Of Person Claiming Refund Due A

Completing the Form Sc 1310 requires several key steps:

- Gather necessary information about the deceased, including their tax returns and any relevant financial documents.

- Fill out the form, ensuring that all sections are completed accurately.

- Sign and date the form, confirming your relationship to the deceased.

- Submit the form along with the deceased's final tax return and any other required documentation to the IRS.

Legal use of the Form Sc 1310 Statement Of Person Claiming Refund Due A

The Form Sc 1310 is legally binding when filled out correctly and submitted according to IRS guidelines. It serves as a formal request for the refund and must be accompanied by proof of the claimant's authority to act on behalf of the deceased. This form is essential for ensuring compliance with tax laws and protecting the rights of beneficiaries.

Key elements of the Form Sc 1310 Statement Of Person Claiming Refund Due A

Key elements of the Form Sc 1310 include:

- The claimant's name and contact information.

- The deceased's name, Social Security number, and date of death.

- The relationship between the claimant and the deceased.

- Signature of the claimant, affirming the accuracy of the information provided.

Eligibility Criteria

To be eligible to use the Form Sc 1310, the claimant must be a legal beneficiary or representative of the deceased. This includes spouses, children, or other relatives who have the legal right to claim the refund. It is important to provide documentation proving this relationship, as the IRS requires verification to process the claim.

Quick guide on how to complete form sc 1310 statement of person claiming refund due a

Effortlessly Prepare Form Sc 1310 Statement Of Person Claiming Refund Due A on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form Sc 1310 Statement Of Person Claiming Refund Due A on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

Efficiently Modify and eSign Form Sc 1310 Statement Of Person Claiming Refund Due A with Ease

- Find Form Sc 1310 Statement Of Person Claiming Refund Due A and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Sc 1310 Statement Of Person Claiming Refund Due A to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sc 1310 statement of person claiming refund due a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form Sc 1310 Statement Of Person Claiming Refund Due A?

The Form Sc 1310 Statement Of Person Claiming Refund Due A is a tax form used to claim a refund for a deceased taxpayer's overpaid taxes. This form identifies the individual claiming the refund and ensures that the correct refund is issued. Understanding how to use this form is crucial for beneficiaries seeking to claim funds efficiently.

-

How does airSlate SignNow simplify the process of submitting Form Sc 1310 Statement Of Person Claiming Refund Due A?

airSlate SignNow streamlines the process by allowing you to eSign and send your Form Sc 1310 Statement Of Person Claiming Refund Due A electronically. This eliminates the need for printing, mailing, and waiting for postal delivery. With just a few clicks, you can complete and submit your form securely.

-

Is there a cost associated with using airSlate SignNow for Form Sc 1310 Statement Of Person Claiming Refund Due A?

Yes, airSlate SignNow offers various pricing plans to fit different needs. These plans are designed to be affordable while providing comprehensive features, including the ability to handle documents like the Form Sc 1310 Statement Of Person Claiming Refund Due A. You can choose a plan based on your expected volume of document handling.

-

What features does airSlate SignNow offer to enhance the eSigning experience for Form Sc 1310 Statement Of Person Claiming Refund Due A?

airSlate SignNow comes equipped with features such as customizable templates, automated reminders, and secure storage. These features ensure that the process of electronic signing for the Form Sc 1310 Statement Of Person Claiming Refund Due A is efficient and user-friendly. You can also track the status of your documents in real time.

-

Can I integrate airSlate SignNow with other platforms when handling Form Sc 1310 Statement Of Person Claiming Refund Due A?

Absolutely! airSlate SignNow offers seamless integrations with popular platforms such as Google Workspace, Salesforce, and Dropbox. This allows for an improved workflow when managing documents like the Form Sc 1310 Statement Of Person Claiming Refund Due A, enabling you to bring all your tools together in one place.

-

What are the benefits of using airSlate SignNow for managing Form Sc 1310 Statement Of Person Claiming Refund Due A?

Using airSlate SignNow for your Form Sc 1310 Statement Of Person Claiming Refund Due A offers numerous benefits, including enhanced efficiency, reduced paperwork, and secure handling of sensitive information. Plus, you can complete and submit the form from anywhere, making it a convenient choice for busy individuals and businesses.

-

Is airSlate SignNow secure for submitting sensitive documents like Form Sc 1310 Statement Of Person Claiming Refund Due A?

Yes, airSlate SignNow prioritizes your security. It uses advanced encryption protocols to ensure that your Form Sc 1310 Statement Of Person Claiming Refund Due A is transmitted securely. This means you can confidently manage sensitive documents without worrying about unauthorized access.

Get more for Form Sc 1310 Statement Of Person Claiming Refund Due A

Find out other Form Sc 1310 Statement Of Person Claiming Refund Due A

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship