Business Registration Application Form 2018

What is the Business Registration Application Form

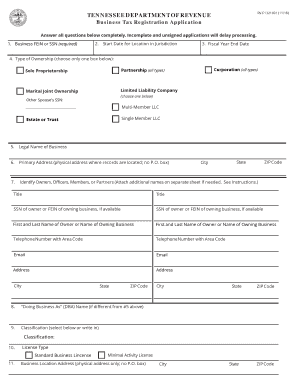

The Tennessee Department of Revenue Business Tax Registration Application is a crucial document for businesses operating in Tennessee. This form allows entities to register for various business taxes, including sales tax, franchise tax, and excise tax. Completing this application is essential for compliance with state tax regulations and ensures that businesses can operate legally within Tennessee.

Steps to Complete the Business Registration Application Form

Filling out the Tennessee business tax registration application involves several key steps:

- Gather Required Information: Collect necessary details about your business, including the legal name, address, and type of business entity.

- Identify Tax Types: Determine which taxes your business needs to register for, such as sales tax or franchise tax.

- Complete the Form: Accurately fill out the application, ensuring all information is correct and complete.

- Review for Accuracy: Double-check the form for any errors or missing information before submission.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person.

Required Documents

When completing the Tennessee Department of Revenue Business Tax Registration Application, certain documents may be required to support your application. These typically include:

- Proof of business formation, such as articles of incorporation or organization.

- Employer Identification Number (EIN) from the IRS.

- Identification for the business owner or responsible party.

- Any relevant licenses or permits specific to your business type.

Form Submission Methods

Businesses have multiple options for submitting the Tennessee business tax registration application. These methods include:

- Online Submission: The most efficient method, allowing for immediate processing.

- Mail: Print the completed form and send it to the designated address provided by the Department of Revenue.

- In-Person: Visit a local Department of Revenue office to submit the application directly.

Eligibility Criteria

To be eligible for the Tennessee Department of Revenue Business Tax Registration Application, businesses must meet specific criteria. These include:

- Operating as a legal entity within Tennessee.

- Engaging in taxable activities as defined by state law.

- Having a physical presence or nexus in Tennessee, such as a storefront or office.

Legal Use of the Business Registration Application Form

The Tennessee business tax registration application is legally binding once submitted and accepted by the Department of Revenue. It is essential for businesses to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. Using a reliable electronic signature solution can enhance the legal standing of the submitted application.

Quick guide on how to complete business registration application form 461335236

Complete Business Registration Application Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb environmentally-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, amend, and electronically sign your documents swiftly without any holdups. Manage Business Registration Application Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to amend and electronically sign Business Registration Application Form with ease

- Locate Business Registration Application Form and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which requires seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Business Registration Application Form and guarantee outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business registration application form 461335236

Create this form in 5 minutes!

People also ask

-

What is the Tennessee Department of Revenue business tax registration application?

The Tennessee Department of Revenue business tax registration application is a required process for all businesses operating in Tennessee to ensure compliance with state tax regulations. This application helps businesses register for various taxes, such as sales tax and franchise tax, enabling them to operate legally in the state.

-

How can airSlate SignNow assist with the Tennessee Department of Revenue business tax registration application?

airSlate SignNow provides an easy-to-use platform that streamlines the eSigning and document management process, making it simpler for businesses to complete their Tennessee Department of Revenue business tax registration application. With our solution, you can send documents for eSignature quickly, ensuring a faster registration process.

-

Are there any costs associated with the Tennessee Department of Revenue business tax registration application?

While the airSlate SignNow platform offers affordable pricing plans, it's essential to note that there may be fees for the Tennessee Department of Revenue business tax registration application itself, depending on the specific business tax types and services required. Always check with the Tennessee Department of Revenue for detailed fee information.

-

What features does airSlate SignNow offer to simplify the registration application process?

airSlate SignNow offers features like customizable templates, secure eSignatures, and automated workflows that can signNowly simplify the Tennessee Department of Revenue business tax registration application process. These features help save time and reduce errors when preparing and sending documents.

-

Can I integrate airSlate SignNow with other software to manage my business tax documents?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications, allowing you to manage your business tax documents efficiently while completing the Tennessee Department of Revenue business tax registration application. Integrating with tools like CRMs and document management systems enhances your workflow and productivity.

-

What are the benefits of using airSlate SignNow for tax registration applications?

Using airSlate SignNow for your Tennessee Department of Revenue business tax registration application offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for sensitive data. Our platform helps ensure that you meet compliance requirements efficiently.

-

How long does it take to complete the Tennessee Department of Revenue business tax registration application?

The time required to complete the Tennessee Department of Revenue business tax registration application can vary based on the complexity of the application and documentation. By using airSlate SignNow, you can expedite the eSigning process, helping you complete the application more quickly.

Get more for Business Registration Application Form

- Shutterpoint model release form

- Constitution scavenger hunt pdf form

- Investec forms

- Declaration of age deposed to by head of family form

- Individual directed goods and services idgs definitions chart form

- Of 2 new york state department of corrections form

- Idgs chart form

- Linear and quadratic regression worksheet 1 answers form

Find out other Business Registration Application Form

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word