Form 656 Sp Rev 4 Offer in Compromise Spanish Version

What is the Form 656 sp Rev 4 Offer In Compromise Spanish Version

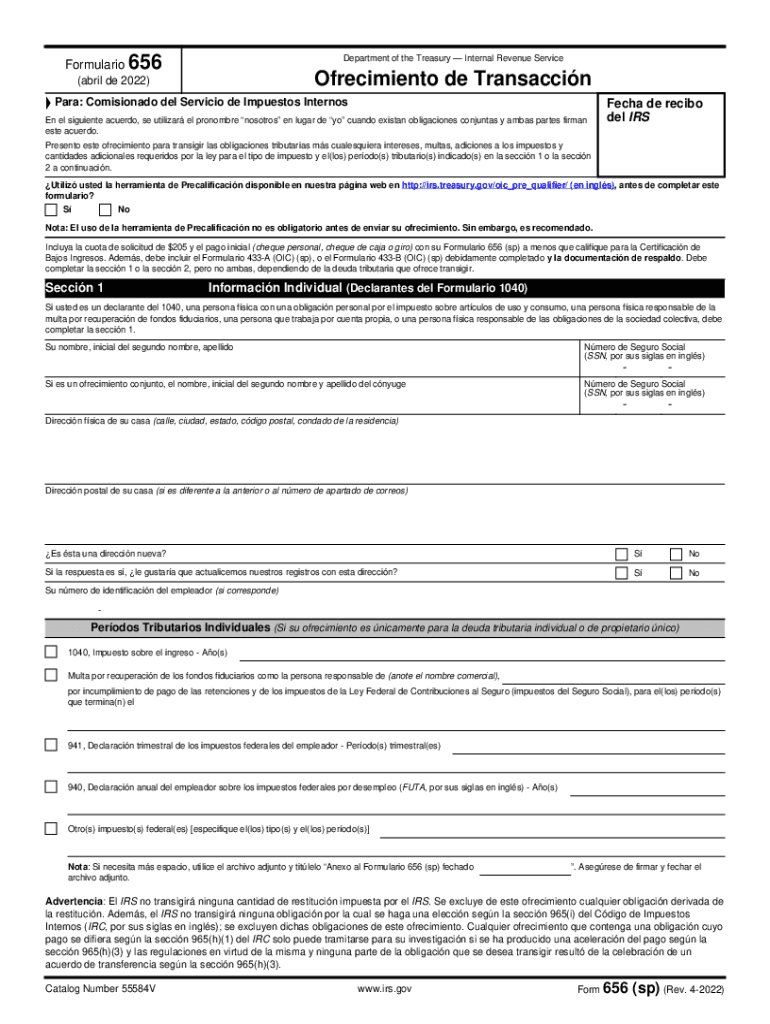

The Form 656 sp Rev 4 Offer In Compromise Spanish Version is a legal document used by taxpayers in the United States to propose a settlement with the Internal Revenue Service (IRS) for their tax debts. This form allows individuals to negotiate a reduced amount to pay off their tax liabilities, providing a pathway to resolve outstanding debts. It is specifically designed for Spanish-speaking taxpayers, ensuring accessibility and understanding of the process.

How to use the Form 656 sp Rev 4 Offer In Compromise Spanish Version

Using the Form 656 sp Rev 4 Offer In Compromise Spanish Version involves several key steps. First, taxpayers must accurately complete the form, providing detailed information about their financial situation, including income, expenses, and assets. Once completed, the form must be submitted to the IRS along with the required payment and supporting documentation. It is essential to ensure that all information is correct and complete to avoid delays in processing.

Steps to complete the Form 656 sp Rev 4 Offer In Compromise Spanish Version

Completing the Form 656 sp Rev 4 Offer In Compromise Spanish Version requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form with accurate personal and financial information.

- Calculate the offer amount based on your ability to pay.

- Include any required fees and supporting documentation.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Offer In Compromise using the Form 656 sp Rev 4, taxpayers must meet specific eligibility criteria. These include demonstrating an inability to pay the full tax liability, showing that the offer is in the best interest of both the taxpayer and the IRS, and providing complete and truthful information on the form. The IRS evaluates each case on its merits, considering the taxpayer's financial situation and compliance history.

Required Documents

When submitting the Form 656 sp Rev 4 Offer In Compromise Spanish Version, taxpayers must include several essential documents to support their offer. Required documents typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and statements.

- Assets documentation, such as bank statements and property valuations.

- Any other relevant financial information that supports the offer.

Form Submission Methods

The Form 656 sp Rev 4 Offer In Compromise Spanish Version can be submitted to the IRS through various methods. Taxpayers can choose to file the form by mail, ensuring that it is sent to the correct address based on their location. Additionally, some may have the option to submit the form electronically through authorized e-filing services, which can streamline the process and provide immediate confirmation of receipt.

Quick guide on how to complete form 656 sp rev 4 offer in compromise spanish version 579088932

Complete Form 656 sp Rev 4 Offer In Compromise Spanish Version effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents swiftly without interruptions. Manage Form 656 sp Rev 4 Offer In Compromise Spanish Version on any device with airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The simplest method to modify and eSign Form 656 sp Rev 4 Offer In Compromise Spanish Version with ease

- Obtain Form 656 sp Rev 4 Offer In Compromise Spanish Version and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to preserve your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 656 sp Rev 4 Offer In Compromise Spanish Version and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 656 sp rev 4 offer in compromise spanish version 579088932

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

The Form 656 sp Rev 4 Offer In Compromise Spanish Version is a document used by taxpayers to submit an offer to the IRS to settle tax debts for less than the full amount owed. This form is specifically tailored for Spanish speakers, allowing them to clearly communicate their financial situation to the IRS. Using this form can help taxpayers navigate the complexities of tax debt resolution more easily.

-

How can airSlate SignNow help with the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

airSlate SignNow provides a seamless platform for preparing, sending, and eSigning the Form 656 sp Rev 4 Offer In Compromise Spanish Version. With our user-friendly interface, you can quickly fill out the necessary fields, and securely obtain signatures from all required parties. This ensures that your submission to the IRS is both efficient and compliant.

-

What are the benefits of using airSlate SignNow for Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Using airSlate SignNow to manage your Form 656 sp Rev 4 Offer In Compromise Spanish Version offers several benefits, including enhanced security, convenience, and time savings. You can easily track the status of your document, receive notifications upon signing, and access it from any device. Our platform is designed to simplify the tax resolution process for Spanish-speaking users.

-

Is there a cost associated with using airSlate SignNow for my Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Yes, there is a pricing structure for using airSlate SignNow; however, we offer competitive rates that provide excellent value for businesses and individuals. We encourage you to check our website for the latest pricing plans, which include options suitable for different budgets. Investing in our solution can greatly simplify the process of managing the Form 656 sp Rev 4 Offer In Compromise Spanish Version.

-

Can I integrate airSlate SignNow with other applications when working on the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow while working with the Form 656 sp Rev 4 Offer In Compromise Spanish Version. Integrate with CRM systems, cloud storage solutions, and business management tools to enhance your document management experience and reduce time spent on administrative tasks.

-

What features does airSlate SignNow offer for handling the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

airSlate SignNow includes a variety of features that are beneficial when handling the Form 656 sp Rev 4 Offer In Compromise Spanish Version. Key features include customizable templates, automatic reminders for signers, secure cloud storage, and the ability to add comments or annotations on documents. These tools help ensure that your document is prepared accurately and efficiently.

-

Is airSlate SignNow secure for submitting my Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols, ensuring that all your documents, including the Form 656 sp Rev 4 Offer In Compromise Spanish Version, are kept confidential. Our platform adheres to industry standards for data protection, so you can have peace of mind while managing sensitive tax information.

Get more for Form 656 sp Rev 4 Offer In Compromise Spanish Version

Find out other Form 656 sp Rev 4 Offer In Compromise Spanish Version

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy