TENNESSEE DEPARTMENT of REVENUE Business Tax 2023-2026

What is the Tennessee Department of Revenue Business Tax?

The Tennessee Department of Revenue Business Tax is a tax imposed on businesses operating within the state. This tax is calculated based on the gross receipts of a business and is designed to generate revenue for state services. Understanding this tax is essential for business owners to ensure compliance and avoid potential penalties. The business tax applies to various entity types, including corporations, partnerships, and limited liability companies (LLCs).

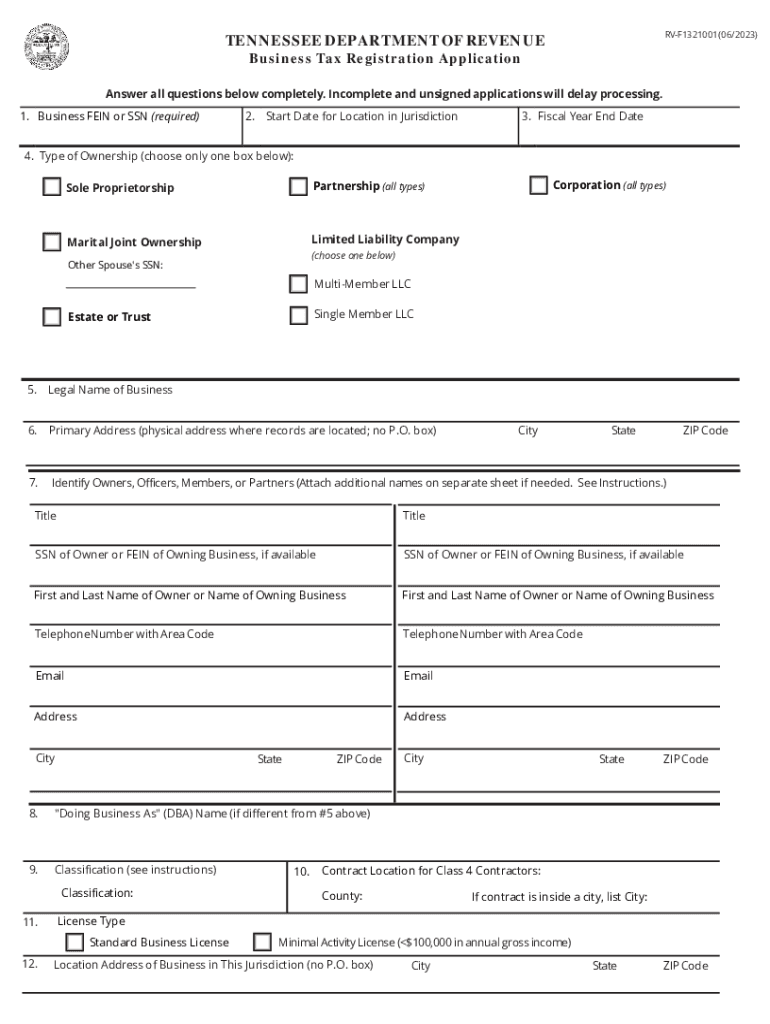

Steps to Complete the Tennessee Department of Revenue Business Tax

Completing the Tennessee Department of Revenue Business Tax involves several key steps. First, businesses must determine their eligibility and the applicable tax rate based on their gross receipts. Next, they need to gather the necessary documentation, including financial records that support their income claims. Once the information is compiled, businesses can fill out the appropriate business registration form, ensuring all details are accurate and complete. After completing the form, it should be submitted to the Tennessee Department of Revenue by the specified deadline.

Required Documents

When filing the Tennessee Department of Revenue Business Tax, certain documents are required to support the application. These typically include:

- Financial statements that detail the business's gross receipts

- Previous tax returns, if applicable

- Identification information for the business entity, such as the Employer Identification Number (EIN)

- Any additional documentation that may be requested by the Department of Revenue

Having these documents ready can streamline the registration process and ensure compliance with state regulations.

Form Submission Methods

Businesses can submit their Tennessee Department of Revenue Business Tax forms through various methods. The most common options include:

- Online submission via the Tennessee Department of Revenue website, which is often the fastest and most efficient method.

- Mailing the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated state offices, which may be useful for businesses needing immediate assistance.

Choosing the right submission method can help ensure timely processing of the business registration.

Penalties for Non-Compliance

Failure to comply with the Tennessee Department of Revenue Business Tax regulations can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is crucial for business owners to understand their obligations and ensure timely filing and payment to avoid these consequences. Keeping accurate records and staying informed about tax deadlines can help mitigate the risk of non-compliance.

Eligibility Criteria

To qualify for the Tennessee Department of Revenue Business Tax, businesses must meet specific eligibility criteria. Generally, any entity conducting business within Tennessee and generating gross receipts is subject to this tax. This includes corporations, partnerships, and sole proprietorships. Additionally, businesses must register with the Department of Revenue and provide accurate information regarding their operations and income. Understanding these criteria is essential for ensuring compliance and proper tax reporting.

Quick guide on how to complete tennessee department of revenue business tax

Complete TENNESSEE DEPARTMENT OF REVENUE Business Tax effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage TENNESSEE DEPARTMENT OF REVENUE Business Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and electronically sign TENNESSEE DEPARTMENT OF REVENUE Business Tax without hassle

- Find TENNESSEE DEPARTMENT OF REVENUE Business Tax and click Retrieve Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Signature tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Finish button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign TENNESSEE DEPARTMENT OF REVENUE Business Tax and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee department of revenue business tax

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenue business tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is business registration and why is it important?

Business registration is the process of officially recording your business with the appropriate governmental authority. It is crucial for establishing your business legally, protecting your brand, and gaining credibility with customers and partners. Proper business registration also helps in obtaining necessary licenses and permits, ensuring compliance with local laws.

-

How can airSlate SignNow assist with business registration documents?

airSlate SignNow simplifies the process of managing business registration documents by allowing you to easily upload, edit, and eSign documents online. Our platform enables you to streamline workflows and reduce the time spent on paperwork. With features like templates and custom branding, airSlate SignNow ensures your registration documents are professional and compliant.

-

What are the pricing plans for airSlate SignNow regarding business registration?

airSlate SignNow offers flexible pricing plans tailored to meet your business registration needs. You can choose from plans that fit startups and larger enterprises alike, ensuring you only pay for the features you need. Each plan comes with various features, including document eSigning, tracking, and integrations.

-

Does airSlate SignNow integrate with other business registration tools?

Yes, airSlate SignNow seamlessly integrates with various business registration tools and platforms. This functionality enables you to synchronize your data and streamline processes across all your applications. By integrating with other tools, you ensure that your business registration procedures are more efficient and organized.

-

What features does airSlate SignNow offer for efficient business registration?

airSlate SignNow provides a comprehensive set of features that make business registration efficient, including eSigning, document templates, and cloud storage. With customizable workflows, users can ensure that every step of the registration process is optimized and easily manageable. Additionally, our platform supports robust security measures to protect your sensitive information during the registration process.

-

Can I track the status of my business registration documents with airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your business registration documents in real-time. You can see who viewed, signed, or completed your documents, which helps manage the registration process and ensures no steps are overlooked. This transparency provides peace of mind as you navigate your business registration.

-

Is airSlate SignNow suitable for multinational business registration?

Yes, airSlate SignNow is designed to accommodate multinational business registration needs. Our platform supports multiple languages and can handle various legal requirements across different countries. This flexibility allows businesses to ensure their registration adheres to local laws while easily managing documents from a single interface.

Get more for TENNESSEE DEPARTMENT OF REVENUE Business Tax

Find out other TENNESSEE DEPARTMENT OF REVENUE Business Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors