the BSalvation Armyb Valuation Guide for BDonatedb Items 2013-2026

Understanding the Salvation Army Valuation Guide for Donated Items

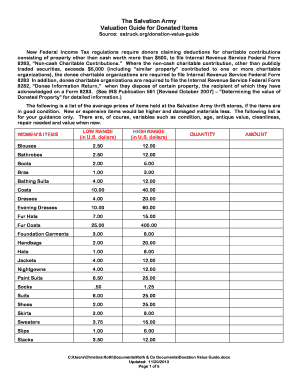

The Salvation Army Valuation Guide serves as a comprehensive resource for individuals looking to donate items. It provides a detailed list of item values, helping donors determine the fair market value of their contributions. This guide is particularly useful for tax purposes, as it assists in accurately reporting donations on tax returns. By understanding the valuation guide, donors can ensure they receive appropriate credit for their charitable contributions while supporting a worthy cause.

How to Utilize the Salvation Army Valuation Guide for Donated Items

Using the Salvation Army Valuation Guide is straightforward. Donors should first identify the items they plan to donate. Next, they can refer to the guide to find the corresponding values for these items. The guide categorizes items into various groups, such as clothing, furniture, and household goods, making it easy to locate specific items. Once the values are determined, donors can document these amounts for their records and tax filings.

Obtaining the Salvation Army Valuation Guide for Donated Items

The Salvation Army Valuation Guide can be obtained through several channels. Many local Salvation Army locations provide printed copies of the guide. Additionally, the guide is often available online as a downloadable PDF, allowing donors to access it conveniently from their devices. This accessibility ensures that anyone wishing to donate can easily reference the guide before making their contributions.

Steps to Complete the Salvation Army Valuation Guide for Donated Items

Completing the Salvation Army Valuation Guide involves a few key steps. First, gather all items intended for donation. Next, consult the valuation guide to assign a value to each item. It is beneficial to keep a record of these values, as they will be necessary for tax documentation. After assigning values, donors should ensure that they receive a donation receipt from the Salvation Army, which may include the total estimated value of the donated items.

Legal Use of the Salvation Army Valuation Guide for Donated Items

The Salvation Army Valuation Guide is legally recognized for tax purposes, provided that donors adhere to IRS guidelines regarding charitable contributions. Donors should ensure that the values assigned to items are reasonable and reflect fair market value. Accurate documentation is crucial, as the IRS may require proof of donations during audits. Utilizing the guide helps maintain compliance with tax regulations while maximizing potential tax benefits.

IRS Guidelines for Donating to the Salvation Army

When donating to the Salvation Army, it is essential to follow IRS guidelines to ensure compliance and maximize tax deductions. Donors should keep detailed records of their donations, including the date, description of items, and estimated values. The IRS requires that donations exceeding a certain value be substantiated with a written acknowledgment from the charity. Familiarity with these guidelines helps donors navigate the donation process effectively and avoid potential issues with their tax filings.

Quick guide on how to complete the bsalvation armyb valuation guide for bdonatedb items

Complete The BSalvation Armyb Valuation Guide For BDonatedb Items seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage The BSalvation Armyb Valuation Guide For BDonatedb Items on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign The BSalvation Armyb Valuation Guide For BDonatedb Items with ease

- Obtain The BSalvation Armyb Valuation Guide For BDonatedb Items and then click Get Form to commence.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your modifications.

- Decide how you prefer to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign The BSalvation Armyb Valuation Guide For BDonatedb Items and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the bsalvation armyb valuation guide for bdonatedb items

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the salvation army donation value guide and how can it help me?

The salvation army donation value guide provides a comprehensive overview of how to assess the value of your donated items. This guide helps you understand the typical market values for various goods, enabling you to maximize your tax deductions and make informed donation choices.

-

How do I access the salvation army donation value guide?

You can easily access the salvation army donation value guide online on the Salvation Army website or through various charity resources. Many local Salvation Army locations also provide physical copies for donors.

-

Is using the salvation army donation value guide advantageous for tax deductions?

Yes, utilizing the salvation army donation value guide is advantageous for tax deductions. By accurately valuing your donations, you can ensure you’re claiming the correct amount during tax season, which can lead to signNow savings.

-

What types of items does the salvation army donation value guide cover?

The salvation army donation value guide covers a wide range of items including clothing, furniture, appliances, and electronics. It provides estimated values for these categories to help donors assess their contributions effectively.

-

Can I use the salvation army donation value guide for items not accepted by Salvation Army?

While the salvation army donation value guide primarily focuses on items accepted by the Salvation Army, you can also use it as a reference for similar items you plan to donate elsewhere. This can give you a general idea of how to value your items for donation purposes.

-

Is there an online version of the salvation army donation value guide available?

Yes, there is an online version of the salvation army donation value guide. This digital resource allows you to easily browse item values from the comfort of your home, making the process of evaluating your donations more convenient.

-

How often is the salvation army donation value guide updated?

The salvation army donation value guide is updated periodically to reflect changes in the market value of donated goods. Keeping yourself informed with the latest version ensures your item valuations remain accurate and fair.

Get more for The BSalvation Armyb Valuation Guide For BDonatedb Items

Find out other The BSalvation Armyb Valuation Guide For BDonatedb Items

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer