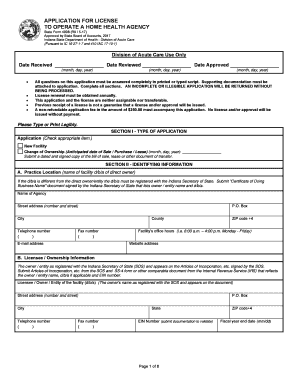

Indiana State Form

Understanding the Indiana State Application

The Indiana application serves as a crucial document for various purposes, including licensing and regulatory compliance. It is essential for individuals and businesses to understand the specific requirements associated with this application. The form is designed to gather necessary information that complies with state regulations, ensuring that applicants meet eligibility criteria. Familiarity with the Indiana state application can streamline the process and facilitate successful submissions.

Steps to Complete the Indiana State Application

Completing the Indiana state application involves several key steps to ensure accuracy and compliance. Start by gathering all required documents, which may include identification, proof of residency, and any relevant certifications. Next, fill out the application form carefully, ensuring that all information is complete and accurate. Review the form for any errors or omissions before submission. Once verified, submit the application through the appropriate method, whether online, by mail, or in person, depending on the specific requirements of the Indiana state application.

Required Documents for the Indiana State Application

When preparing to submit the Indiana state application, it is important to gather all necessary documentation. Commonly required documents include:

- Proof of identity (e.g., driver's license, state ID)

- Proof of residency (e.g., utility bill, lease agreement)

- Relevant certifications or licenses, if applicable

- Any additional forms or documents specified by the application guidelines

Having these documents ready can expedite the application process and help avoid delays.

Legal Use of the Indiana State Application

The Indiana state application must be used in accordance with state laws and regulations. It is essential to ensure that all information provided is truthful and accurate, as false information can lead to penalties or denial of the application. Understanding the legal implications of the application process can help applicants navigate potential challenges and ensure compliance with state requirements.

Form Submission Methods for the Indiana State Application

Applicants have several options for submitting the Indiana state application. These methods typically include:

- Online submission: Many applications can be completed and submitted through state websites, providing a convenient and efficient option.

- Mail: Applicants may choose to print the application and send it via postal service to the designated address.

- In-person submission: Some applications may require or allow for in-person submission at designated state offices.

Choosing the right submission method can impact processing times and overall efficiency.

Eligibility Criteria for the Indiana State Application

Eligibility for the Indiana state application varies depending on the specific type of application being submitted. Generally, applicants must meet specific criteria, which may include age requirements, residency status, and compliance with any relevant laws or regulations. It is important to carefully review the eligibility criteria outlined in the application instructions to ensure compliance and avoid potential issues during the application process.

Quick guide on how to complete indiana state 409995179

Complete Indiana State effortlessly on any device

Digital document management has become favored by corporations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and electronically sign your documents quickly and without interruptions. Handle Indiana State on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Indiana State effortlessly

- Locate Indiana State and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with utilities that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Indiana State to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana state 409995179

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana application process for eSigning documents?

The Indiana application process for eSigning documents is streamlined with airSlate SignNow. Our platform allows users to quickly and securely sign documents online, meeting all state-specific legal requirements for eSignatures in Indiana. By leveraging our intuitive interface, you can efficiently complete your Indiana application without any hassle.

-

How much does the Indiana application service cost with airSlate SignNow?

The pricing for the Indiana application service through airSlate SignNow is designed to be cost-effective and transparent. We offer various subscription plans tailored to meet the needs of businesses, ensuring that you find a plan that fits your budget while still allowing for unlimited eSigning capabilities. Check our website for specific pricing details and special offers.

-

What features does airSlate SignNow offer for the Indiana application?

airSlate SignNow provides a robust set of features for Indiana applications, including customizable templates, real-time notifications, and secure cloud storage. Our platform also includes features like team collaboration and automated workflows to enhance efficiency when managing your Indiana application documents. You can maximize productivity while ensuring compliance with local laws.

-

What are the benefits of using airSlate SignNow for Indiana applications?

Using airSlate SignNow for Indiana applications offers numerous benefits, including faster turnaround times for document completion and enhanced security for sensitive information. With our user-friendly interface, you can easily navigate the process from start to finish. Additionally, our solution supports remote work, allowing you to manage your Indiana application from anywhere.

-

Can I integrate airSlate SignNow with other tools for my Indiana application?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools to enhance your Indiana application process. Whether you use CRM software, cloud storage services, or email platforms, our integrations ensure smooth data transfer and workflow continuity. This interoperability allows you to maximize efficiency and maintain consistency across your operating systems.

-

Is airSlate SignNow compliant with Indiana law for electronic signatures?

Absolutely! airSlate SignNow is fully compliant with Indiana law governing electronic signatures. Our platform meets all legal requirements, ensuring that your Indiana application is valid and enforceable. By using our service, you can have peace of mind knowing that your documents comply with local regulations.

-

How can I track the status of my Indiana application documents?

Tracking the status of your Indiana application documents is easy with airSlate SignNow. Our platform provides real-time notifications and status updates whenever a document is viewed or signed. This transparency helps you manage your workflow effectively, ensuring you are always informed about the progress of your Indiana applications.

Get more for Indiana State

- Eeg documentation form abret abret

- Dermatology template prescription form

- Report form for tuberculin test tb test alexandria city public

- Listing presentation script form

- Tempo dynamics mood style smyser elementary school smyser form

- Downingtown area recreation consortium darc form

- Blazer depot is the official supplier of the fccla red blazer form

- Mentoring program proposal california courts form

Find out other Indiana State

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement