Fwgoodwill OrgcareersBuild Your Future Career Goodwill Industries of NE Indiana 2020-2026

IRS Guidelines

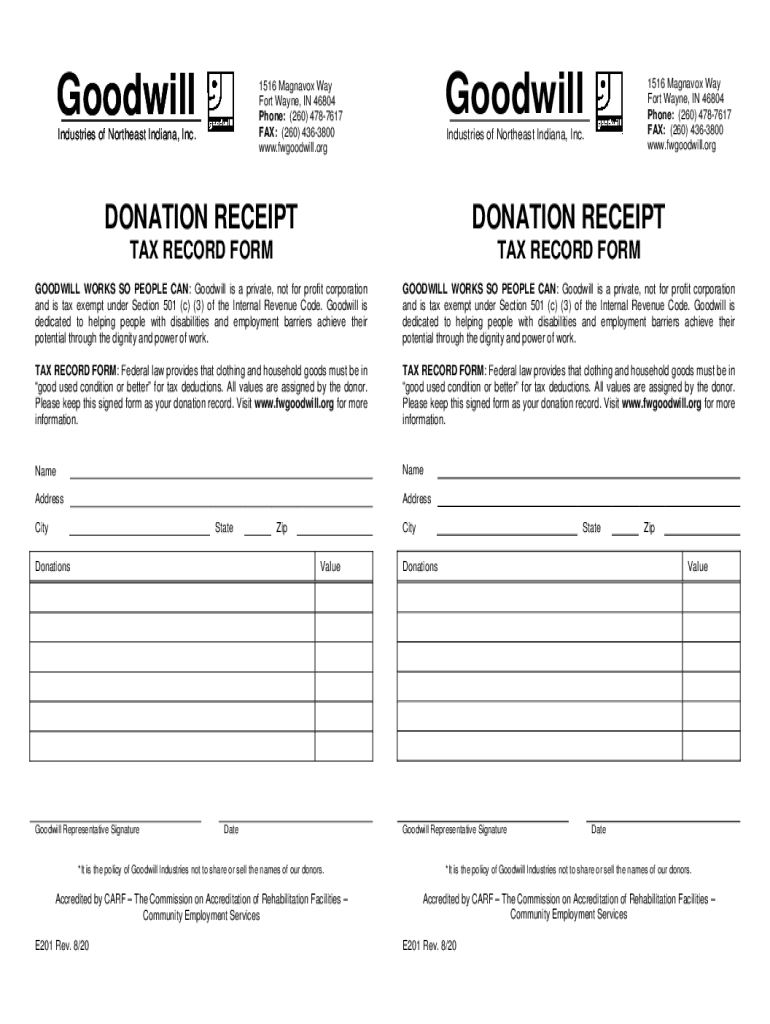

The IRS provides specific guidelines for documenting charitable donations, including the use of a goodwill receipt form. This form serves as proof of your donation and is essential for claiming tax deductions. According to IRS regulations, donors must obtain a written acknowledgment for any contribution of $250 or more. This acknowledgment should include the name of the organization, the date of the contribution, and a description of the donated items.

Key elements of the goodwill receipt form

A goodwill receipt form typically includes several key elements that ensure it meets IRS requirements. These elements include:

- Donor's name and address: This identifies the individual or entity making the donation.

- Organization's name and address: This specifies the charitable organization receiving the donation.

- Date of donation: This indicates when the donation was made, which is crucial for tax records.

- Description of donated items: A detailed list of the items donated helps substantiate the value of the contribution.

- Estimated value of the donation: While not required, providing an estimated value can assist in tax reporting.

Steps to complete the goodwill receipt form

Completing a goodwill receipt form involves several straightforward steps:

- Gather all necessary information, including your name, address, and details about the donated items.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign and date the form to validate your donation.

- Keep a copy of the completed form for your records, as you may need it for tax purposes.

Form Submission Methods

Goodwill receipt forms can typically be submitted in various ways, depending on the organization’s policies. Common submission methods include:

- Online submission: Many organizations allow you to complete and submit the form electronically through their website.

- Mail: You can print the form, fill it out, and mail it to the organization.

- In-person: You may also deliver the form directly to a local goodwill location, where staff can assist you.

Eligibility Criteria

To use the goodwill receipt form effectively, donors must meet certain eligibility criteria. Generally, these criteria include:

- The donor must be an individual or entity making a charitable contribution.

- The donation must be made to a qualified charitable organization, such as Goodwill Industries.

- The donated items must be in good condition or better, as required by IRS guidelines.

Penalties for Non-Compliance

Failure to comply with IRS requirements regarding charitable donations can lead to penalties. These may include:

- Disallowance of tax deductions for unsubstantiated donations.

- Potential audits by the IRS if proper documentation is not maintained.

- Fines or penalties for inaccurate reporting of charitable contributions.

Quick guide on how to complete fwgoodwill orgcareersbuild your future career goodwill industries of ne indiana

Effortlessly Prepare Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and Electronically Sign Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana with Ease

- Locate Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fwgoodwill orgcareersbuild your future career goodwill industries of ne indiana

Create this form in 5 minutes!

How to create an eSignature for the fwgoodwill orgcareersbuild your future career goodwill industries of ne indiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a goodwill receipt form?

A goodwill receipt form is a document that serves as proof of a charitable donation made to a nonprofit organization. It typically outlines the items donated, their estimated value, and is essential for tax purposes. Using a digital service like airSlate SignNow simplifies the process of creating and signing these forms.

-

How can airSlate SignNow help with goodwill receipt forms?

airSlate SignNow offers an efficient way to create, send, and eSign goodwill receipt forms. The platform allows users to customize templates, ensuring all necessary information is included. This streamlines the donation process and provides a digital audit trail for your records.

-

Is the goodwill receipt form customizable?

Yes, the goodwill receipt form can be fully customized in airSlate SignNow. Users can add logos, adjust fields, and include personalized messages to fit their organization’s branding. This flexibility ensures that each receipt meets specific donor requirements and enhances recognition.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate different needs and budgets, including a free trial to explore its features. Pricing is tiered based on the number of users and the features required, making it easy to find a cost-effective solution for managing goodwill receipt forms. You can choose a plan that suits your organization’s size and donation volume.

-

Are there integrations available for airSlate SignNow?

airSlate SignNow seamlessly integrates with various applications, enhancing the workflow for creating goodwill receipt forms. Popular integrations include CRMs and accounting software, which allow you to automate record-keeping for your donations. These connections help streamline the donation and receipt process for nonprofits.

-

What security features does airSlate SignNow offer?

Security is a priority for airSlate SignNow, especially when handling sensitive data like goodwill receipt forms. The platform employs industry-standard encryption to protect your information and complies with major regulations. Additionally, electronic signatures are legally binding, adding an extra layer of security to your documentation.

-

How do I track donations with a goodwill receipt form?

airSlate SignNow enables users to track donations effectively through the use of its goodwill receipt forms. By storing all receipts digitally, organizations can easily search and categorize donations. The platform provides real-time updates on document status, ensuring you never lose track of a donation made.

Get more for Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana

Find out other Fwgoodwill orgcareersBuild Your Future Career Goodwill Industries Of NE Indiana

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form