Non Residents Relief under Double Taxation Agreements Non Residents Relief under Double Taxation Agreements 2020

Understanding Non-Residents Relief Under Double Taxation Agreements

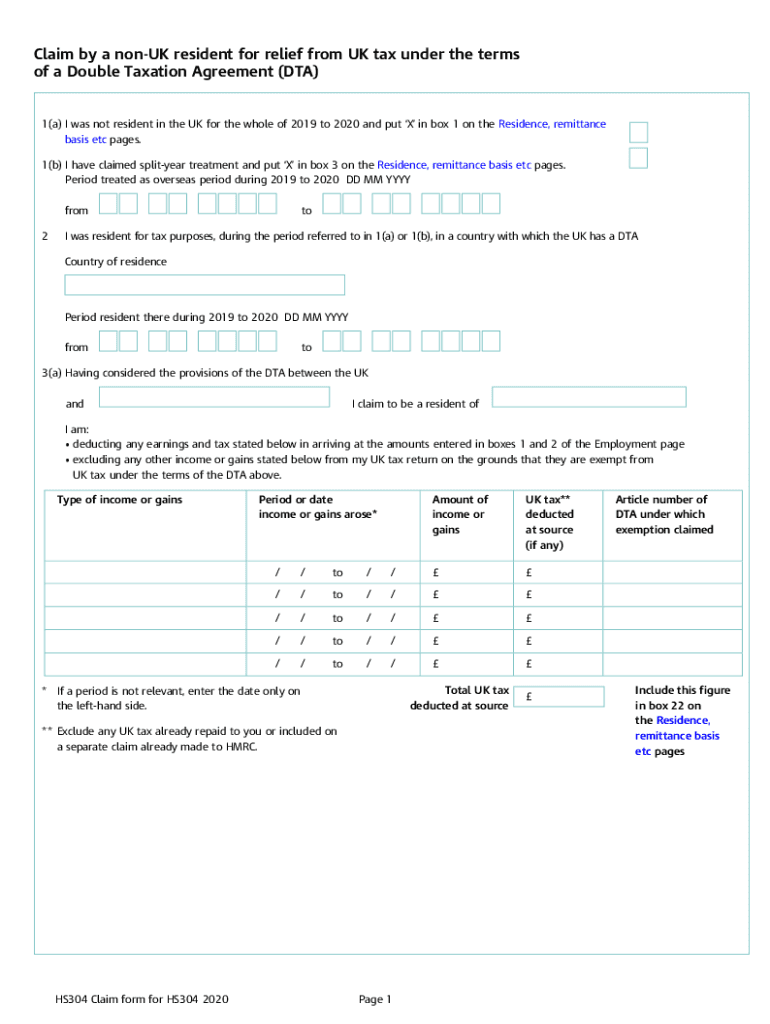

The Non-Residents Relief under Double Taxation Agreements (DTAs) is designed to prevent individuals and businesses from being taxed twice on the same income. This relief is particularly relevant for non-residents who earn income in the United States but are also subject to tax in their home country. The agreements typically outline which country has taxing rights over specific types of income, such as dividends, interest, and royalties. Understanding these provisions is crucial for non-residents to ensure compliance and maximize their tax benefits.

Steps to Complete the Non-Residents Relief Under Double Taxation Agreements

Completing the Non-Residents Relief form involves several key steps:

- Gather Required Information: Collect all necessary documents, including proof of residency in your home country and details of your U.S. income.

- Fill Out the Form: Carefully complete the hs304 form 2022, ensuring that all information is accurate and matches your supporting documents.

- Review for Accuracy: Double-check all entries to avoid mistakes that could delay processing or lead to penalties.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in-person, as specified by the IRS guidelines.

Required Documents for Non-Residents Relief

To successfully claim relief under the Non-Residents provisions, certain documents are essential. These typically include:

- Proof of Residency: Documentation that verifies your status as a non-resident, such as a passport or residency certificate.

- Income Statements: Forms like W-2 or 1099 that detail your income earned in the United States.

- Tax Identification Number: Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is necessary for processing.

IRS Guidelines for Non-Residents Relief

The IRS provides specific guidelines for non-residents seeking relief under DTAs. These guidelines outline eligibility criteria, the types of income eligible for relief, and the necessary forms to complete. It is essential to familiarize yourself with these regulations to ensure compliance and avoid potential penalties. The IRS website offers comprehensive resources to assist non-residents in understanding their obligations and rights under U.S. tax law.

Filing Deadlines for Non-Residents Relief

Timely submission of the hs304 form 2022 is crucial to secure relief under the Non-Residents provisions. Generally, non-residents must file their forms by the tax deadline, which is typically April fifteenth for most individuals. However, extensions may be available under certain circumstances. It is advisable to check for any updates or changes to filing deadlines each tax year to ensure compliance.

Eligibility Criteria for Non-Residents Relief

To qualify for Non-Residents Relief under Double Taxation Agreements, individuals must meet specific criteria, including:

- Residency Status: Must be a non-resident alien for U.S. tax purposes.

- Type of Income: The income must be of a type eligible for relief under the applicable DTA.

- Compliance with Tax Laws: Must have filed all required tax returns and paid any applicable taxes in both the U.S. and home country.

Quick guide on how to complete non residents relief under double taxation agreements non residents relief under double taxation agreements

Complete Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements effortlessly on any device

Online document administration has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements on any device with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to alter and eSign Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements without hassle

- Locate Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non residents relief under double taxation agreements non residents relief under double taxation agreements

Create this form in 5 minutes!

How to create an eSignature for the non residents relief under double taxation agreements non residents relief under double taxation agreements

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the hs304 form 2022 and why is it important?

The hs304 form 2022 is a specific document utilized for various business and tax-related processes. Understanding its importance helps businesses maintain compliance and streamline their operations while ensuring accurate record-keeping.

-

How can airSlate SignNow assist with the hs304 form 2022?

airSlate SignNow provides a secure, easy-to-use platform for electronically signing and sending the hs304 form 2022. By using our solution, you can complete the signing process faster and more efficiently, saving time and resources.

-

What features of airSlate SignNow support the hs304 form 2022?

airSlate SignNow offers features such as customizable templates, in-depth tracking, and automated workflows that enhance your experience with the hs304 form 2022. These tools simplify document management and improve overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the hs304 form 2022?

Yes, while airSlate SignNow is a cost-effective solution, there are subscription plans available that offer different features for users managing the hs304 form 2022. Each plan is designed to accommodate varying business needs and budgets.

-

Can I integrate airSlate SignNow with other software for the hs304 form 2022?

Absolutely! airSlate SignNow seamlessly integrates with various applications to help manage the hs304 form 2022. This integration ensures a smooth workflow, enabling you to sync data and enhance productivity.

-

How does airSlate SignNow ensure the security of the hs304 form 2022?

Security is our top priority at airSlate SignNow. We implement advanced encryption and secure data storage measures to protect the integrity of your hs304 form 2022 and other sensitive documents throughout the signing process.

-

What are the benefits of using airSlate SignNow for the hs304 form 2022?

Using airSlate SignNow for the hs304 form 2022 provides several benefits, including reducing paperwork, speeding up the signing process, and improving document accessibility. This results in more efficient business operations.

Get more for Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements

- Form jv 433 ampquotsix month permanency attachment

- Council record application for bsa lifeguard form

- Nyl group long term disability 500469 interactive pdf form

- Wwwpdffillercom203795160 ujs324 stipulationstipulation agreement florida department fill online form

- Pdf form 170s authorizing direct deposit for survivors benefit orbit

- Unicare fitness reimbursement fill out and sign printable form

- Isa manager transfer form instruction to transfer an existing isa to an isa with lloyds bank share dealing isa manager transfer

- Accord cancellation form

Find out other Non residents Relief Under Double Taxation Agreements Non residents Relief Under Double Taxation Agreements

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile