Non Residents Relief under Double Taxation Agreements 2022-2026

What is the Non-residents Relief Under Double Taxation Agreements

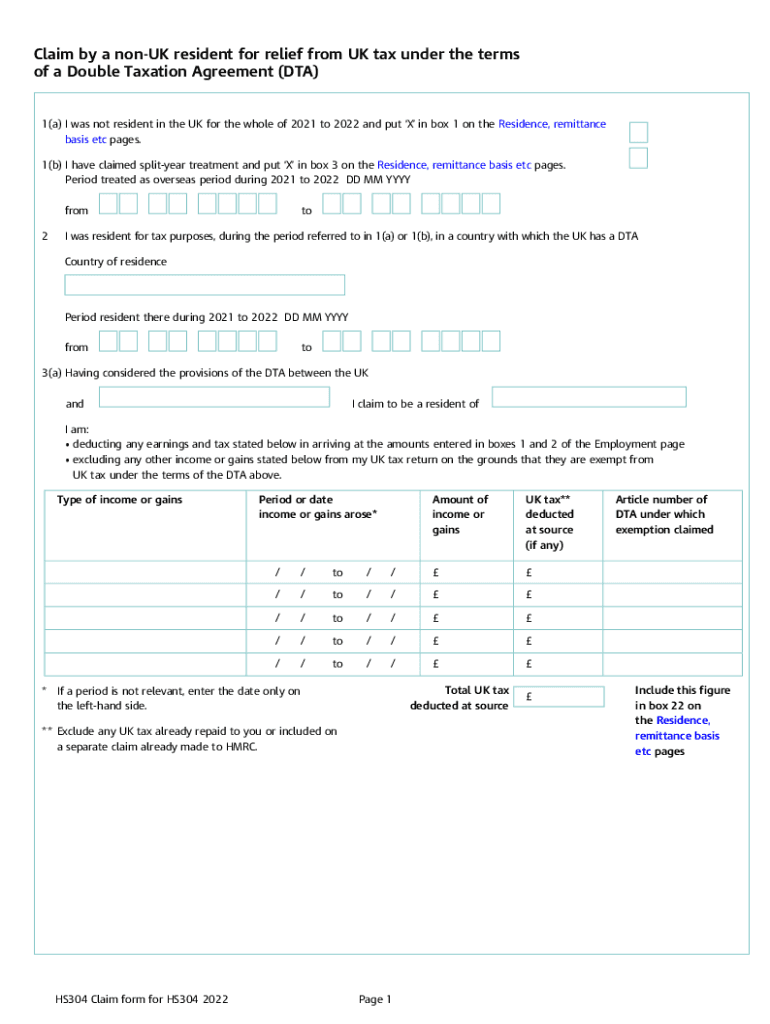

The Non-residents Relief Under Double Taxation Agreements (DTAs) is a provision that helps prevent individuals and businesses from being taxed on the same income in multiple jurisdictions. These agreements are established between countries to delineate which country has taxing rights over various types of income, such as dividends, interest, and royalties. For non-residents, this relief can significantly reduce their tax burden, ensuring that they are not unfairly taxed by both their home country and the country where they earn income.

How to use the Non-residents Relief Under Double Taxation Agreements

To effectively utilize the Non-residents Relief Under Double Taxation Agreements, individuals and businesses must first identify the applicable DTA between their home country and the country where they earn income. Once identified, they should review the specific provisions of the agreement to understand eligibility criteria and the types of income covered. It is essential to complete the necessary forms accurately and submit them to the relevant tax authorities to claim the relief. Consulting with a tax professional can also provide guidance on leveraging these agreements effectively.

Steps to complete the Non-residents Relief Under Double Taxation Agreements

Completing the Non-residents Relief Under Double Taxation Agreements involves several key steps:

- Identify the applicable DTA between your home country and the foreign country.

- Review the agreement to understand the types of income eligible for relief and any specific conditions.

- Gather necessary documentation, such as proof of residency and income statements.

- Complete the required forms, ensuring all information is accurate and complete.

- Submit the forms to the appropriate tax authority, either online or by mail, as specified in the agreement.

Legal use of the Non-residents Relief Under Double Taxation Agreements

The legal use of the Non-residents Relief Under Double Taxation Agreements is crucial for ensuring compliance with tax laws. Taxpayers must adhere to the specific provisions outlined in the DTA, including reporting requirements and deadlines. Failure to comply can result in penalties or denial of relief. It is important to maintain thorough records and documentation to support claims made under the agreement, as tax authorities may request this information during audits.

Eligibility Criteria

Eligibility for the Non-residents Relief Under Double Taxation Agreements typically depends on several factors, including:

- Residency status: Individuals or entities must be residents of a country that has a DTA with the foreign country.

- Type of income: Only specific types of income, such as dividends, interest, or royalties, may qualify for relief.

- Compliance with local tax laws: Taxpayers must comply with the tax laws of both their home country and the foreign country.

Filing Deadlines / Important Dates

Filing deadlines for claiming Non-residents Relief Under Double Taxation Agreements can vary based on the specific agreement and the countries involved. Generally, it is advisable to submit claims as soon as the income is earned or reported. Taxpayers should be aware of any specific deadlines set by the tax authorities in both jurisdictions to ensure timely processing of their claims. Keeping track of these dates is essential to avoid penalties or missed opportunities for relief.

Quick guide on how to complete non residents relief under double taxation agreements

Complete Non residents Relief Under Double Taxation Agreements effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Non residents Relief Under Double Taxation Agreements on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Non residents Relief Under Double Taxation Agreements with ease

- Find Non residents Relief Under Double Taxation Agreements and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from your preferred device. Modify and eSign Non residents Relief Under Double Taxation Agreements and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non residents relief under double taxation agreements

Create this form in 5 minutes!

How to create an eSignature for the non residents relief under double taxation agreements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hs304 form 2024?

The hs304 form 2024 is an essential document for businesses needing to manage specific transactions and compliance requirements. It outlines important details required for purposes such as tax reporting and regulatory adherence. Understanding the hs304 form 2024 is crucial for ensuring your business stays compliant.

-

How can airSlate SignNow help with the hs304 form 2024?

airSlate SignNow simplifies the process of signing and sending the hs304 form 2024 electronically. Our platform allows users to quickly upload the form, send it for eSignature, and track its status. This not only saves time but also enhances security and compliance management for your business.

-

What are the benefits of using airSlate SignNow for the hs304 form 2024?

Using airSlate SignNow for the hs304 form 2024 offers numerous benefits, including increased efficiency and reduced paperwork. The electronic signing process accelerates message delivery and allows for better document management. Additionally, the platform provides robust security features to protect sensitive information.

-

Is there a cost associated with using airSlate SignNow for the hs304 form 2024?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be an affordable solution for businesses. Our pricing plans cater to various organizational needs, ensuring you have everything necessary to manage the hs304 form 2024 effectively. Signup offers often include a free trial, so you can test our platform before committing.

-

What features should I look for in a solution for the hs304 form 2024?

When choosing a solution for the hs304 form 2024, look for features such as eSignature capabilities, document tracking, and integration options with existing systems. airSlate SignNow provides all these features to enhance your document workflow. Additionally, user-friendly interfaces are important for ensuring all team members can easily navigate the platform.

-

Can I integrate airSlate SignNow with other software for the hs304 form 2024?

Absolutely! airSlate SignNow offers integration options with a variety of software applications, making it easy to manage the hs304 form 2024 alongside your existing tools. Whether you are using CRM systems or cloud storage solutions, our integrations help streamline your workflow and maximize efficiency.

-

How secure is the process of signing the hs304 form 2024 with airSlate SignNow?

Security is a top priority at airSlate SignNow. The signing process for the hs304 form 2024 is protected by advanced encryption and security protocols to ensure your documents remain confidential. Additionally, all signed documents are stored securely, allowing for easy access and compliance audits.

Get more for Non residents Relief Under Double Taxation Agreements

- Dom to chose insurance new mexico form

- Clear form import data submit form division of athleticsactivities and accreditation parent permission form field trip field

- Navy siq chit pdf form

- Ccp 0345 clerk of the circuit court of cook county form

- Psychiatric evaluation questionnaire children annexure b to indian passport application identity certificate form

- Lost property report word template form

- Hearusa provider form

- Lfo interest waiver guide january aclu wa form

Find out other Non residents Relief Under Double Taxation Agreements

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast